Assessing Aeris Resources (ASX:AIS) Valuation After Constellation Project Approval

Why Aeris Resources (ASX:AIS) is back on investors’ radar

Aeris Resources (ASX:AIS) is attracting fresh attention after securing Development Consent for its Constellation Project. This project is expected to lift production capacity at the Tritton Copper Mine in New South Wales.

See our latest analysis for Aeris Resources.

The Constellation approval comes after a strong run in the shares, with a 30 day share price return of 25.74% and a 1 year total shareholder return of 252.78%. However, 3 and 5 year total shareholder returns remain slightly negative, suggesting momentum has picked up only more recently.

If developments like Constellation have you thinking about where growth could come from next, it may be worth scanning fast growing stocks with high insider ownership as a starting point for other ideas.

The shares now sit close to one broker’s price target and the recent rally has been powerful. The key question for you is whether Aeris still trades at a discount or if the market is already pricing in future growth.

Most Popular Narrative: 3% Overvalued

Compared with the last close of A$0.64, the most followed narrative points to a fair value of A$0.62, which creates a small valuation gap for investors to consider.

The Constellation deposit presents a significant opportunity for increasing production, with updated reserves indicating a larger open pit than initially expected. This is expected to provide a baseload feed to the Tritton mill for several years, which in turn may support sustainable revenue growth and improved earnings.

Curious how a single ore body, modest revenue assumptions and a tighter margin profile still support that price? The full narrative lays out the numbers step by step.

Result: Fair Value of $0.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh up risks such as project delays at Murrawombie or Constellation, as well as pressure on cash flows from high capital spending and bonding requirements.

Find out about the key risks to this Aeris Resources narrative.

Another Angle on Value

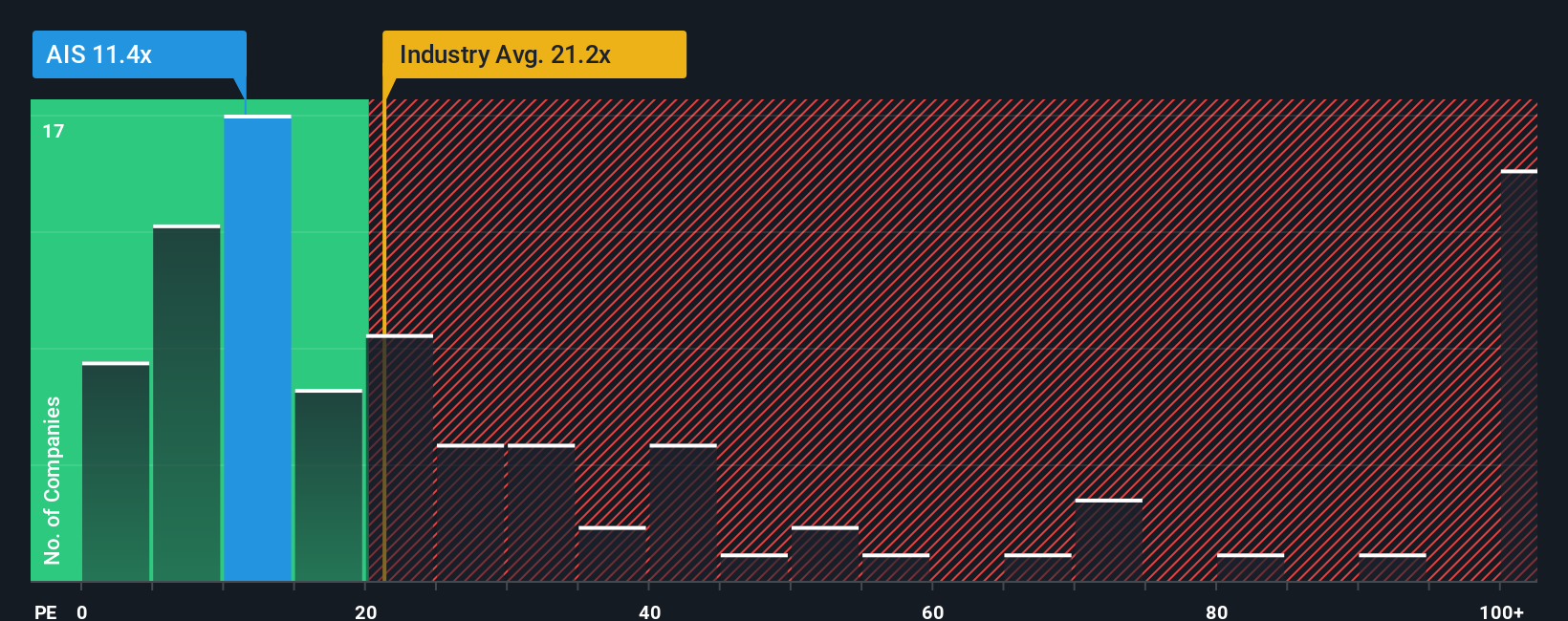

The narrative fair value of A$0.62 suggests Aeris is around 3% above that mark, yet our earnings based view points in a different direction. On a P/E of 16.1x, Aeris trades well below the Australian Metals and Mining industry at 24x and peers at 28.9x, and also below its fair ratio of 22.4x. That gap could point to upside if sentiment shifts, or signal that the market is still cautious. Which story do you think holds more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aeris Resources Narrative

If you see the numbers differently or want to stress test your own view, the tools are available to build a custom thesis in minutes: Do it your way.

A great starting point for your Aeris Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Aeris has sparked your interest, do not stop here. The market is full of other stories waiting for you to weigh them up thoughtfully.

- Spot potential value by scanning these 884 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into future focused themes with these 26 AI penny stocks that are tied to artificial intelligence trends.

- Harvest potential income ideas through these 12 dividend stocks with yields > 3% offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal