Undervalued Small Caps With Insider Activity To Watch In January 2026

As the U.S. stock market navigates a complex landscape marked by recent record highs in major indices like the S&P 500 and Dow, small-cap stocks present unique opportunities for investors seeking growth potential amid broader economic fluctuations. In this environment, identifying promising small-cap companies involves considering factors such as insider activity and their ability to adapt to shifting economic indicators, making them intriguing prospects for those looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 10.1x | 1.9x | 24.43% | ★★★★★★ |

| Wolverine World Wide | 16.9x | 0.8x | 39.09% | ★★★★★☆ |

| Peoples Bancorp | 10.7x | 1.9x | 46.59% | ★★★★★☆ |

| First United | 9.6x | 2.9x | 46.28% | ★★★★★☆ |

| Metropolitan Bank Holding | 12.8x | 3.1x | 34.54% | ★★★★☆☆ |

| Union Bankshares | 9.6x | 2.1x | 21.91% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 37.40% | ★★★★☆☆ |

| Farmland Partners | 6.5x | 8.1x | -93.35% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.3x | 5.1x | 35.39% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -11.08% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

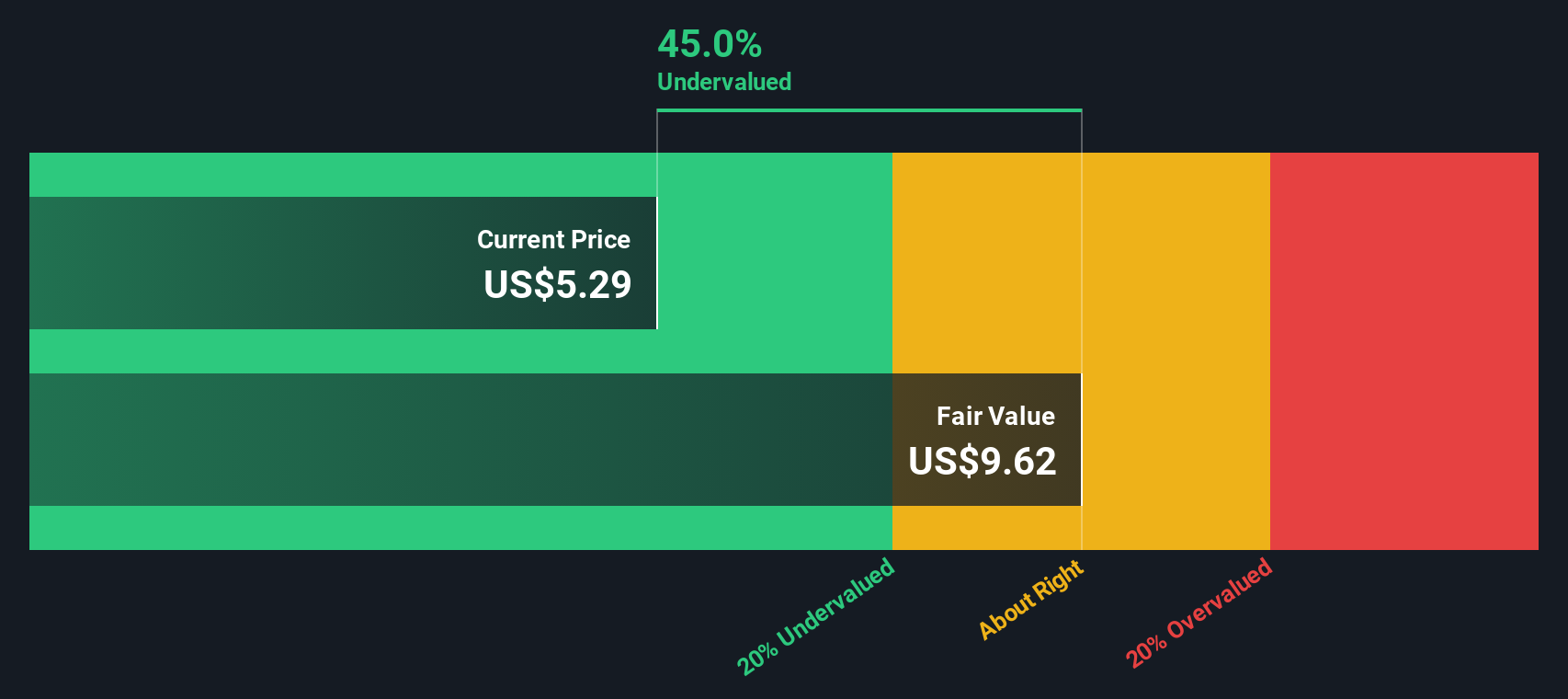

TSS (TSSI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: TSS operates in procurement, system integration, and facilities management with a market cap of $4.75 million.

Operations: The company generates revenue primarily from Procurement, System Integration, and Facilities Management services. Over the observed periods, the gross profit margin showed variability, with a notable low of 12.21% and reaching as high as 42.18%. Operating expenses are significant in relation to revenue, with General & Administrative Expenses being a major component. The company's financial performance has fluctuated between losses and profits across different quarters.

PE: 49.1x

TSS, Inc. is navigating the competitive landscape with a focus on AI and high-performance computing, as highlighted by recent board additions and strategic acquisition plans. Despite revenue for Q3 2025 dropping to US$41.88 million from US$70.07 million a year ago, the company remains committed to growth through acquisitions in AI and edge computing sectors. Insider confidence is evident with leadership changes aimed at transformation initiatives. While profit margins have slightly decreased to 2.1%, future earnings are projected to grow annually by 46%.

- Click here to discover the nuances of TSS with our detailed analytical valuation report.

Explore historical data to track TSS' performance over time in our Past section.

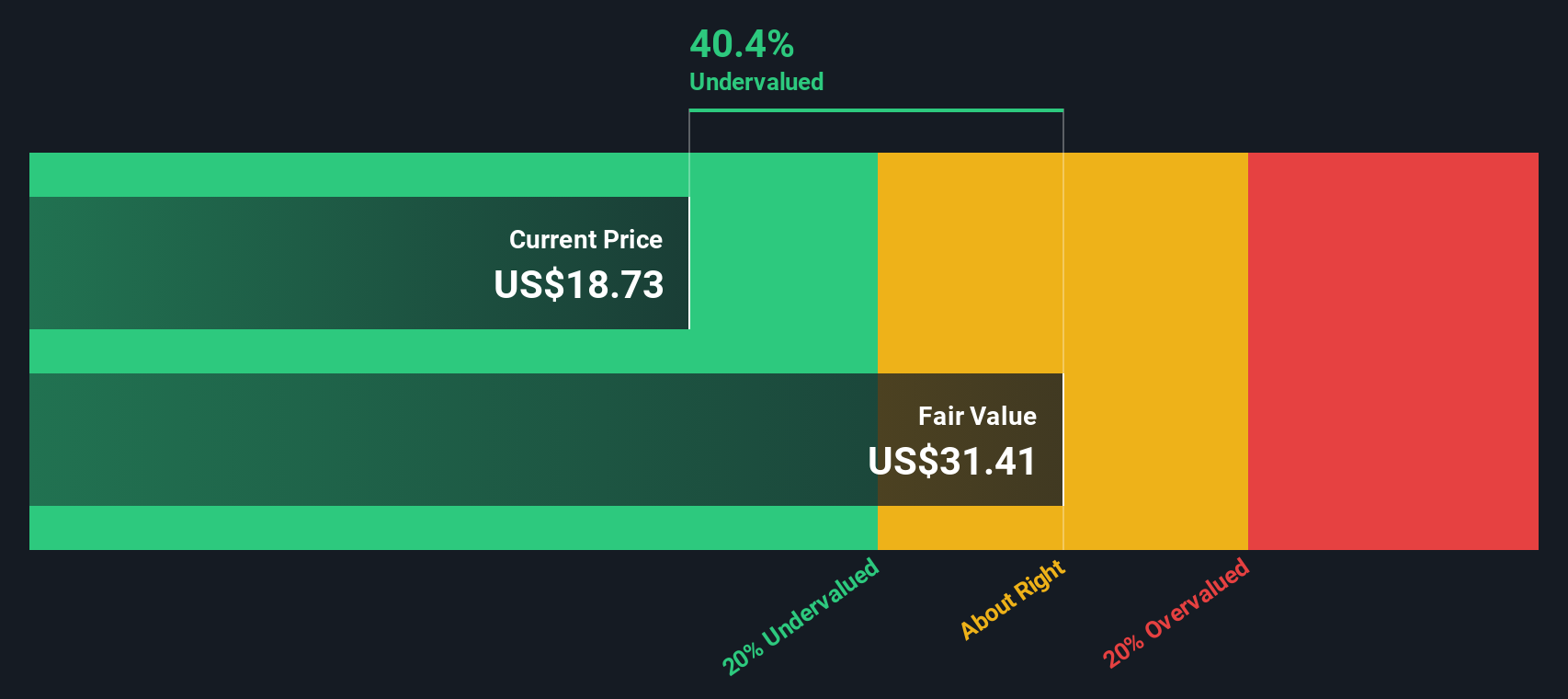

Integra LifeSciences Holdings (IART)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Integra LifeSciences Holdings is a medical technology company specializing in regenerative technologies and neurosurgical solutions, with a market capitalization of approximately $2.92 billion.

Operations: The company's revenue primarily comes from Codman Specialty Surgical, generating $1.19 billion, and Tissue Technologies, contributing $451.10 million. The gross profit margin has shown a downward trend over the periods provided, with recent figures around 57.50%. Operating expenses and non-operating expenses have significantly impacted net income margins, which have been negative in recent periods.

PE: -2.1x

Integra LifeSciences, a smaller player in the medical device sector, has recently gained attention due to its potential for growth and insider confidence. They announced FDA clearance for their CUSA Clarity Ultrasonic Surgical Aspirator System's use in cardiac surgeries, broadening their market reach. Despite reporting a net loss of US$5.4 million for Q3 2025, sales increased to US$402 million from US$381 million the previous year. Looking ahead, they project annual revenues between US$1.62 billion and US$1.64 billion amidst challenging organic growth conditions.

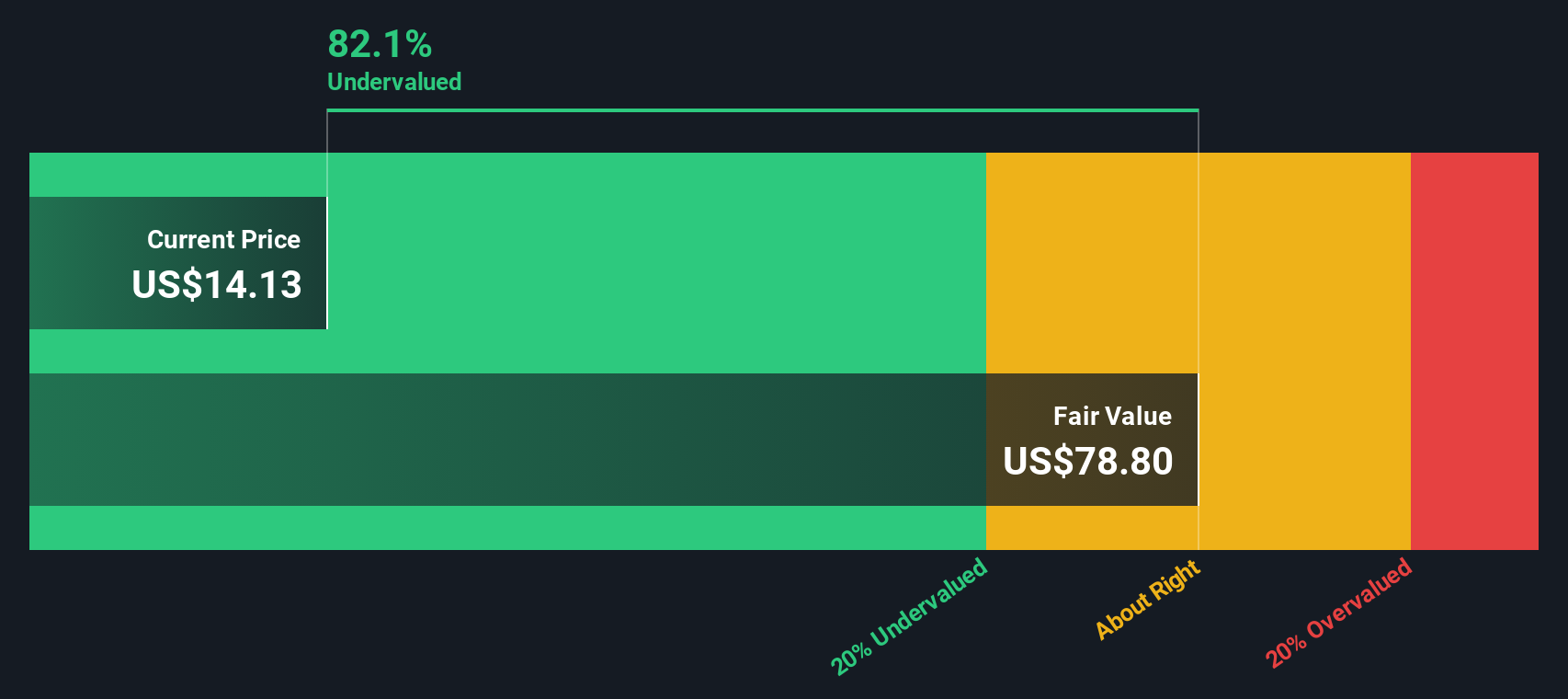

JetBlue Airways (JBLU)

Simply Wall St Value Rating: ★★★★★☆

Overview: JetBlue Airways is a major American low-cost airline providing air transportation services, with operations primarily in the United States, and has a market capitalization of approximately $2.33 billion.

Operations: JetBlue Airways generates revenue primarily from air transportation services, with a recent quarterly revenue of $9.10 billion. The company's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which was $6.98 billion in the latest period, resulting in a gross profit margin of 23.22%. Operating expenses, including depreciation and sales & marketing costs, further impact profitability, contributing to a net loss in several recent periods.

PE: -3.9x

JetBlue Airways, a smaller player in the U.S. airline industry, has been expanding its network significantly, particularly in Florida and New York. Recent announcements include new routes from Fort Lauderdale to Orlando and Dallas starting mid-2026, and a new service between JFK and Cleveland beginning March 30, 2026. Insider confidence is evident with Independent Director Nikhil Mittal purchasing 100,000 shares for approximately US$614K recently. Despite challenges like high external borrowing risks and recent losses reported at US$143 million for Q3 2025, JetBlue's strategic expansions aim to enhance connectivity across key markets.

- Get an in-depth perspective on JetBlue Airways' performance by reading our valuation report here.

Review our historical performance report to gain insights into JetBlue Airways''s past performance.

Next Steps

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 76 more companies for you to explore.Click here to unveil our expertly curated list of 79 Undervalued US Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal