How To Find Options Trades This Earnings Season

Earnings season is here and we’ve got the first batch of big name companies reporting earnings next week with Taiwan Semiconductor (TSM), JP Morgan Chase (JPM), Wells Fargo (WFC), Bank of America (BAC), Goldman Sachs (GS) and Delta Airlines (DAL) all set to report.

Earnings season can supercharge option premiums. But not all setups are worth chasing.

The key is narrowing your focus to a handful of trades where risk and reward are actually in your favor.

Here’s a framework to help you identify high-quality setups, avoid traps, and capitalize on elevated implied volatility.

Start With IV Rank

Implied volatility is always higher into earnings, but that doesn’t mean it’s high enough.

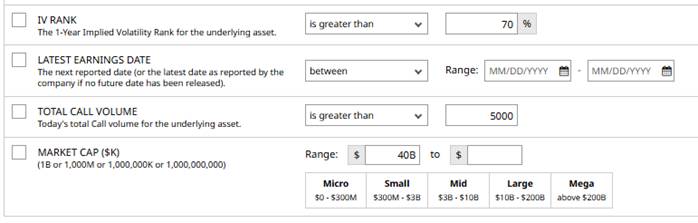

Use IV Rank to filter for stocks with rich premium.

I look for IV Rank > 50%, but ideally 70% or higher.

That tells me the current IV is elevated relative to the past year. These are the names where options are most overpriced.

Avoid tickers with low IV Rank, even if they have earnings coming up.

Focus on Liquid Names

You can’t trade tight spreads on illiquid options.

Liquidity matters, especially with earnings trades where you might need to adjust quickly.

Screen for tickers with:

- Tight bid/ask spreads (preferably under $0.20)

- Open interest above 500 contracts on near-term strikes

- Total call option volume over 5k contracts

This keeps slippage low and execution tight.

If you’re trading multi-leg strategies like iron condors or butterflies, liquidity isn’t optional—it’s mandatory.

Choose the Right Strategy for the Setup

There’s no one-size-fits-all approach to earnings trades.

Strategy choice depends on the expected move, the volatility crush, and your directional bias (if any).

- Neutral bias + high IV: Consider iron condors or straddles. Sell premium and play for a post-earnings volatility collapse.

- Bullish bias + high IV: Sell put spreads or naked puts just outside the expected move. These often perform well when a stock beats modest expectations.

- Bearish bias + high IV: Use call credit spreads or bearish calendars. Watch for crowded long setups—disappointment can cause outsized moves lower.

The best trades are structured outside the expected move range.

Give yourself margin for error.

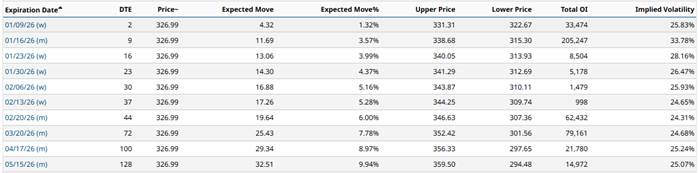

Use Expected Move to Set Strikes

The market’s pricing in a move. Respect it.

The expected move, often derived from the nearest straddle, gives you a statistical boundary. Most earnings moves stay within this range.

Use it to guide strike selection:

- Sell spreads just outside the expected move

- Buy directional spreads inside if you expect a breakout

- Avoid selling naked options inside the move—too much risk for too little reward

Don’t guess.

Let the market’s expectations do the math for you.

JP Morgan Expected Move:

Watch Out For Binary Landmines

Some earnings reports are unpredictable minefields. Think biotech approvals, legal overhangs, or meme stock volatility.

Avoid names where:

- The stock has a history of huge post-earnings gaps

- There's an upcoming product announcement or regulatory decision

- Liquidity is thin and spreads are wide

Even a perfectly structured trade can blow up if the underlying makes a 30% move.

Don’t trade earnings just for the sake of it.

Know what you’re walking into.

Final Thoughts

Earnings season is a goldmine for disciplined traders, and a graveyard for the careless.

Focus on high IV Rank, tight spreads, and strike placement just outside the expected move.

Use strategy as a tool, not a crutch.

Know when to sell premium, when to stay delta neutral, and when to take a shot.

Trade selectively. Trade defensively.

Let the numbers guide your decisions, not emotion.

If you can do that, you should be able to navigate the volatility of this upcoming earnings season.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal