3 TSX Growth Stocks To Watch With Up To 29% Insider Ownership

As investors prepare for 2026, keeping an eye on the health of both the Canadian and U.S. economies becomes crucial, especially with recent fluctuations in employment trends and inflation data. In this context, growth companies with high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business while potentially offering robust opportunities in a diverse portfolio.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 29.8% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Electrovaya (TSX:ELVA) | 28.0% | 38.1% |

| CEMATRIX (TSX:CEMX) | 10.7% | 58.3% |

| Aritzia (TSX:ATZ) | 17.1% | 23.5% |

| Almonty Industries (TSX:AII) | 11.1% | 50.4% |

Let's explore several standout options from the results in the screener.

Black Diamond Group (TSX:BDI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Black Diamond Group Limited provides modular space and workforce accommodation solutions across Canada, the United States, and Australia, with a market cap of CA$1.08 billion.

Operations: The company generates revenue through two main segments: Workforce Solutions, contributing CA$202.72 million, and Modular Space Solutions, accounting for CA$242.93 million.

Insider Ownership: 21.4%

Black Diamond Group has demonstrated strong growth, with recent earnings rising to C$12.21 million in Q3 2025 from C$7.37 million the previous year. The company anticipates significant earnings growth of over 20% annually, outpacing the Canadian market's average. Despite high debt levels, it trades at a substantial discount to its estimated fair value. Insider activity shows more buying than selling recently, signaling confidence despite some insider sales in the past quarter.

- Unlock comprehensive insights into our analysis of Black Diamond Group stock in this growth report.

- Upon reviewing our latest valuation report, Black Diamond Group's share price might be too optimistic.

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. is involved in the production and distribution of cannabis products both in the United States and internationally, with a market cap of CA$2.60 billion.

Operations: The company generates revenue of $1.28 billion from the cultivation, production, distribution, and sale of cannabis products.

Insider Ownership: 18.5%

Curaleaf Holdings is positioned for growth, with revenue forecasted to increase by 6.9% annually, surpassing the Canadian market's average. Analysts expect the company to become profitable within three years. Despite recent volatility and a net loss of US$57.03 million in Q3 2025, insider activity reflects more buying than selling recently. The company trades significantly below its estimated fair value and has expanded its credit facility to support debt reduction and working capital needs.

- Navigate through the intricacies of Curaleaf Holdings with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Curaleaf Holdings is priced lower than what may be justified by its financials.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

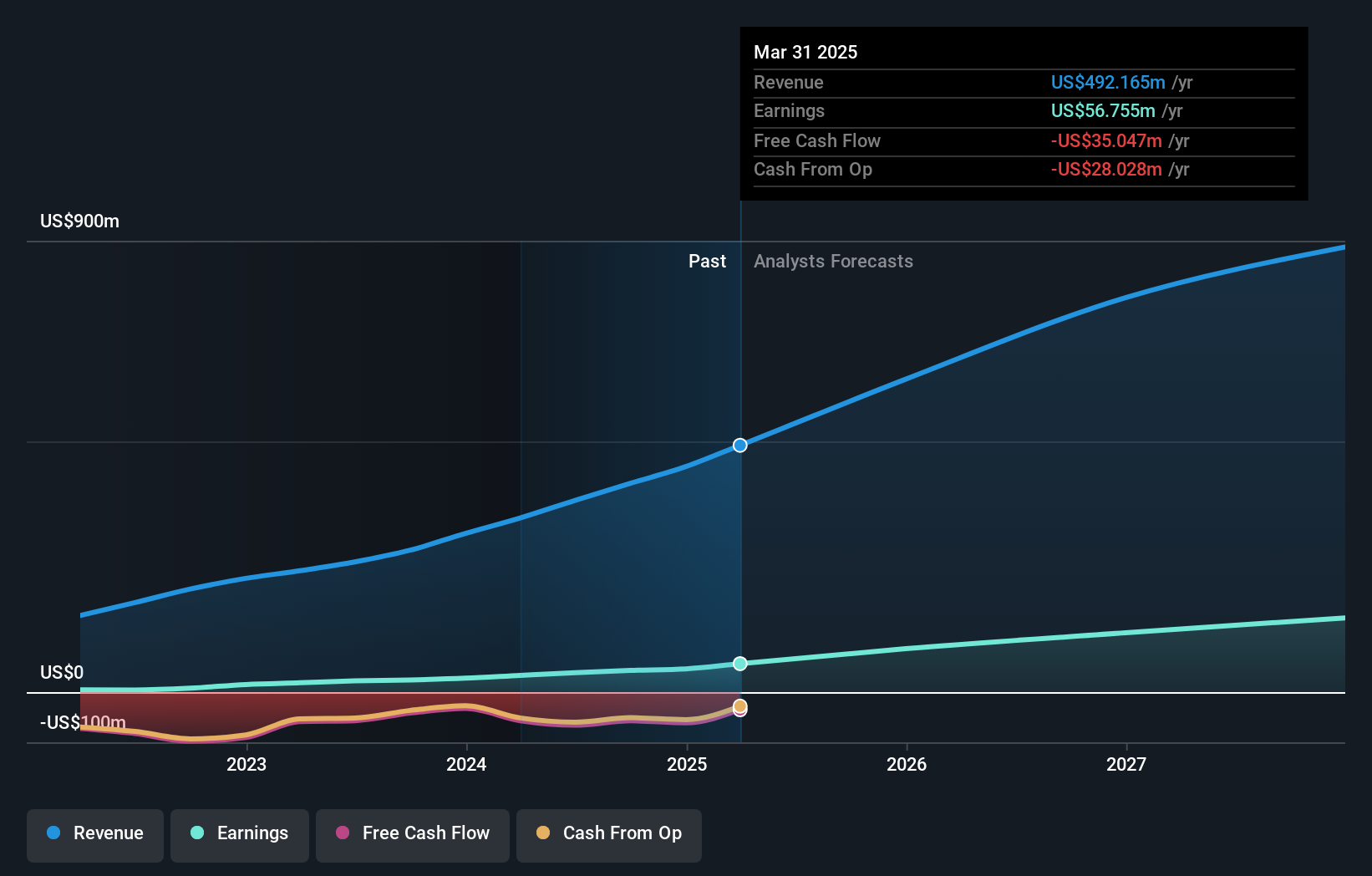

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of approximately CA$967.36 million.

Operations: The company generates revenue by providing lending-related services to borrowers, banks, and other institutions, amounting to $563.27 million.

Insider Ownership: 29.8%

Propel Holdings is poised for significant growth, with revenue expected to grow 23.6% annually, outpacing the Canadian market. Despite recent insider selling and a dividend not well covered by free cash flows, the company trades at a substantial discount to its estimated fair value. Propel's strategic expansion includes establishing Propel Bank in Puerto Rico, enhancing service diversification and market access. Recent partnerships aim to deepen its presence in underserved markets while leveraging fintech innovations.

- Take a closer look at Propel Holdings' potential here in our earnings growth report.

- Our expertly prepared valuation report Propel Holdings implies its share price may be lower than expected.

Taking Advantage

- Investigate our full lineup of 48 Fast Growing TSX Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal