A Look At Turning Point Brands (TPB) Valuation After Strong One Year Shareholder Returns

Context for Turning Point Brands stock

Turning Point Brands (TPB) has not been in the headlines for a specific news event, so the current focus for investors is how its business profile and recent returns line up with the latest share price.

See our latest analysis for Turning Point Brands.

Turning Point Brands' share price at $103.25 reflects a mixed recent pattern, with a 19.31% 90 day share price return alongside a year to date decline, while the 1 year total shareholder return of 83.82% hints at strong longer term momentum.

If TPB has you thinking about where else returns might be building, this could be a useful moment to scan fast growing stocks with high insider ownership for other ideas catching investors’ attention.

With TPB up 83.82% over the past year and trading at $103.25, yet sitting about 15% below an analyst price target of $118.75, the question is whether there is still upside potential or if future growth is already priced in.

Most Popular Narrative: 13.1% Undervalued

With Turning Point Brands last closing at $103.25 against a narrative fair value of $118.75, the valuation hinges heavily on growth in newer product categories and margin resilience.

Strong growth in the Modern Oral nicotine pouch segment, with sales growing nearly 8x year-over-year and now accounting for 26% of total revenue, positions TPB to capture significant market share in a category projected to reach $10 billion by decade's end; this will drive long-term revenue and margin expansion as the modern oral segment scales and premiumizes.

Curious how fast growing pouches, premium brands, and a higher future earnings base are stitched together into that price tag and growth path? The full narrative spells out the revenue climb, margin shift, and earnings multiple that all have to line up for $118.75 to make sense.

Result: Fair Value of $118.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Modern Oral growth holding up and on regulators not tightening rules on nicotine pouches in ways that affect volumes or margins.

Find out about the key risks to this Turning Point Brands narrative.

Another View: Rich P/E Puts Pressure On The Story

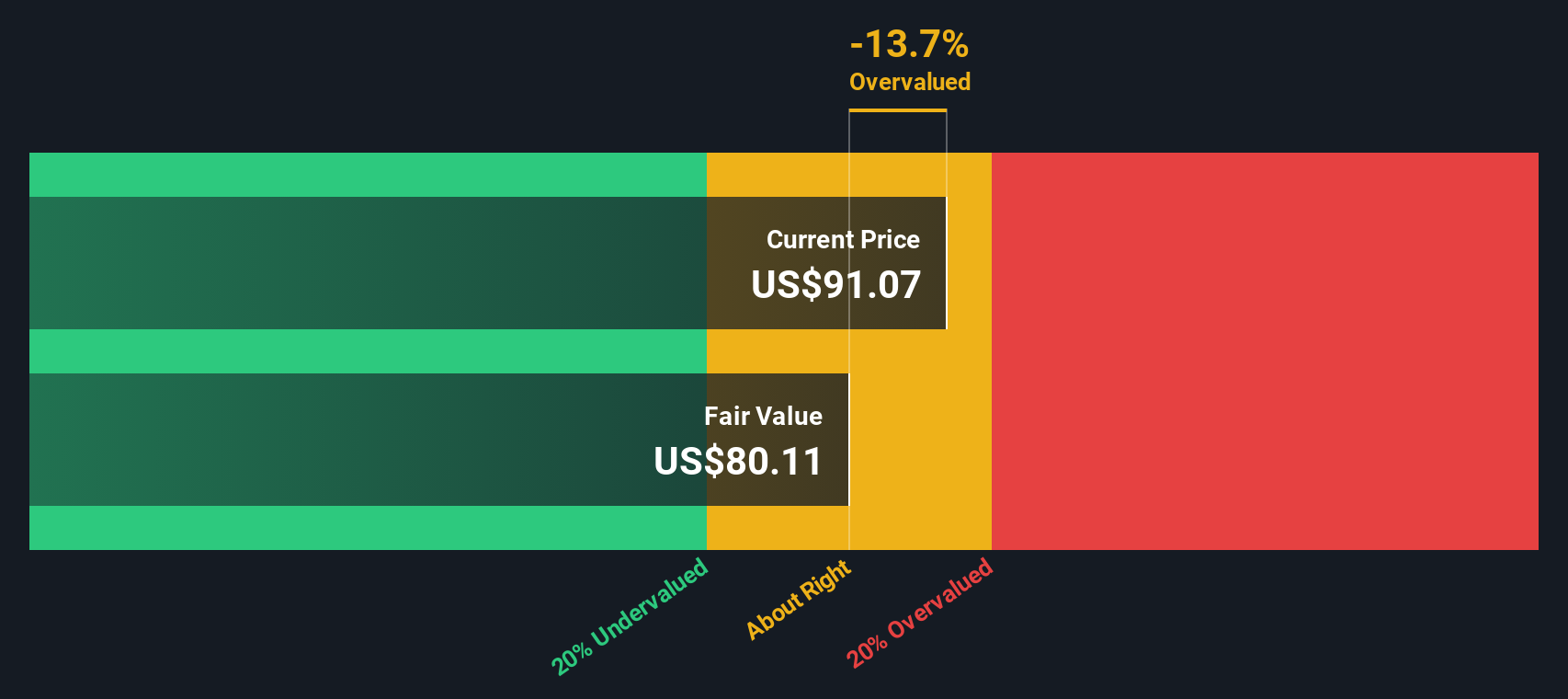

Our SWS DCF model points to a fair value of $88.28 per share, which is below the current $103.25 price and suggests Turning Point Brands screens as overvalued on that basis. If cash flows do not build as expected, how much patience would you really have with that gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Turning Point Brands Narrative

If parts of this story do not quite fit your view, or you prefer to anchor everything in your own assumptions and data checks, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Turning Point Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next idea?

Do not stop with just one company, use the Simply Wall Street Screener to spot fresh opportunities that match your style before they move without you.

- Target higher income potential by scanning these 12 dividend stocks with yields > 3% that may suit an approach focused on regular cash returns.

- Ride long term trends in automation and data by checking out these 26 AI penny stocks that are tied to artificial intelligence themes.

- Seek value opportunities by reviewing these 884 undervalued stocks based on cash flows that currently trade below estimates based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal