Antengene Leads The Charge In Global With 2 Other Penny Stocks

As global markets navigate a mix of economic signals, such as rising home sales in the U.S. and fluctuating stock indices, investors are contemplating the potential of smaller companies. Penny stocks, a term that may seem outdated but remains relevant, represent an intriguing investment area due to their potential for growth and value. In this article, we will explore three penny stocks that stand out for their financial strength and resilience, offering promising opportunities for those seeking under-the-radar investments with long-term potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.46 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.50 | THB1.05B | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.31 | £494.97M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.92 | A$447.24M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.64 | SGD14.33B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.72 | $418.55M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.21 | MYR323.58M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,550 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a clinical-stage APAC biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$2.77 billion.

Operations: The company generated CN¥84.35 million from its research, development, and commercialization of pharmaceutical products.

Market Cap: HK$2.77B

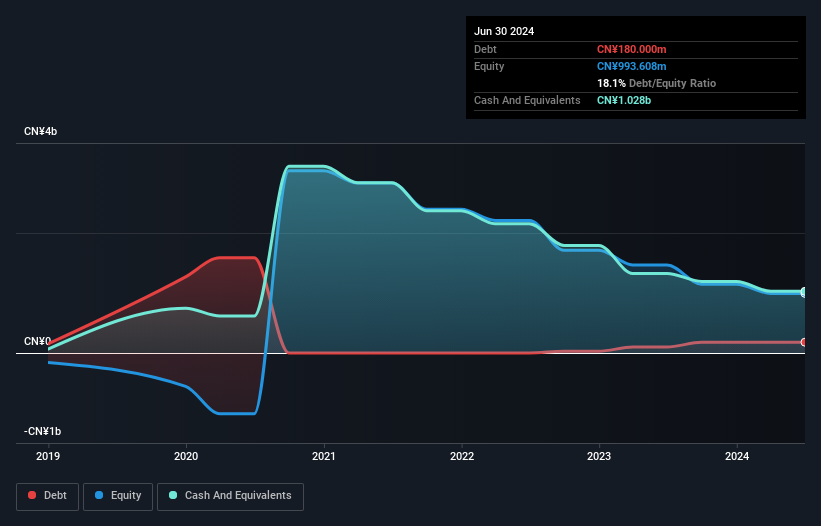

Antengene Corporation Limited, with a market cap of HK$2.77 billion, has been advancing its oncology portfolio by securing regulatory approvals and expanding clinical trials. Although currently unprofitable, the company has reduced losses by 39.9% annually over the past five years and possesses a solid cash runway exceeding two years if current cash flow trends persist. Recent approvals for XPOVIO® in Malaysia and Hong Kong broaden its therapeutic reach in hematology, while ongoing studies like CLINCH-2 for ATG-022 show promising safety and efficacy results across diverse tumor types. Antengene's experienced management team supports strategic growth amid significant R&D developments.

- Click to explore a detailed breakdown of our findings in Antengene's financial health report.

- Assess Antengene's future earnings estimates with our detailed growth reports.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for industries such as electrolytic aluminum, steel, construction machinery, and non-ferrous sectors in China and internationally, with a market cap of CN¥6.20 billion.

Operations: Zhuzhou Tianqiao Crane Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.2B

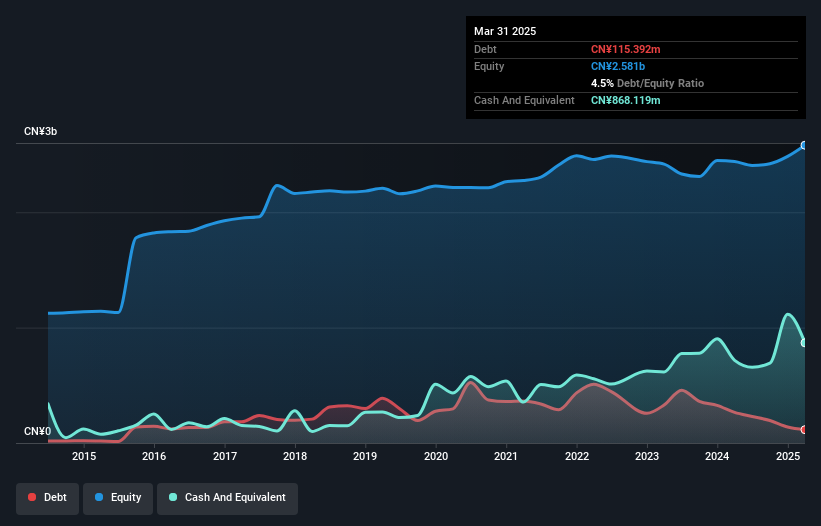

Zhuzhou Tianqiao Crane Co., Ltd. has shown robust earnings growth, with a 101.8% increase over the past year, significantly outpacing the machinery industry average. The company maintains a healthy financial position, with short-term assets of CN¥3.6 billion covering both short and long-term liabilities comfortably and more cash than total debt. Recent earnings reports indicate improved profitability, with net income rising to CN¥85.2 million for the nine months ending September 2025 from CN¥17.62 million a year earlier, reflecting enhanced operational efficiency despite low return on equity at 3.7%. Management's seasoned experience underpins strategic stability moving forward.

- Navigate through the intricacies of Zhuzhou Tianqiao Crane with our comprehensive balance sheet health report here.

- Evaluate Zhuzhou Tianqiao Crane's historical performance by accessing our past performance report.

Beijing Tongtech (SZSE:300379)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Tongtech Co., Ltd. offers high-security products and solutions in China, with a market cap of CN¥836.88 million.

Operations: The company generates revenue of CN¥883.06 million from its operations in China.

Market Cap: CN¥836.88M

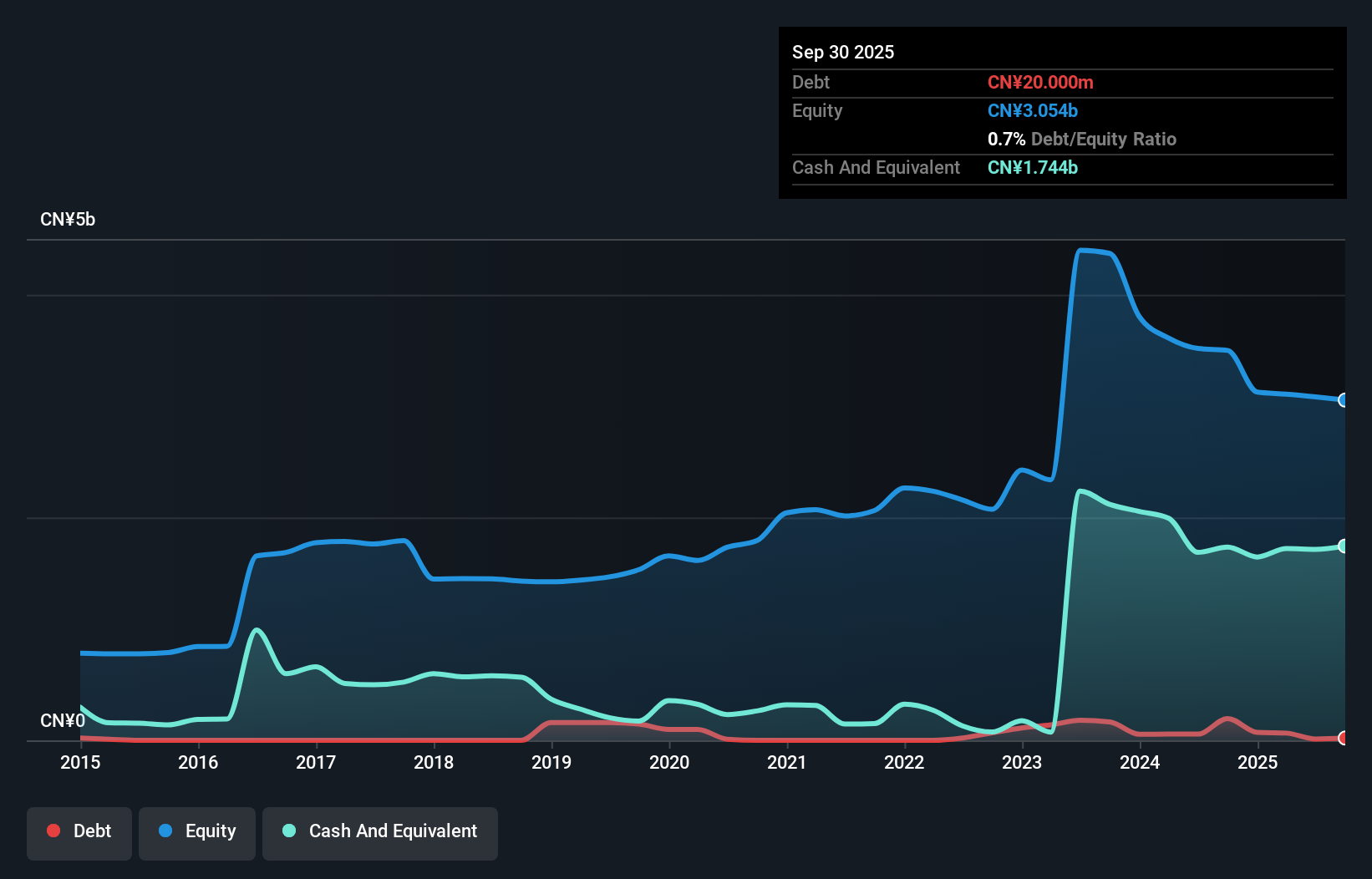

Beijing Tongtech Co., Ltd. has faced challenges recently, including being dropped from the Shenzhen Stock Exchange Composite and A Share Indexes. Despite reporting a net loss of CN¥84 million for the nine months ending September 2025, revenue increased to CN¥418.99 million from CN¥293.66 million year-on-year, indicating some operational improvement. The company holds strong short-term assets of CN¥2.7 billion, exceeding both its short and long-term liabilities significantly, providing financial stability despite ongoing unprofitability and a negative return on equity of -15.59%. High volatility persists in its share price movement over recent months.

- Dive into the specifics of Beijing Tongtech here with our thorough balance sheet health report.

- Understand Beijing Tongtech's track record by examining our performance history report.

Make It Happen

- Reveal the 3,550 hidden gems among our Global Penny Stocks screener with a single click here.

- Interested In Other Possibilities? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal