Assessing W. P. Carey (WPC) Valuation After Recent Share Price Momentum And Mixed Performance

What W. P. Carey’s recent performance means for investors

W. P. Carey (WPC) has seen mixed share performance recently, with a one month gain of 1.8% and a 3 month decline of 1.1%. This may have some income focused real estate investors reassessing the stock.

See our latest analysis for W. P. Carey.

At a share price of $66.31, W. P. Carey’s recent 2.98% 1 day and 3.03% 7 day share price returns sit alongside a year to date share price return of 2.24% and a 1 year total shareholder return of 28.07%. This suggests near term momentum has picked up after a softer 3 month patch.

If W. P. Carey has you thinking about your next idea, this can be a good moment to widen the search and check out fast growing stocks with high insider ownership.

With W. P. Carey trading at $66.31, a model-based intrinsic value gap of 56% and a modest 4.2% discount to the average analyst target, you have to ask: is this a genuine mispricing, or is the market already baking in future growth?

Most Popular Narrative Narrative: 4% Undervalued

The most followed narrative puts W. P. Carey’s fair value at US$69.09, a touch above the recent US$66.31 close, which raises some clear questions about what is baked into those numbers.

Significant lease structures feature inflation-linked escalators (CPI-based) and higher fixed annual bumps (around 2.8% on recent deals), enabling robust same-store rent growth even in a stable inflation environment, directly enhancing rental revenues and overall earnings.

Want to see what sits behind that rent escalator story? The narrative leans on paired revenue expansion and margin rebuilding, underpinned by earnings forecasts that stretch several years out.

Result: Fair Value of $69.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points to watch, especially tenant credit risk on single tenant properties and the reliance on asset sales to fund new investments.

Find out about the key risks to this W. P. Carey narrative.

Another angle on valuation: earnings multiples

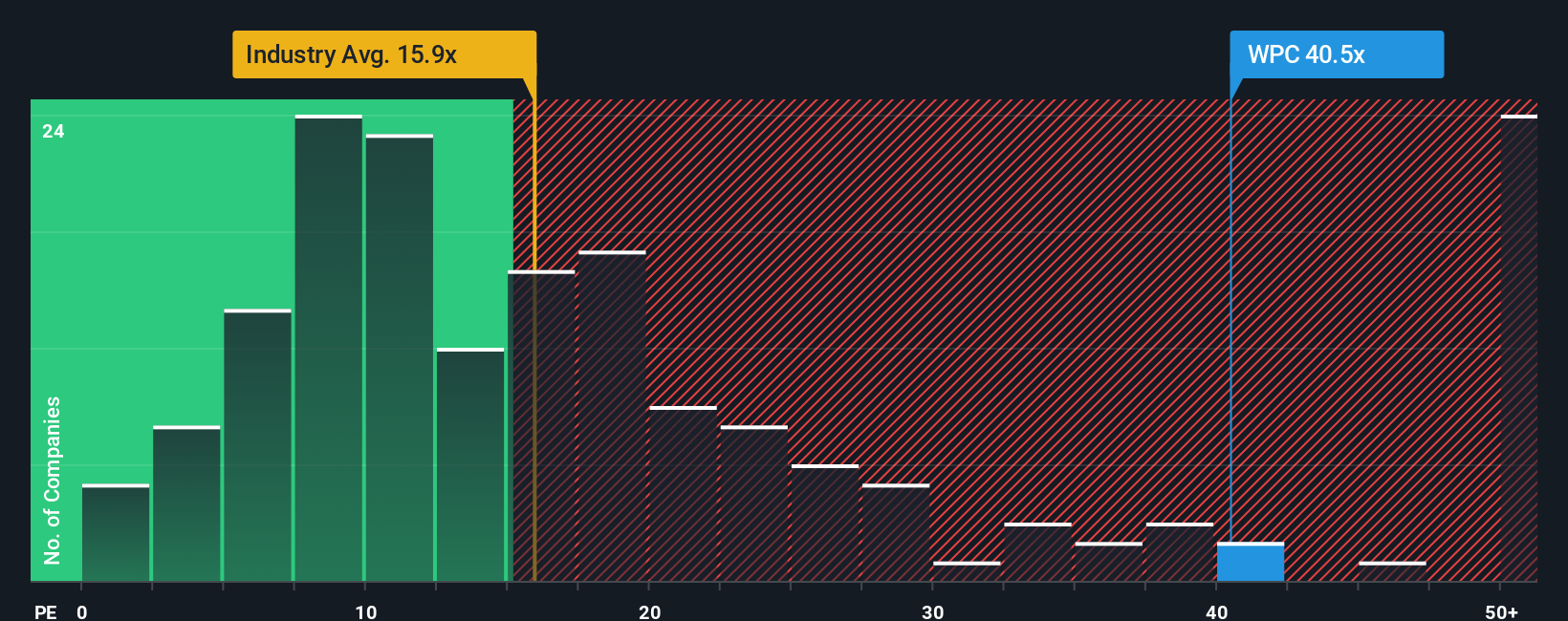

The SWS model points to a large intrinsic value gap, yet the earnings multiple tells a cooler story. W. P. Carey trades on a P/E of 39.8x, compared with a fair ratio of 37.8x, a Global REITs average of 16x and a peer average of 28.2x, which suggests investors are already paying up for the income profile and growth forecasts. If sentiment or earnings expectations reset, how comfortable are you with that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. P. Carey Narrative

If you are not fully on board with this view, or simply prefer to test the numbers yourself, you can build your own narrative in a few minutes, Do it your way.

A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If W. P. Carey has given you fresh perspective, do not stop there. Widen your search and pressure test more ideas before you put new money to work.

- Spot potential value by reviewing these 887 undervalued stocks based on cash flows that appear attractively priced based on their cash flows and fundamentals.

- Supercharge your growth hunt with these 26 AI penny stocks that sit at the intersection of artificial intelligence themes and higher risk reward potential.

- Target reliable income streams through these 12 dividend stocks with yields > 3% that currently offer yields above 3% and may complement a long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal