Is It Too Late To Consider IBM (IBM) After Its 201% Five Year Share Price Jump?

- Wondering if International Business Machines (IBM) is still good value after its long run, or if the easy money has already been made? This article walks through that question step by step so you can judge the current price with more confidence.

- IBM shares last closed at US$296.73, with returns of 0.2% over 7 days, a 4.0% decline over 30 days, a 1.8% gain year to date, 36.4% over 1 year, 127.9% over 3 years and 201.1% over 5 years.

- Recent attention on IBM has focused on its position in software and services, along with how its business mix fits into broader trends in large cap tech. These themes have framed how investors interpret the share price moves you are seeing today.

- On our checks, IBM scores 1 out of 6 for being undervalued. This suggests that some metrics may point to a full price while others hint at possible upside. Next, we will walk through those different valuation approaches before finishing with a way to tie them all together.

International Business Machines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: International Business Machines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes projected future cash flows and discounts them back to today, aiming to estimate what the entire stream of cash is worth in present dollar terms.

For International Business Machines, the model is a 2 Stage Free Cash Flow to Equity approach, using cash flows reported and projected in US$. The latest twelve month free cash flow is about US$11.7b. Analyst inputs and extrapolated estimates point to free cash flow of US$15.1b in 2026 and US$17.2b by 2028, with further projections out to 2035 based on gradually changing growth assumptions provided by Simply Wall St.

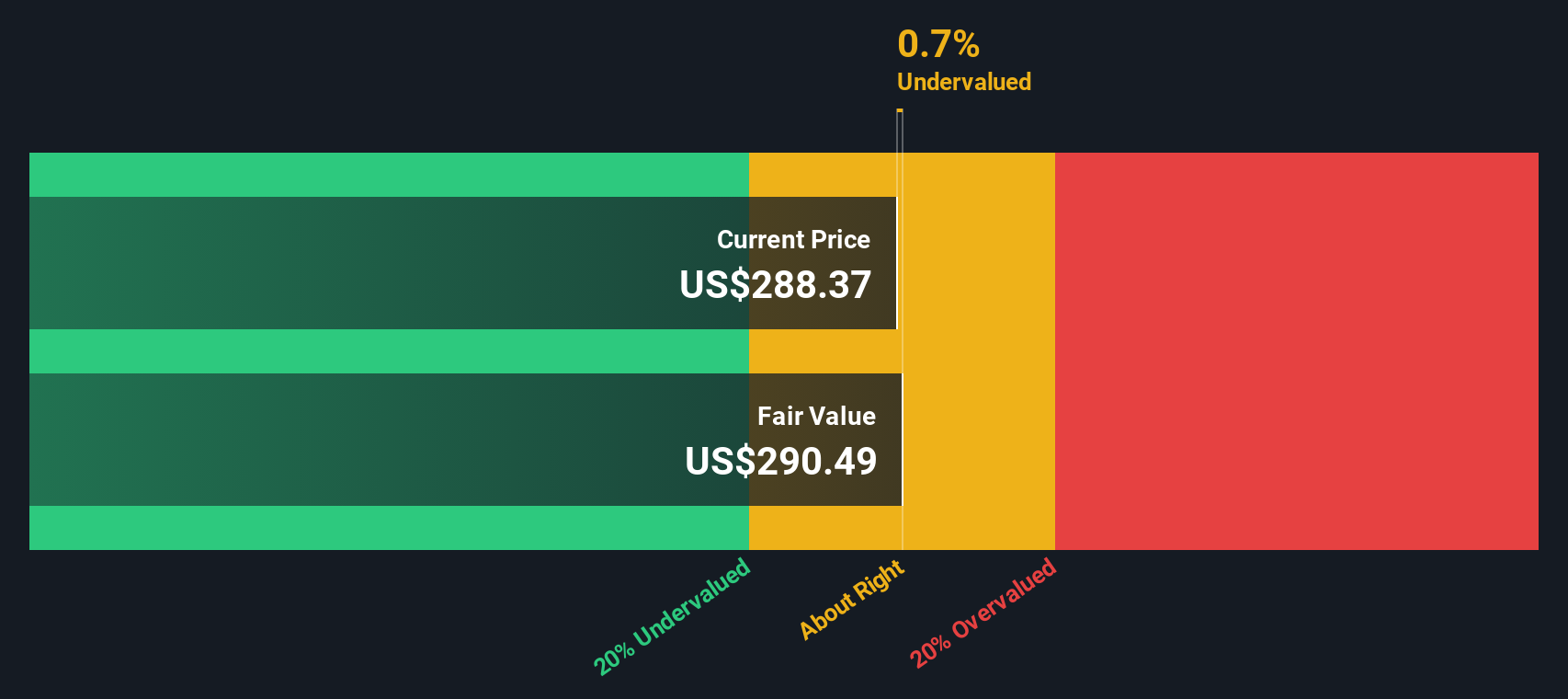

When those projected cash flows are discounted back to today and added together, the model arrives at an estimated intrinsic value of US$275.59 per share. Compared with the recent share price of US$296.73, this implies the stock is about 7.7% overvalued. This is a relatively small gap and is within the sort of margin where market pricing and model estimates often overlap.

Result: ABOUT RIGHT

International Business Machines is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: International Business Machines Price vs Earnings

For profitable companies, the P/E ratio is a useful shorthand for how many dollars the market is willing to pay for each dollar of earnings. It gives you a quick sense of how the share price lines up with the company’s current profit base.

What counts as a “normal” P/E depends heavily on the growth investors expect and the level of risk they see. Higher expected earnings growth or lower perceived risk usually justify a higher P/E, while slower growth or higher uncertainty tend to support a lower multiple.

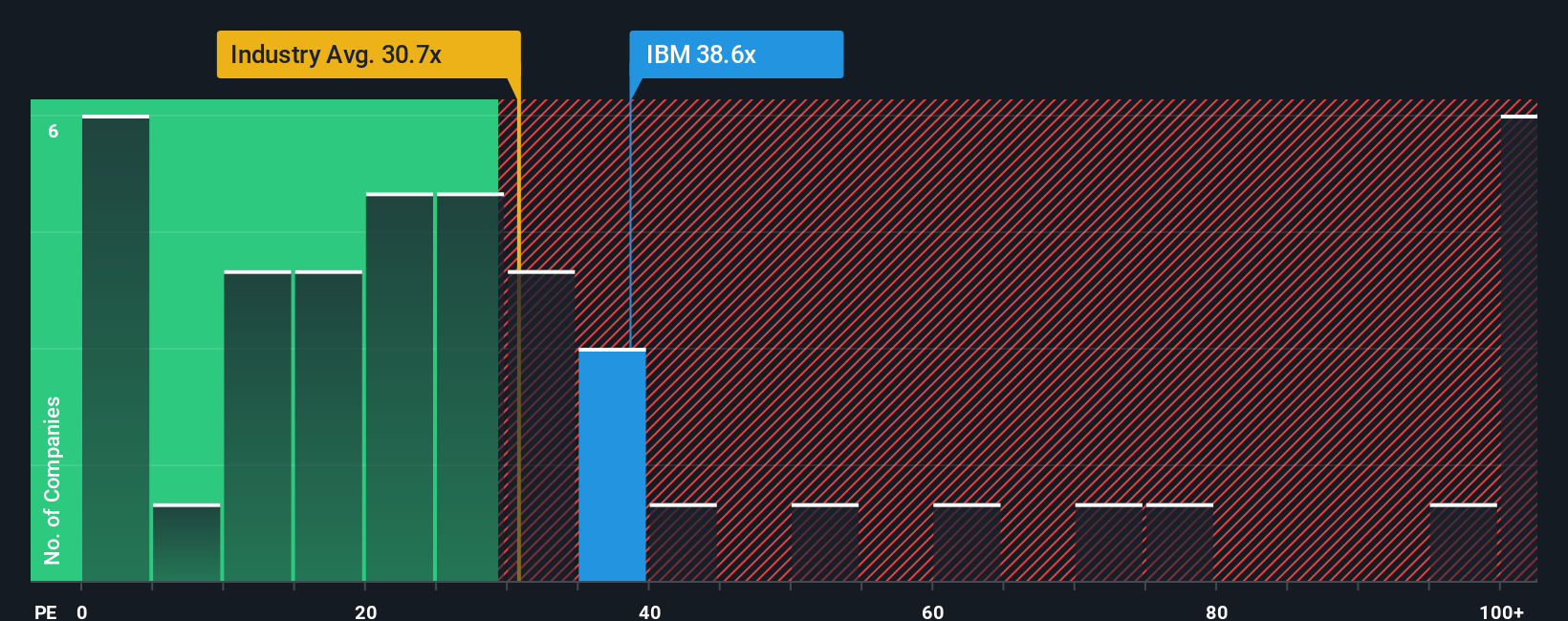

International Business Machines currently trades on a P/E of 35.03x. That sits above the IT industry average of about 31.30x, and also above the peer average of 22.65x. Simply Wall St’s Fair Ratio for IBM is 38.09x, which is its proprietary estimate of what the P/E might be given IBM’s earnings growth profile, margins, industry, market cap and risk factors.

The Fair Ratio can be more helpful than a simple peer or industry comparison because it adjusts for IBM specific characteristics rather than assuming all IT companies deserve the same multiple. With the actual P/E of 35.03x below the Fair Ratio of 38.09x, this suggests that the shares may be somewhat undervalued on this measure.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Business Machines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. With Narratives, you combine your story about International Business Machines with your own numbers, link that story to a forecast for revenue, earnings and margins, and then see a Fair Value that you can compare with today’s price inside the Simply Wall St Community page. This page updates as new news or earnings arrive and can span views from a more optimistic IBM case that lines up with a US$350 fair value through to a more cautious stance closer to US$198, depending on which version of the IBM story you find more convincing for your own decision making.

For International Business Machines, however, we will make it really easy for you with previews of two leading International Business Machines Narratives:

🐂 International Business Machines Bull Case

Fair value: US$350.00 per share

Gap to fair value: about 15.2% below this narrative fair value based on the last close

Assumed revenue growth: 6.14% a year

- Backs a faster build out of AI, hybrid cloud and modernization work in regulated sectors, which would support higher recurring software and services revenue.

- Leans on integration of Red Hat, HashiCorp and DataStax to shift more of IBM's mix toward higher margin software and recurring cash flows.

- Sees quantum computing, automation and infrastructure like Power11 and watsonx as potential sources of new, higher value revenue streams if adoption continues.

🐻 International Business Machines Bear Case

Fair value: US$293.89 per share

Gap to fair value: about 1.0% above this narrative fair value based on the last close

Assumed revenue growth: 5.16% a year

- Centers on a more moderate path for revenue and margin expansion, with hybrid cloud and AI helping but set against competition and macro related risks to Consulting and Software demand.

- Builds in the idea that projects like z17 and generative AI can support revenue and margins, while still leaving room for currency swings and project delays.

- Anchors on an analyst consensus fair value close to the current share price, with upside or downside depending on how software execution, Red Hat momentum and quantum potential play out.

Both narratives use the same raw company data but reach different conclusions about what matters most. Your own view may sit closer to one side, or somewhere between them, depending on how confident you are about IBM's ability to grow software, manage competition and turn long run projects like quantum into material earnings.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for International Business Machines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal