3 European Dividend Stocks Yielding Up To 9.7%

As the European market continues to show strength, with the STOXX Europe 600 Index reaching new highs and closing 2025 with its best performance in four years, investors are increasingly looking towards dividend stocks as a reliable source of income amidst this economic optimism. In such a robust environment, selecting dividend stocks that offer both attractive yields and stable financial foundations can be a strategic way to capitalize on Europe's positive momentum.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.22% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.95% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.74% | ★★★★★★ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.99% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.86% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.09% | ★★★★★★ |

Click here to see the full list of 193 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

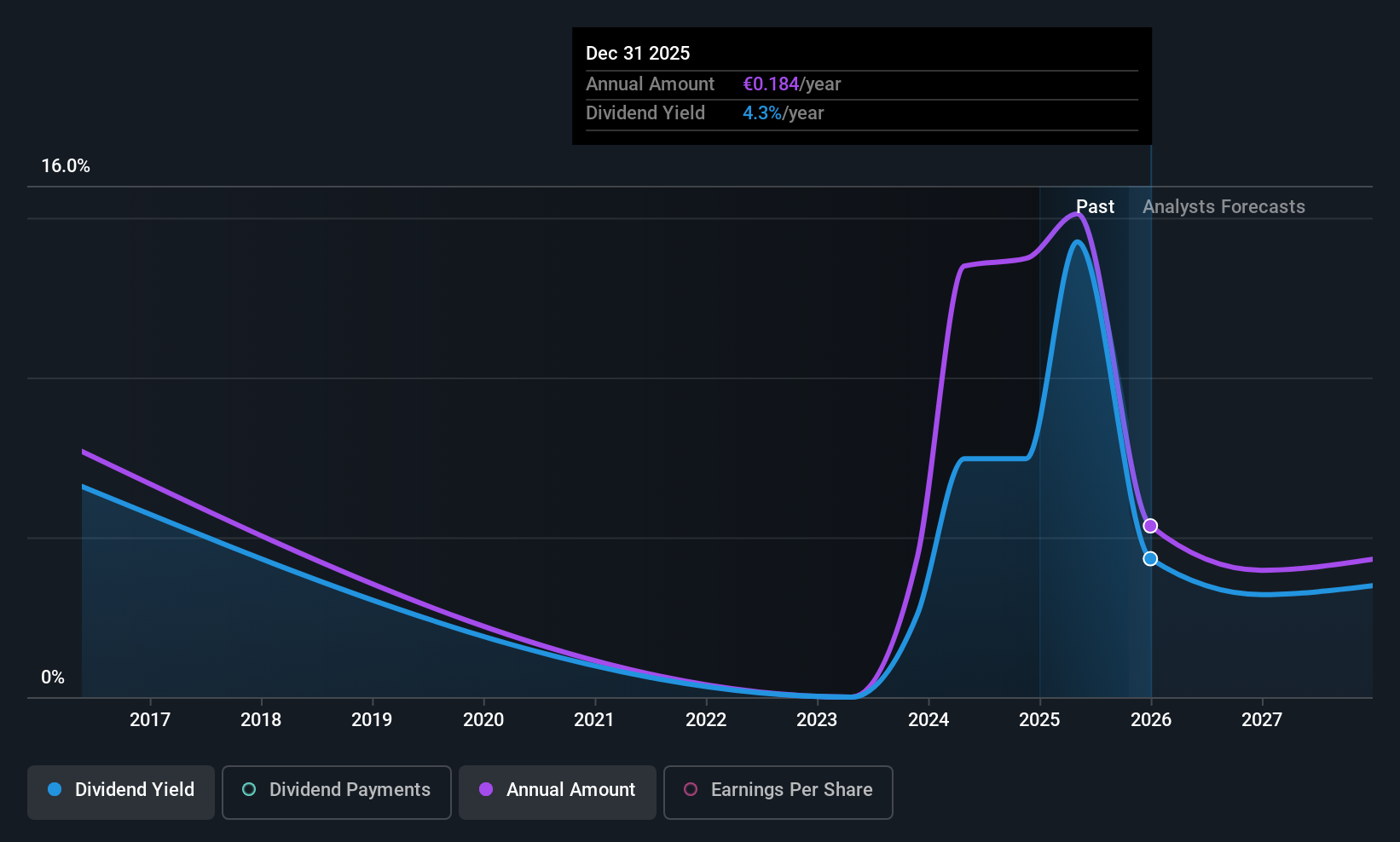

d'Amico International Shipping (BIT:DIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: d'Amico International Shipping S.A., with a market cap of €616.25 million, operates as a marine transportation company through its subsidiaries worldwide.

Operations: d'Amico International Shipping S.A. generates revenue primarily from its product tankers segment, totaling $367.40 million.

Dividend Yield: 9.7%

d'Amico International Shipping presents a mixed outlook for dividend investors. Despite a stable and reliable dividend history over the past decade, recent financials show challenges. The company's third-quarter earnings declined, with net income falling to US$24.29 million from US$40.2 million year-on-year. A high cash payout ratio of 126.4% indicates dividends are not well covered by cash flows, questioning sustainability despite a competitive yield of 9.71%. Trading below estimated fair value suggests potential undervaluation relative to peers and industry benchmarks.

- Unlock comprehensive insights into our analysis of d'Amico International Shipping stock in this dividend report.

- The analysis detailed in our d'Amico International Shipping valuation report hints at an deflated share price compared to its estimated value.

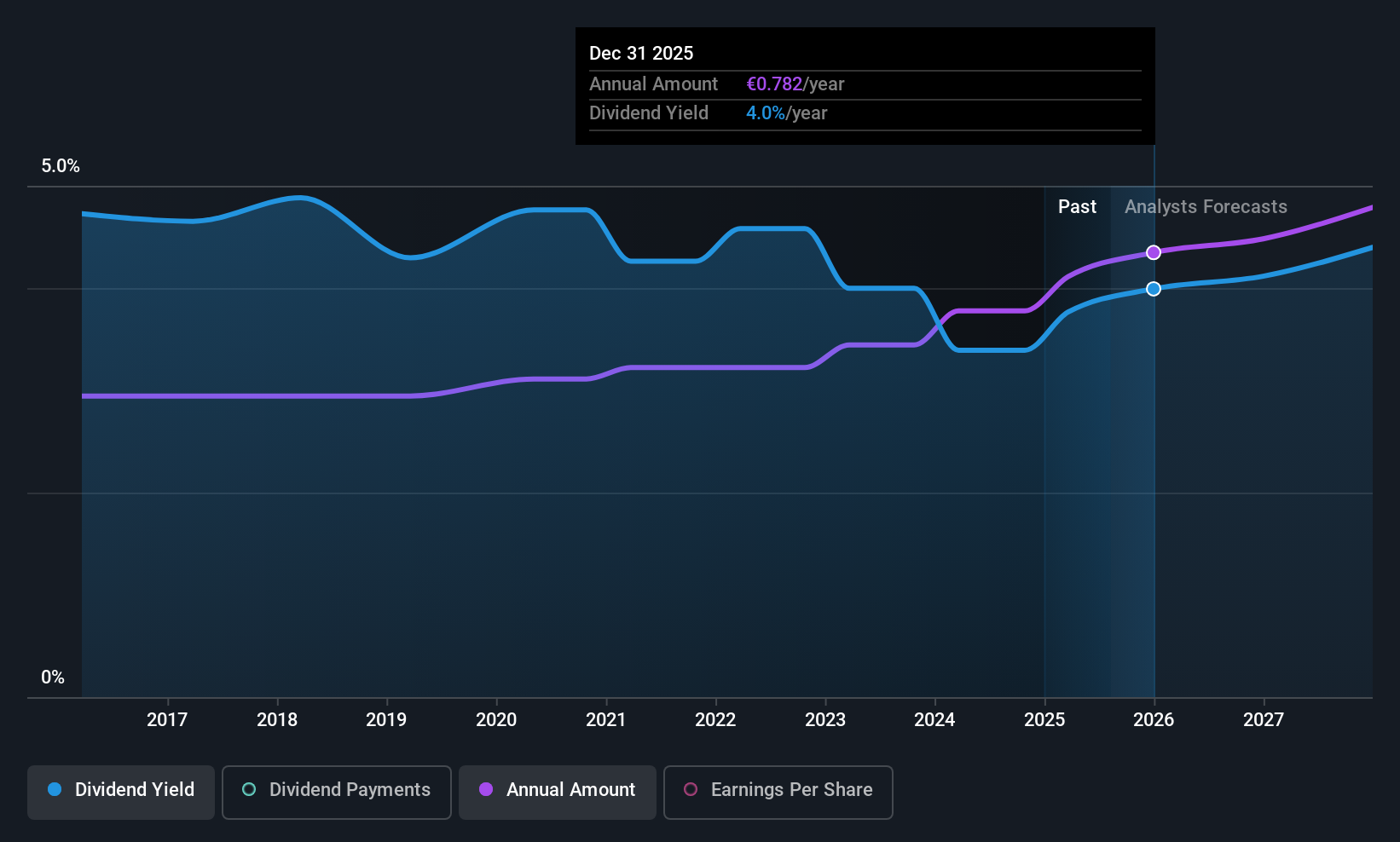

Kemira Oyj (HLSE:KEMIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kemira Oyj is a chemicals company that operates in Finland and internationally across Europe, the Middle East, Africa, the Americas, and the Asia Pacific, with a market cap of €3.03 billion.

Operations: Kemira Oyj generates revenue from its Water Solutions segment, which amounts to €1.24 billion.

Dividend Yield: 3.6%

Kemira Oyj offers a stable dividend profile, supported by a payout ratio of 52% and cash payout ratio of 48.8%, ensuring dividends are well covered by earnings and cash flows. Although it provides a reliable dividend yield of 3.65%, this is lower than the top quartile in Finland. Despite recent declines in revenue and net income, Kemira's stock trades at an attractive valuation below its estimated fair value, suggesting potential for capital appreciation alongside steady dividends.

- Dive into the specifics of Kemira Oyj here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Kemira Oyj is priced lower than what may be justified by its financials.

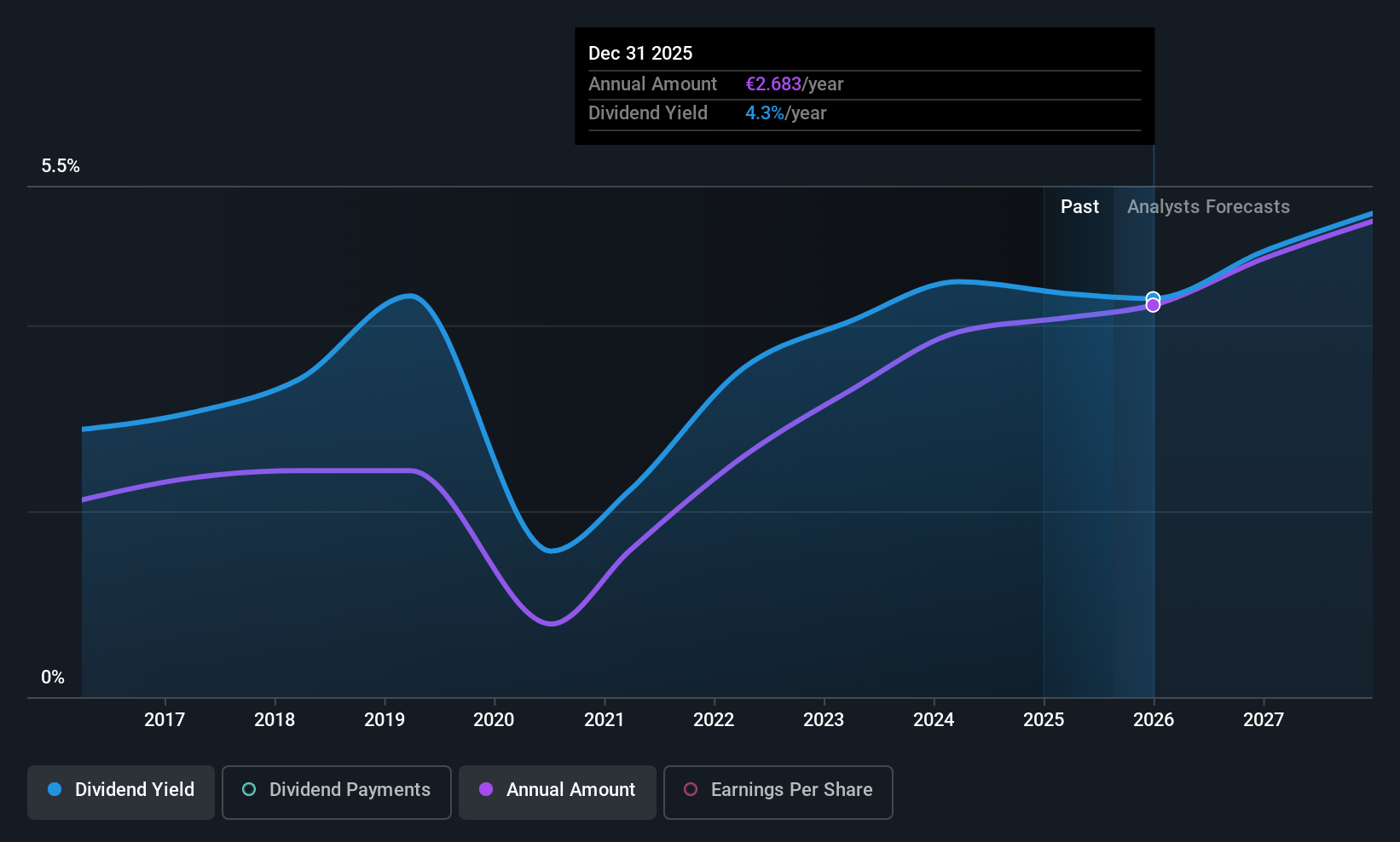

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG provides industrial machinery, equipment, and services across various regions including Europe, North America, South America, China, Asia, Africa, and Australia with a market cap of €6.76 billion.

Operations: Andritz AG's revenue is primarily derived from its segments: Metals (€1.68 billion), Hydro Power (€1.68 billion), Pulp & Paper (€2.94 billion), and Environment & Energy (€1.52 billion).

Dividend Yield: 3.8%

Andritz AG's dividend payments are supported by a payout ratio of 55.7% and a cash payout ratio of 74.2%, indicating coverage by earnings and cash flows, though they have been volatile over the past decade. The current yield of 3.75% is below the Austrian market's top quartile, yet the stock trades at 51% below its estimated fair value, offering potential value despite recent declines in revenue and net income for Q3 and nine months ending September 2025.

- Take a closer look at Andritz's potential here in our dividend report.

- According our valuation report, there's an indication that Andritz's share price might be on the cheaper side.

Turning Ideas Into Actions

- Dive into all 193 of the Top European Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal