3 Undiscovered Gems In The US Market With Strong Potential

As the U.S. market navigates a period of volatility with major indices like the S&P 500 and Dow Jones Industrial Average recently hitting all-time highs before pulling back, investors are keenly observing economic indicators that could impact small-cap companies, such as job openings and oil prices. In this dynamic environment, identifying stocks with strong potential often involves looking beyond the headlines to find companies that are well-positioned to capitalize on unique opportunities or market inefficiencies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Investar Holding (ISTR)

Simply Wall St Value Rating: ★★★★★★

Overview: Investar Holding Corporation is the bank holding company for Investar Bank, offering a variety of commercial banking products to individuals, professionals, and small to medium-sized businesses in south Louisiana, southeast Texas, and Alabama with a market cap of $369.61 million.

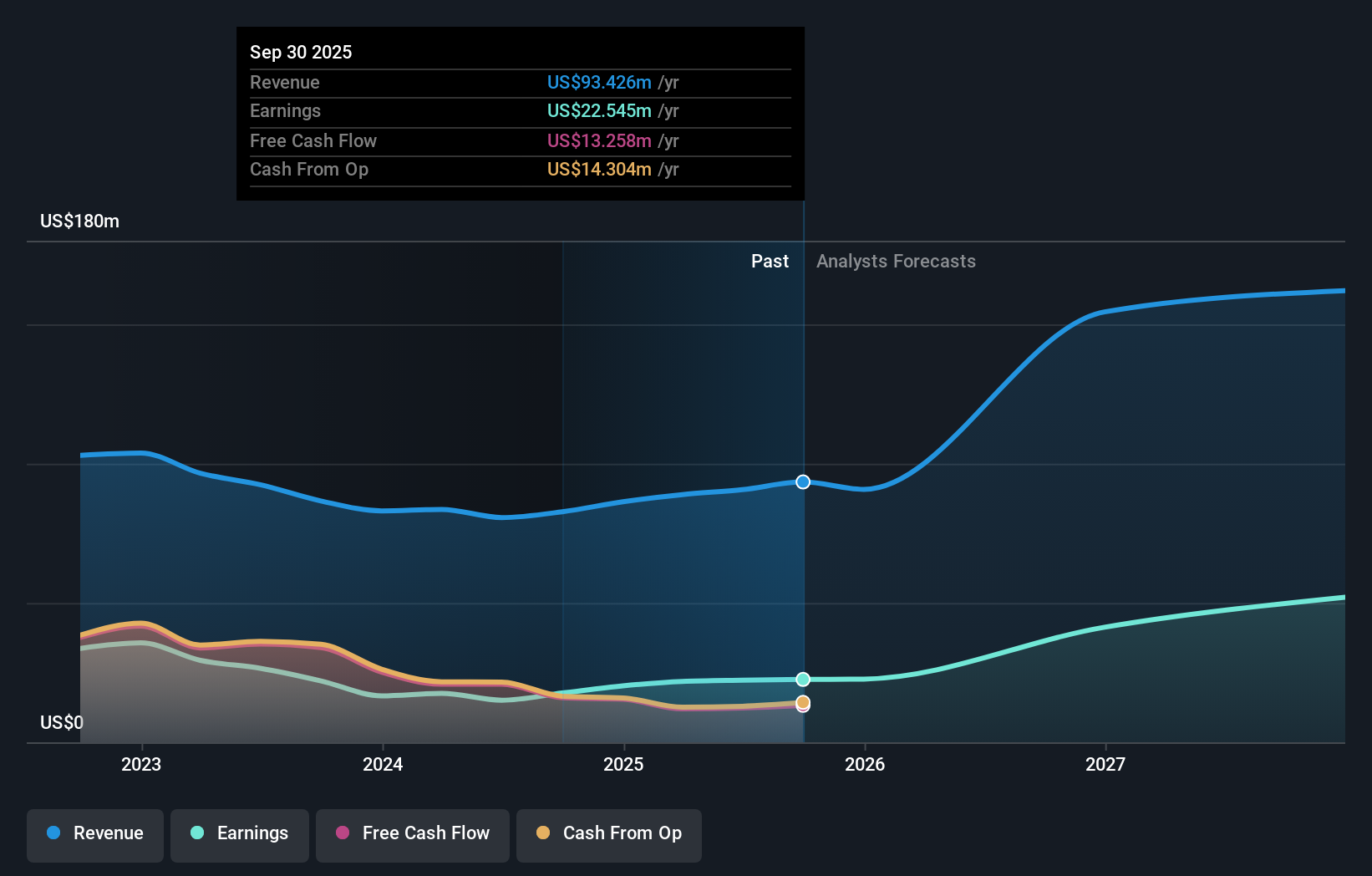

Operations: Investar Holding generates revenue primarily from its banking segment, amounting to $93.43 million.

Investar Holding, a bank holding company with total assets of US$2.8 billion and equity of US$295.3 million, demonstrates solid financial health. It has total deposits of US$2.4 billion and loans amounting to US$2.1 billion, supported by a net interest margin of 2.6%. The company maintains an appropriate level of bad loans at 0.4% and provides sufficient allowance for these loans at 345%. Recent board changes include the appointments of David Flack and James Dunkerley, while the company repurchased shares worth US$0.32 million in Q3 2025, enhancing shareholder value amidst steady earnings growth surpassing industry averages.

- Click here and access our complete health analysis report to understand the dynamics of Investar Holding.

Understand Investar Holding's track record by examining our Past report.

Willdan Group (WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States with a market cap of $1.69 billion.

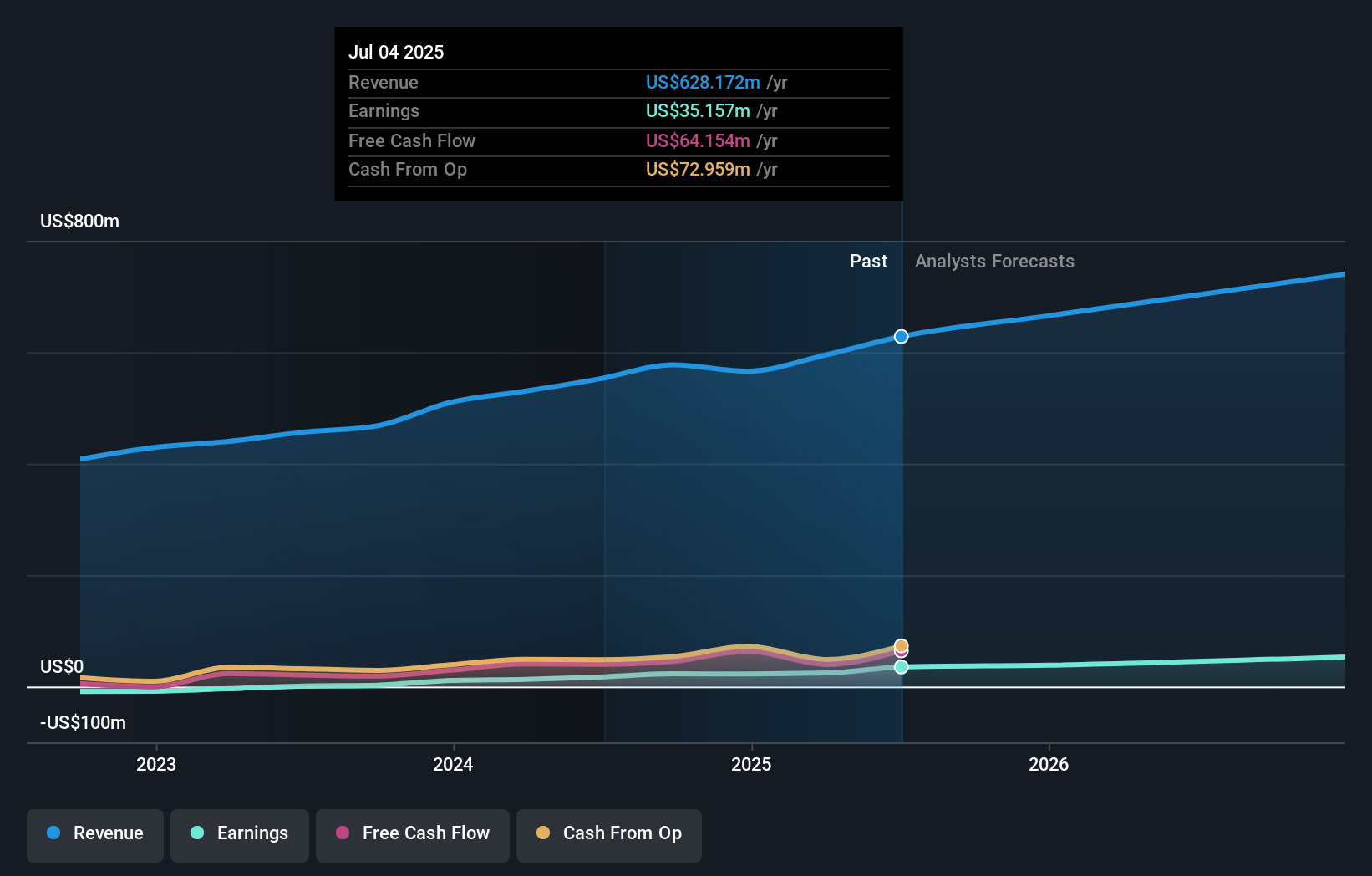

Operations: The company's revenue is primarily derived from two segments: Energy, contributing $548.42 million, and Engineering & Consulting, adding $103.50 million.

Willdan Group, with its strong financial footing, shows promise in the professional services sector. Its net debt to equity ratio stands at a satisfactory 5.6%, and interest payments are well covered by EBIT at 6.7 times, indicating robust financial health. Over the past year, earnings surged by 81.4%, outpacing industry growth of 8.1%. The company recently secured a $97 million contract for energy upgrades in Alameda County and raised its earnings guidance for 2025, reflecting confidence in future performance. Trading at over 40% below estimated fair value suggests potential upside for investors eyeing value opportunities in smaller companies like Willdan.

- Click to explore a detailed breakdown of our findings in Willdan Group's health report.

Gain insights into Willdan Group's past trends and performance with our Past report.

Pathward Financial (CASH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.66 billion.

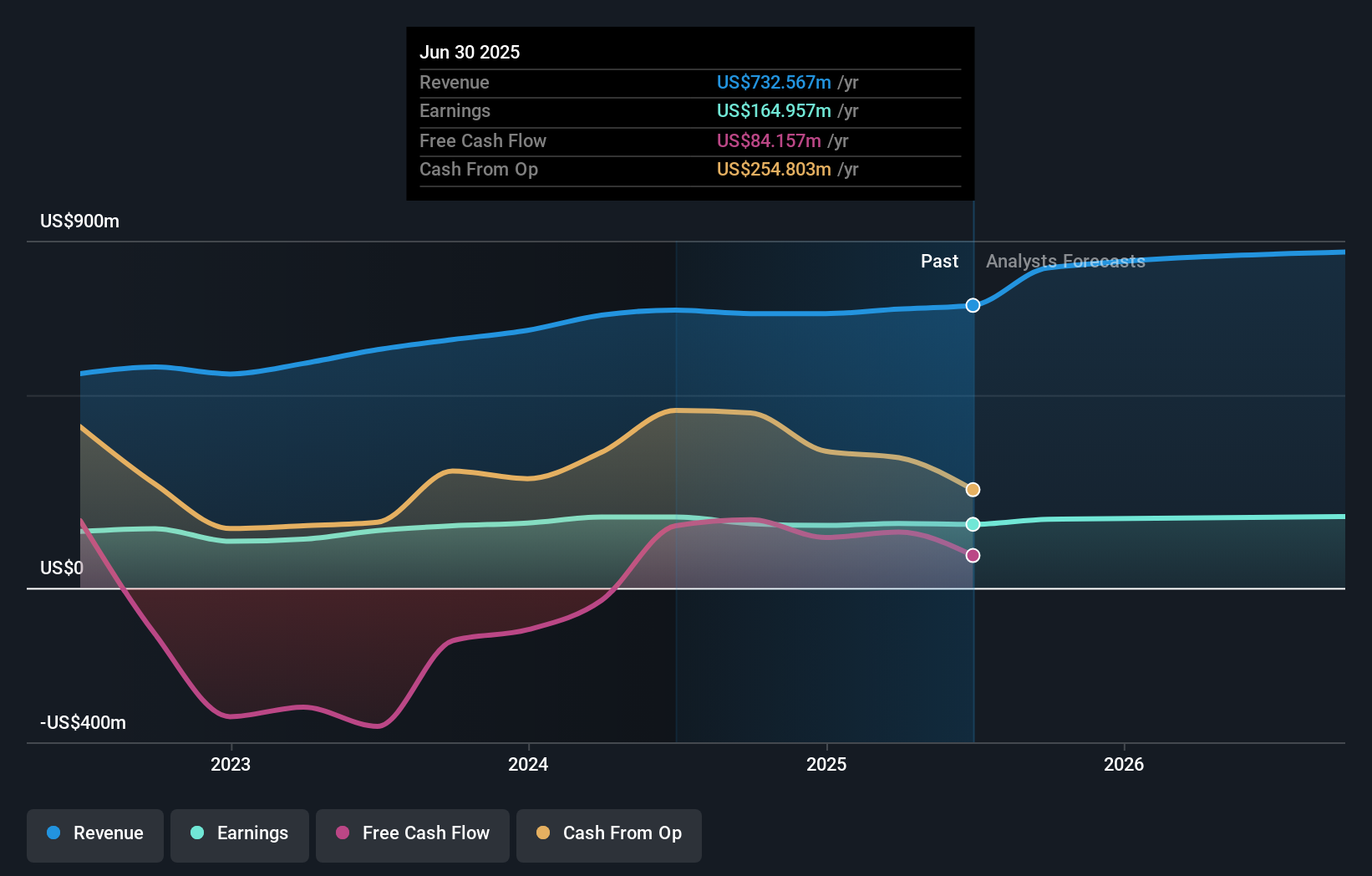

Operations: Pathward Financial generates revenue primarily from its Consumer and Commercial segments, with $498.67 million and $248.34 million respectively. The company also earns $36.10 million from Corporate Services.

Pathward Financial, with assets totaling US$7.2 billion and equity of US$857.5 million, presents a compelling profile in the financial sector. Its total deposits stand at US$5.9 billion against loans of US$4.6 billion, but it faces challenges with a high 2.1% bad loan ratio and insufficient allowance for these loans at 54%. Despite these hurdles, Pathward is trading at nearly 70% below its estimated fair value and has demonstrated earnings growth of 8.2% annually over five years, signaling potential upside for investors seeking value opportunities in under-the-radar stocks.

Key Takeaways

- Investigate our full lineup of 297 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal