A Look At Boyd Gaming (BYD) Valuation After Renewed Interest In Online Casino Growth And Earnings Beats

Recent enthusiasm around Boyd Gaming (BYD) centers on its online casino business and a consistent record of beating earnings expectations, with supportive analyst commentary adding to investor attention despite no major shift in the core business.

See our latest analysis for Boyd Gaming.

Recent price action has cooled slightly, with a 1-day share price return of a 2% decline after a solid 8% 30-day share price return and a 1-year total shareholder return of 20.88%, suggesting momentum has eased but longer term holders remain well ahead.

If Boyd Gaming’s move has caught your eye, this can be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With Boyd Gaming trading around $86.07, sitting on a 30.15% intrinsic discount estimate and an 8.67% gap to analyst targets, investors may ask whether there is still mispricing or whether the market is already pricing in future growth.

Most Popular Narrative: 6.8% Undervalued

With Boyd Gaming last closing at US$86.07 against a narrative fair value of about US$92.33, the valuation hinges on how future earnings quality and capital returns play out.

The analysts have a consensus price target of $90.769 for Boyd Gaming based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.0, and the most bearish reporting a price target of just $80.0.

Want to see what sits behind that tight range of targets? The narrative leans heavily on changing margins, modest revenue shifts, and a future earnings multiple that undercuts many peers. Curious which assumptions really carry the weight in that fair value math?

Result: Fair Value of $92.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if competitive pressure at key properties or weather related disruptions in regions like the Midwest & South continue to weigh on revenue stability.

Find out about the key risks to this Boyd Gaming narrative.

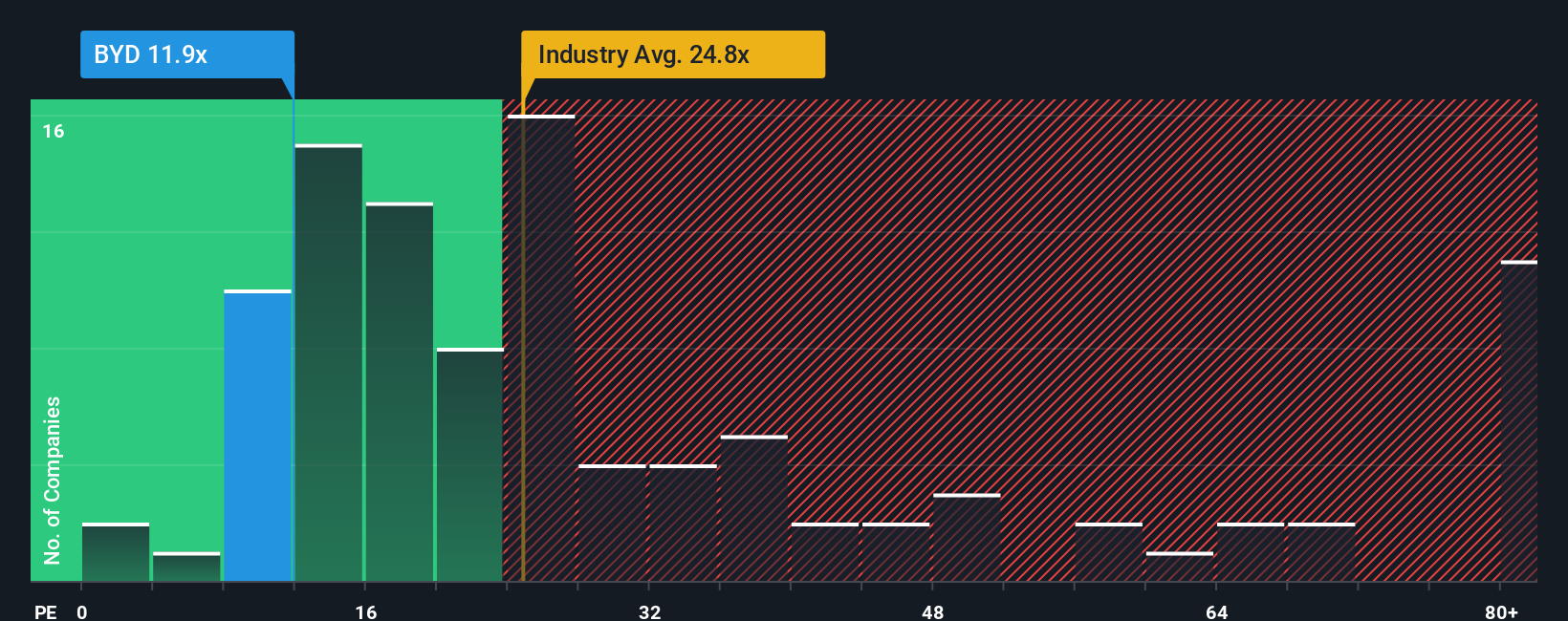

Another Take: Multiples Send A Different Signal

Our SWS DCF model suggests Boyd Gaming is trading about 30.2% below an estimated fair value of US$123.22, while a simple P/E check paints a tighter picture, with a current P/E of 3.6x versus a fair ratio of 3.5x. That small gap hints at less obvious upside, so which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boyd Gaming Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a custom Boyd story in minutes, starting with Do it your way.

A great starting point for your Boyd Gaming research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Boyd Gaming is already on your radar, do not stop there. Broaden your opportunity set and let the Screener surface a few more angles worth your time.

- Spot potential mispricing by scanning these 887 undervalued stocks based on cash flows that might offer more attractive entry points based on their cash flow profiles.

- Tap into future facing themes by checking out these 26 AI penny stocks that are building around artificial intelligence and automation.

- Strengthen your income shortlist by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% and may complement a total return approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal