A Look At DraftKings (DKNG) Valuation As Mindway AI Partnership Highlights Responsible Gaming Focus

DraftKings (DKNG) is in focus after Mindway AI agreed to integrate its Gamalyze decision-analysis tool into the DraftKings Responsible Gaming Center, placing responsible play and behavioral insights at the center of the customer experience.

See our latest analysis for DraftKings.

Despite the responsible gaming push and growing attention from investors, DraftKings' 1-year total shareholder return of 9.62% decline and 1-day share price return of 0.83% decline suggest momentum has cooled recently, even though the 3-year total shareholder return of about 2.7x still reflects a strong longer term journey.

If this kind of customer focused use of technology interests you, it could be a good moment to see what else is shaping sports betting, online gaming and fast growing stocks with high insider ownership.

So with DraftKings shares giving up some ground over the past year, yet still sitting on a multiyear gain and trading below the average analyst price target, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 22.1% Undervalued

With DraftKings last closing at US$34.66 against a narrative fair value of about US$44.47, the valuation gap is built on some very specific growth and margin assumptions that investors may want to understand more clearly.

Analysts are assuming DraftKings's revenue will grow by 20.5% annually over the next 3 years.

Analysts assume that profit margins will increase from 5.6% loss today to 13.8% profit in 3 years time.

Want to see what kind of revenue base, margin shift, and future earnings multiple all need to line up to back that valuation gap? The full narrative sets out a detailed earnings ramp, a specific profitability timeline, and the P/E level that would need to hold by the late 2020s to make this fair value stack up.

Result: Fair Value of $44.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still leans on regulators staying reasonably supportive and on prediction market rivals not eroding DraftKings share or pressuring its margins.

Find out about the key risks to this DraftKings narrative.

Another Angle: Price To Sales Paints A Richer Picture

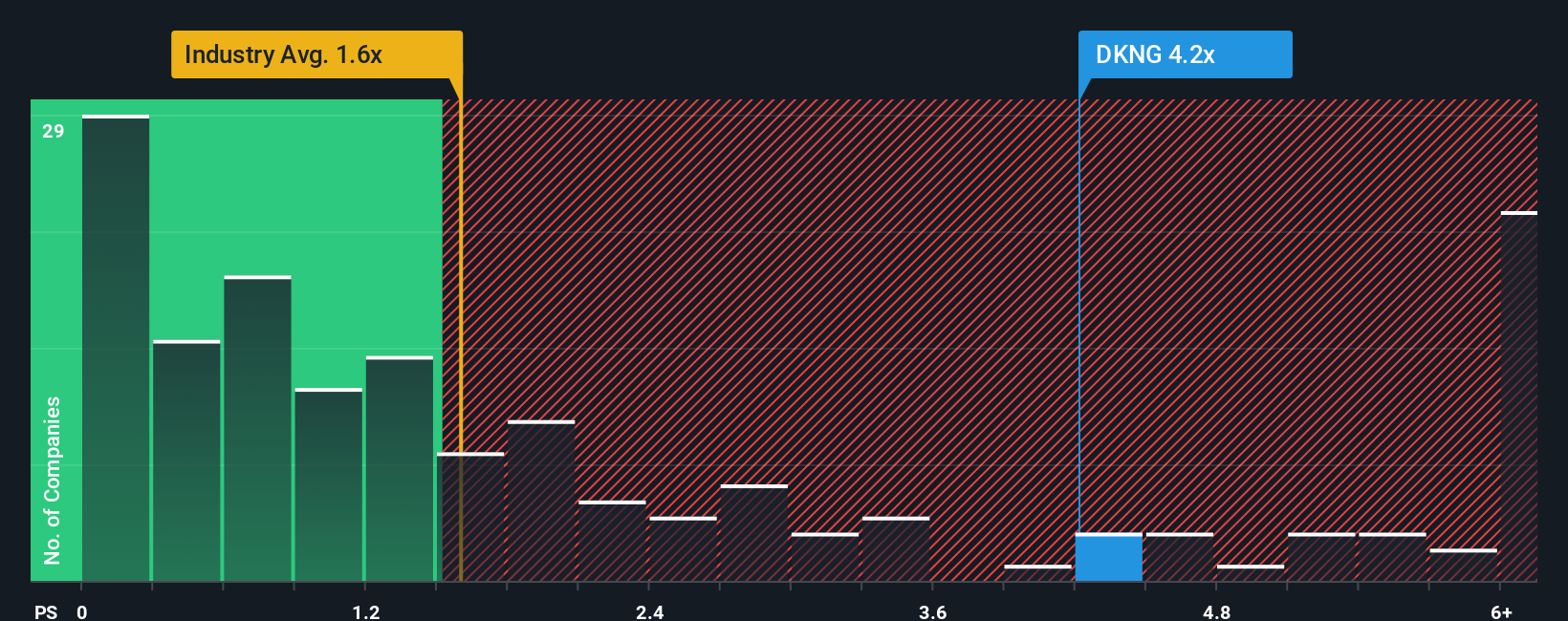

While the narrative fair value suggests underpricing, the current P/S ratio of 3.2x tells a more cautious story. It is higher than the US Hospitality average of 1.7x and the peer average of 2.1x. However, it is very close to the fair ratio of 3.3x that the market could gravitate toward.

Put simply, the market is already paying a premium versus the sector and peers, with only a small cushion against the fair ratio. Is that a margin of safety you are comfortable with, or does it leave too little room for error if expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DraftKings Narrative

If you see the numbers differently and prefer to weigh the assumptions yourself, you can stress test the inputs and Do it your way in just a few minutes.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DraftKings.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one stock. Use the screener to quickly surface ideas that actually fit your plan.

- Spot potential value gaps by checking out these 884 undervalued stocks based on cash flows that may offer more attractive pricing relative to their cash flows.

- Ride powerful tech themes by scanning these 26 AI penny stocks that are tied to artificial intelligence across different parts of the market.

- Target income potential by reviewing these 12 dividend stocks with yields > 3% that already meet a minimum yield hurdle of 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal