Assessing MarketAxess (MKTX) Valuation As Lower Transaction Fees Pressure Profitability

Why the latest fee update matters for MarketAxess

MarketAxess Holdings (MKTX) recently reported a drop in transaction fees tied to shifts in trading protocols on its bond platform, adding to ongoing pressure on gross and operating margins and sharpening investor focus on profitability.

See our latest analysis for MarketAxess Holdings.

The latest update on lower transaction fees comes after a 4.24% one day share price decline and a 4.16% 7 day share price decline. At the same time, the 1 year total shareholder return of 19.64% and 5 year total shareholder return of 65.79% highlight how sentiment toward MarketAxess has weakened over time, despite a recent 5.24% 30 day share price gain.

If fee pressure on MarketAxess has you rethinking where growth and pricing power might sit in your portfolio, it could be a good moment to look at fast growing stocks with high insider ownership.

With the share price down over 40% in three years, yet still sitting about 10% below one estimate of intrinsic value, you have to ask: is MarketAxess now trading at a discount, or is the market already pricing in future growth?

Most Popular Narrative: 13.2% Undervalued

With MarketAxess last closing at US$173.71 versus a fair value estimate of US$200.20, the most followed narrative sees meaningful upside baked into its long term cash generation.

The company's accelerated investments in automation, portfolio trading, and proprietary trading protocols (such as Open Trading and Mid-X) are resulting in demonstrable gains across multiple strategic channels (client-initiated, portfolio trading, dealer-initiated). This is creating new, higher-margin revenue streams that are expected to enhance net margins over time.

Curious what kind of revenue growth and margin profile supports that higher fair value? The narrative leans on steady expansion, rising profitability and a richer earnings multiple. Want to see how those moving parts fit together?

Result: Fair Value of $200.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view runs into two immediate hurdles: rising competition that pressures fees and market share, and a tilt toward lower margin trading protocols.

Find out about the key risks to this MarketAxess Holdings narrative.

Another Angle On The Valuation

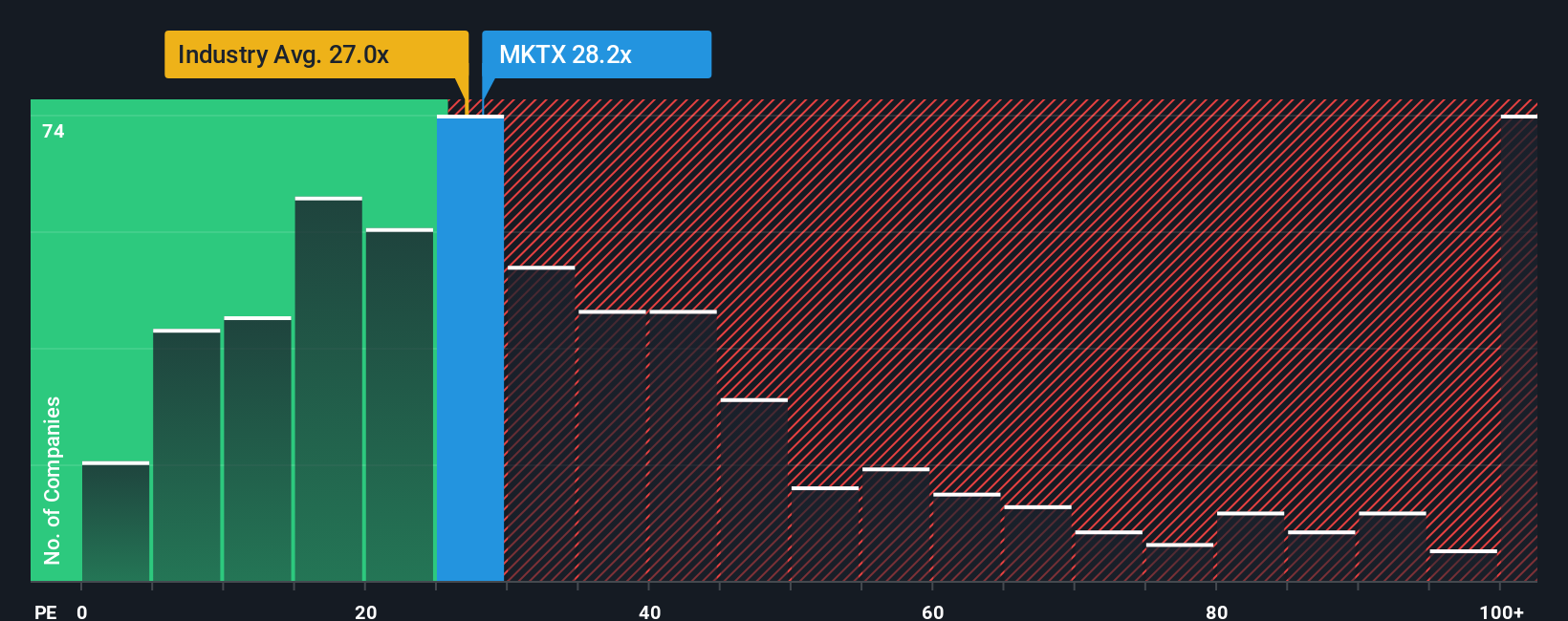

The narrative and fair value estimate suggest MarketAxess looks 10.1% below one intrinsic value mark, yet the current P/E of 29.4x tells a different story. That multiple is higher than the US Capital Markets average of 25.7x, the peer average of 26.2x, and its own fair ratio of 15.2x. This points to meaningful valuation risk if sentiment or growth expectations cool.

If you are weighing up that gap, See what the numbers say about this price — find out in our valuation breakdown. can help you see how similar trade offs look across the market.

Build Your Own MarketAxess Holdings Narrative

If this view does not match your own, or you prefer to work straight from the numbers, you can build a personalised thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding MarketAxess Holdings.

Looking for more investment ideas?

If MarketAxess is only one piece of your watchlist, now is the time to scan for fresh ideas so you are not late to the next opportunity.

- Target potential mispricing by checking out these 887 undervalued stocks based on cash flows that may offer more attractive entry points based on cash flows.

- Tap into the AI wave with these 26 AI penny stocks that link real business models to advances in artificial intelligence.

- Position yourself early in a fast moving theme through these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal