Is Tennant’s Capital Returns And Low Leverage Profile Reshaping The Investment Case For TNC?

- In the fourth quarter of 2025, Texas-based Kopion Asset Management increased its holdings in Tennant to 123,037 shares, investing about US$9.07 million as the company expanded profitability and generated strong free cash flow despite a volume downturn.

- Tennant’s ability to lift its dividend, repurchase US$28 million of stock, and keep net leverage below one times adjusted EBITDA signals management’s confidence in the resilience of its industrial cleaning business model.

- We’ll now examine how Tennant’s disciplined capital returns and low leverage profile affect its existing investment narrative and risk-reward balance.

Find companies with promising cash flow potential yet trading below their fair value.

Tennant Investment Narrative Recap

To own Tennant, you need to believe its industrial cleaning niche can support consistent cash generation even when volumes soften, and that management will keep capital allocation disciplined. The latest update, showing higher free cash flow, a raised dividend and buybacks during a volume downturn, supports that view but does not materially change the near term focus on demand for autonomous and service-based offerings as a key catalyst or the risk from international volume and pricing pressure.

The October 2025 dividend increase to US$0.31 per share stands out against Kopion Asset Management’s higher stake, because it underlines Tennant’s willingness to return cash while volumes are under pressure. For investors watching the rollout of autonomous mobile robots and equipment as a service, that combination of cash returns and low leverage may be attractive, but it also raises questions about how well Tennant can handle a prolonged period of weaker international demand or more aggressive low cost competitors.

Yet behind Tennant’s rising dividend and buybacks, investors should be aware of the growing risk that...

Read the full narrative on Tennant (it's free!)

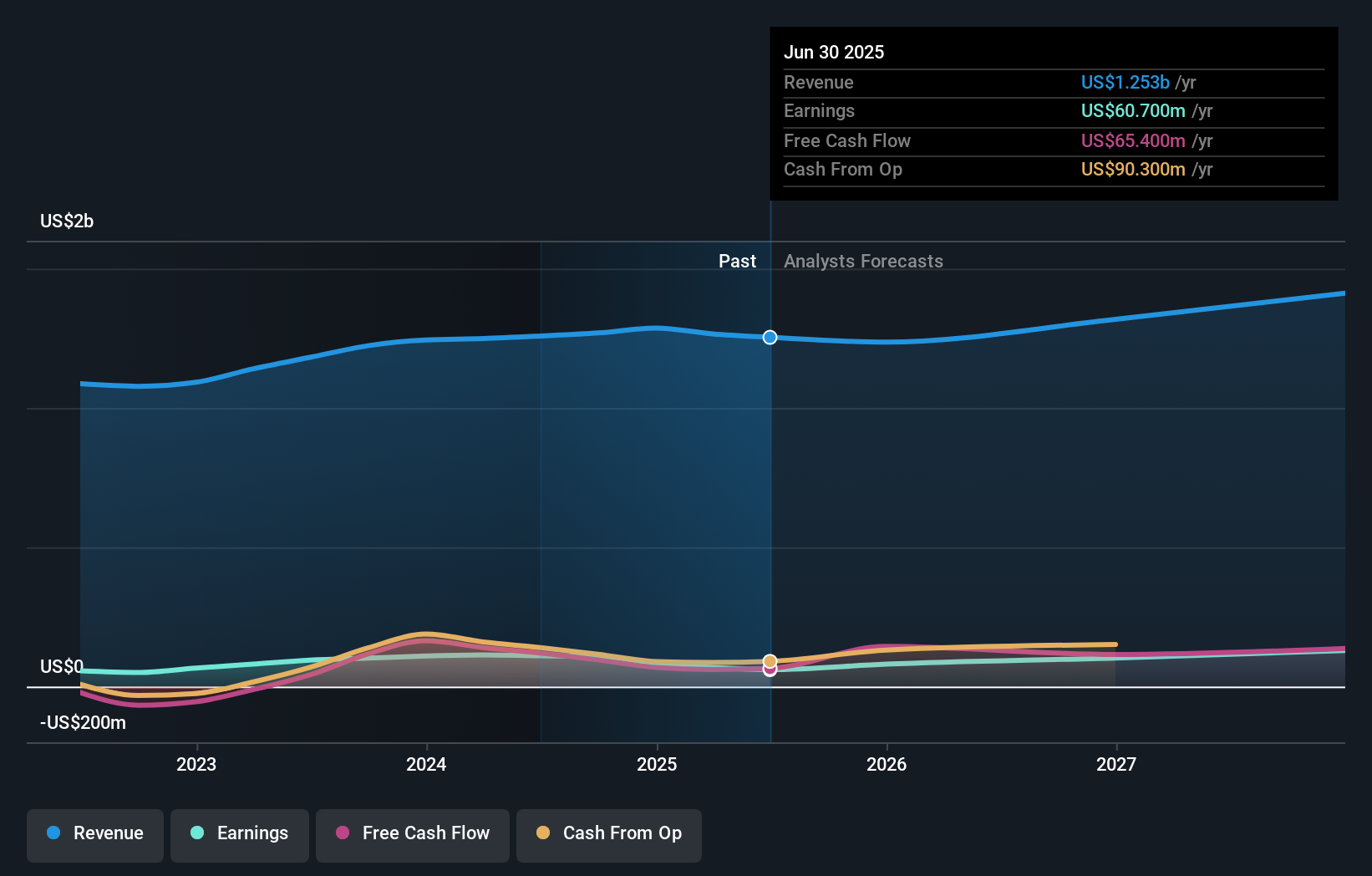

Tennant's narrative projects $1.5 billion revenue and $138.4 million earnings by 2028. This requires 5.2% yearly revenue growth and about a $77.7 million earnings increase from $60.7 million today.

Uncover how Tennant's forecasts yield a $109.00 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community cluster between US$103.87 and US$110, suggesting some investors see considerable upside from current levels. You should weigh those views against the risk that weaker international volumes and intensified price competition could pressure Tennant’s margins and challenge its ability to sustain recent capital returns over time.

Explore 3 other fair value estimates on Tennant - why the stock might be worth just $103.87!

Build Your Own Tennant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tennant research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tennant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tennant's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal