Azimut Holding (BIT:AZM) Valuation Check After Upgraded 2025 And 2026 Profit Guidance

Azimut Holding (BIT:AZM) has drawn fresh investor attention after recent price moves, with the share last closing at €36.41. That puts current performance in focus alongside its record of multi year total returns.

See our latest analysis for Azimut Holding.

Looking past the latest tick to €36.41, Azimut Holding’s 30 day share price return of 4.03% and 90 day share price return of 9.31% sit alongside a 1 year total shareholder return of 58.85%. This signals momentum that has built over time rather than suddenly appearing.

If Azimut’s run has you rethinking your watchlist, this could be a good moment to cast a wider net and check out fast growing stocks with high insider ownership.

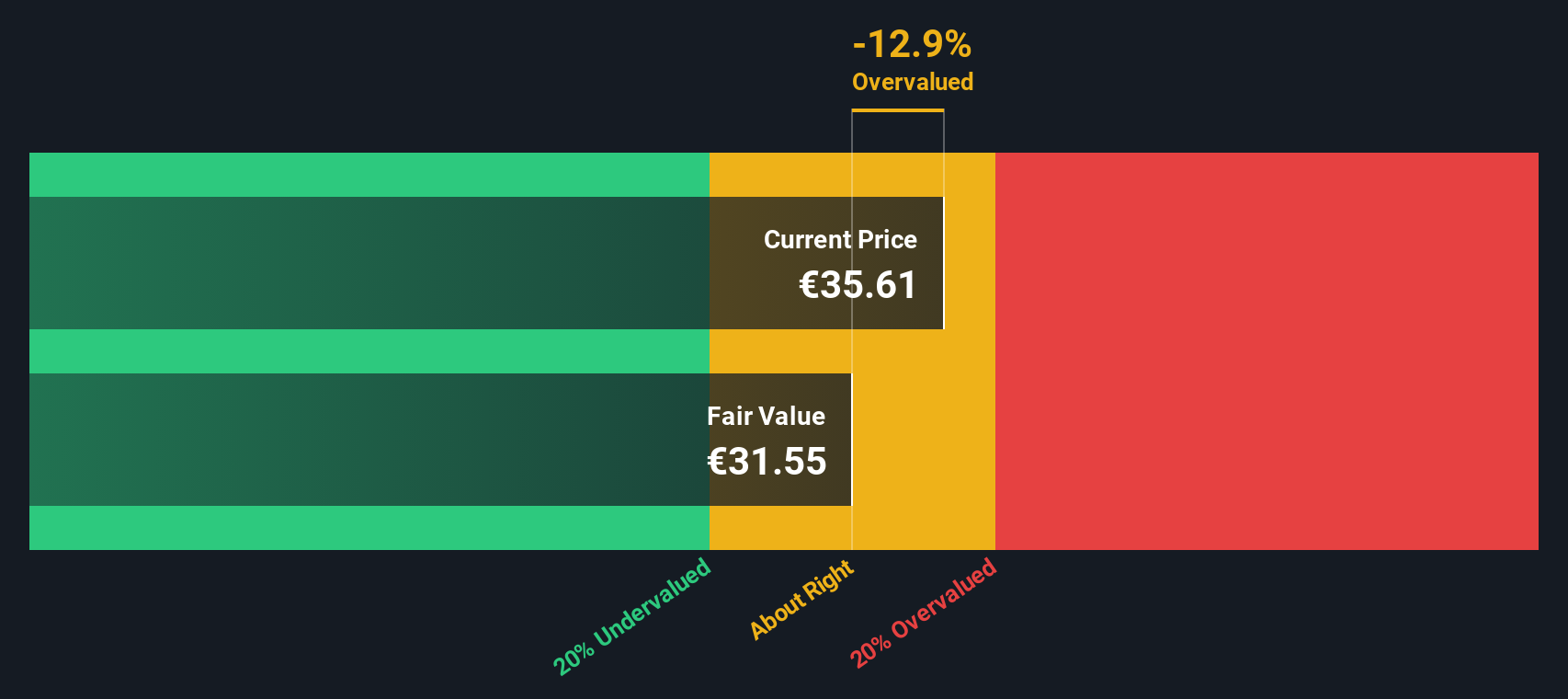

With the share price close to the latest analyst target and an indicated intrinsic discount of about 19%, the key question is whether Azimut is still undervalued or whether the market is already pricing in future growth.

Most Popular Narrative: 20% Overvalued

Compared with the last close at €36.41, the most followed narrative sets fair value closer to €36.34, putting Azimut almost exactly in line with that view.

Azimut Holding updated its 2025 earnings guidance, now expecting core group net profit to exceed EUR 500 million, compared with a prior lower end target of EUR 400 million (company guidance).

The company issued new guidance for 2026, forecasting group net profit above EUR 1 billion (company guidance).

Curious what kind of earnings profile could back that guidance and still point to overvaluation? The core of this narrative sits in steady revenue assumptions, firm profit margins, and a trimmed future earnings multiple that stays below many peers. Want to see exactly how those moving parts line up in the model and why the required return is set where it is?

Result: Fair Value of €36.34 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on fee pressure and regulation not intensifying, and on expansion into higher risk markets not eroding margins through currency or compliance costs.

Find out about the key risks to this Azimut Holding narrative.

Another View On Value

While the most followed narrative sees Azimut as roughly in line with a €36.34 fair value, our DCF model points to a higher figure of €45.22. That gap suggests the market price may not fully reflect the same cash flow outlook. Which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Azimut Holding Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a fresh Azimut story in minutes: Do it your way.

A great starting point for your Azimut Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at just one company. Use the screener to spot more ideas worth your attention.

- Spot potential value opportunities early by scanning these 884 undervalued stocks based on cash flows that align with your return and risk preferences.

- Zero in on income potential by checking out these 12 dividend stocks with yields > 3% that offer yields above 3%.

- Stay ahead of emerging themes by tracking these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal