Engie (ENXTPA:ENGI) Valuation Check After New Community Solar Projects In Illinois

Engie stock in focus after new community solar projects

Engie (ENXTPA:ENGI) is back on investor radars after ENGIE North America launched two community solar farms in Knox County, Illinois, aimed at providing clean energy and electricity bill savings to local subscribers.

See our latest analysis for Engie.

Those Illinois community solar projects land at a time when Engie’s €23.69 share price has seen firm momentum, with a 30 day share price return of 9.32% and a 1 year total shareholder return of 63.70% pointing to stronger sentiment building around the stock.

If clean energy is on your radar, this could be a good moment to scan healthcare stocks as another way to spot companies tied to long term demand themes.

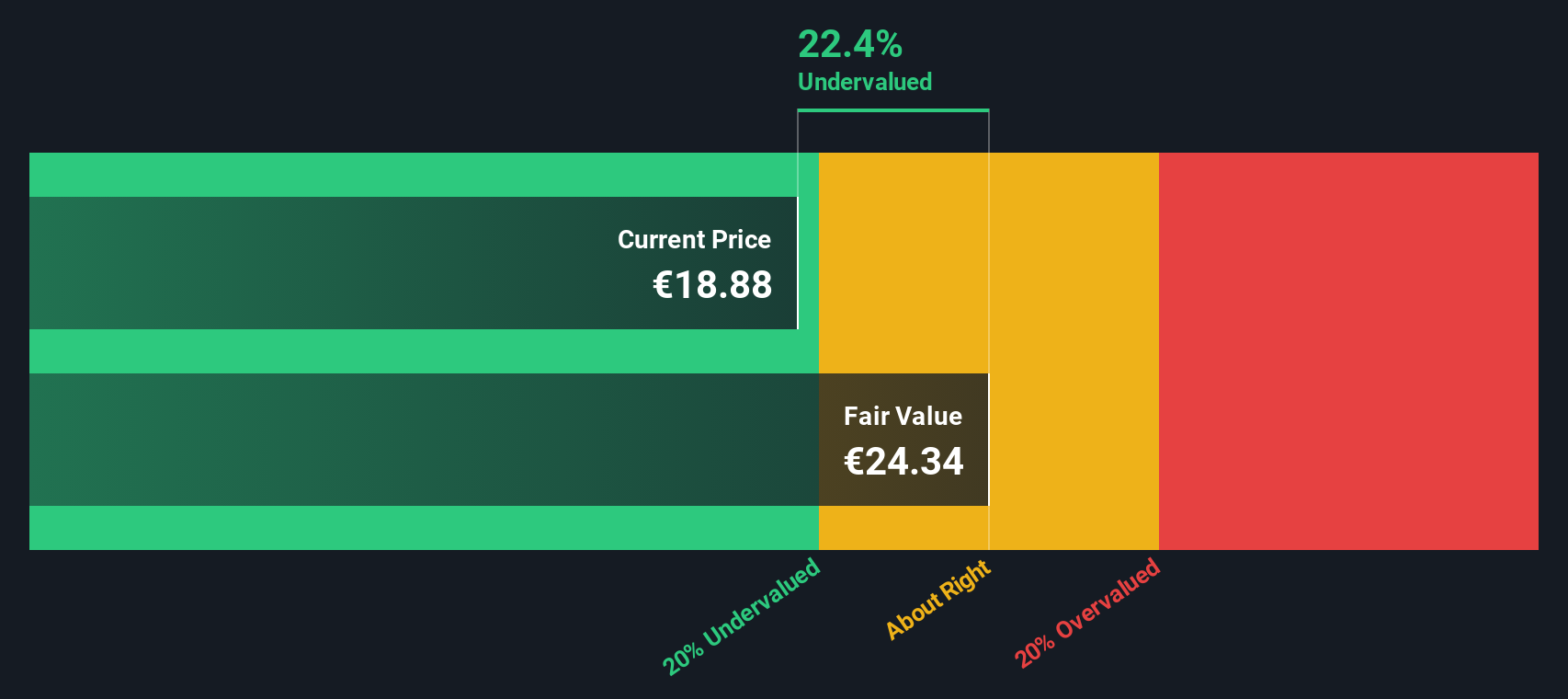

With Engie trading around €23.69, showing a 1 year total return of 63.70% and an intrinsic value implying roughly a 10% discount, investors now face a key question: is there still upside here, or is future growth already priced in?

Most Popular Narrative: 1% Overvalued

With Engie last closing at €23.69 against a narrative fair value of about €23.39, the current pricing sits just above that widely followed estimate.

Portfolio optimization and disciplined asset rotations exiting non core and lower margin businesses and reallocating capital to higher growth segments are enhancing capital efficiency and improving return on equity, ultimately supporting higher net income and shareholder payouts.

Curious what earnings profile and margin shift need to line up for that valuation to hold? The narrative leans on modest growth, steady profitability, and a higher future earnings multiple than today. The details behind that mix are where the story really gets interesting.

Result: Fair Value of €23.39 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to keep an eye on risks such as FX pressure and weather-driven swings in hydro output, which could challenge those valuation assumptions.

Find out about the key risks to this Engie narrative.

Another Angle On Valuation

The narrative fair value of about €23.39 suggests Engie is roughly in line with where it trades today, but our DCF model tells a different story, indicating fair value closer to €26.29. That implies the market may still be pricing in a gap. Which view do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Engie Narrative

If this view does not quite fit how you see Engie, you can stress test the numbers yourself and build a custom story in minutes: Do it your way.

A great starting point for your Engie research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Engie has caught your attention, do not stop there. Broadening your watchlist with other focused themes can help you spot opportunities you might otherwise miss.

- Target potential mispricings by scanning these 886 undervalued stocks based on cash flows that may offer a gap between current prices and underlying cash flows.

- Ride long term tech shifts by checking out these 26 AI penny stocks that are closely tied to artificial intelligence adoption across sectors.

- Balance growth with income by reviewing these 12 dividend stocks with yields > 3% that combine ongoing business strength with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal