Some Confidence Is Lacking In CuriosityStream Inc. (NASDAQ:CURI) As Shares Slide 30%

The CuriosityStream Inc. (NASDAQ:CURI) share price has fared very poorly over the last month, falling by a substantial 30%. Still, a bad month hasn't completely ruined the past year with the stock gaining 83%, which is great even in a bull market.

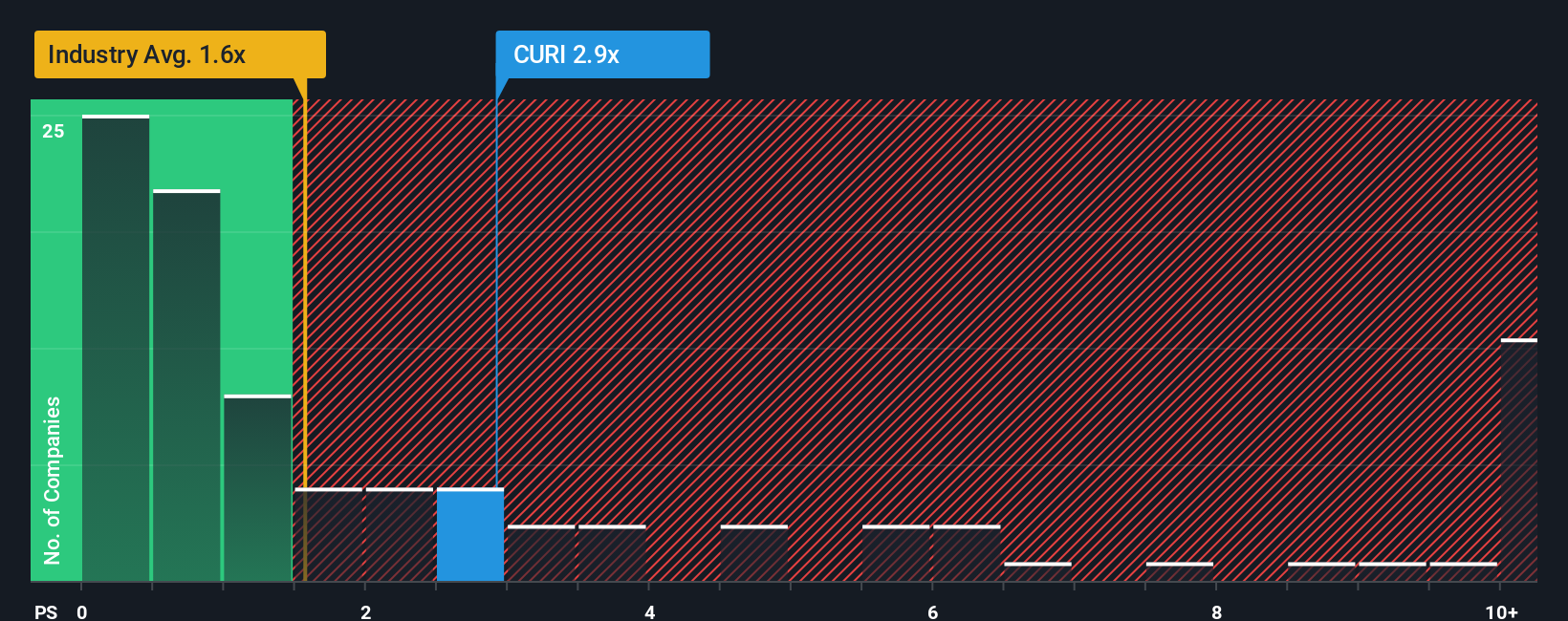

Although its price has dipped substantially, when almost half of the companies in the United States' Entertainment industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider CuriosityStream as a stock probably not worth researching with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CuriosityStream

What Does CuriosityStream's Recent Performance Look Like?

Recent times have been advantageous for CuriosityStream as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think CuriosityStream's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like CuriosityStream's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. Still, revenue has fallen 27% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the three analysts following the company. With the industry predicted to deliver 3,153% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that CuriosityStream is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From CuriosityStream's P/S?

Despite the recent share price weakness, CuriosityStream's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for CuriosityStream, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for CuriosityStream (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on CuriosityStream, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal