A Look At Fidelity National Information Services (FIS) Valuation After Recent Choppy Share Price Performance

Why Fidelity National Information Services is on investors’ radar

Fidelity National Information Services (FIS) has drawn fresh attention after recent share price moves, with the stock closing at US$66.73 and showing mixed returns over the past year and past 3 months.

See our latest analysis for Fidelity National Information Services.

Recent trading has been choppy, with a 1 month share price return of 1.29% but a 1 year total shareholder return decline of 13.99%. This suggests momentum has been fading even as expectations around future growth and risk are reassessed.

If FIS has you reassessing the payments and fintech space, it could be a good time to broaden your watchlist with high growth tech and AI stocks that are shaping the next wave of financial technology.

With FIS trading at US$66.73, sitting at a sizeable intrinsic discount and below the average analyst price target, you have to ask yourself: is this a genuine value opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 17.7% Undervalued

With a fair value estimate of US$81.05 against the last close at US$66.73, the most followed narrative sees meaningful upside potential priced into FIS.

Execution of operational simplification (e.g., Worldpay divestiture, focused acquisitions like Everlink and Global Payments Issuer), strong cost reduction programs, and improved working capital management are expected to lower operating expenses and drive EBITDA margin expansion, supporting higher future earnings.

Want to see what kind of earnings overhaul that implies? The narrative leans on sharper margins, steadier revenue progress, and a richer future earnings multiple. Curious which specific numbers need to click into place to reach that fair value and beyond?

Result: Fair Value of $81.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a real risk that rising fintech competition and ongoing integration challenges around past deals could pressure margins and weaken the earnings story that analysts are assuming.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Multiples Point To A Richer Price Tag

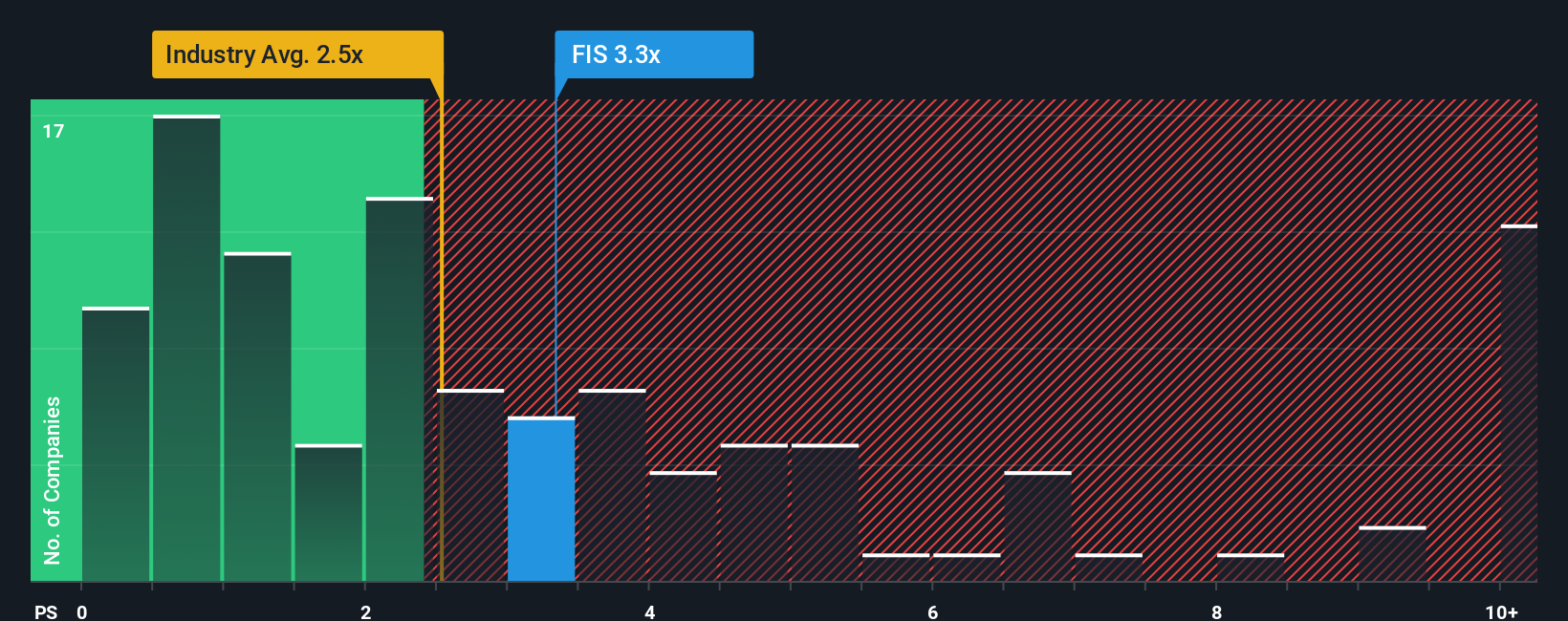

The analyst narrative and our fair value estimate both lean toward upside, but the company’s current P/S ratio of 3.3x paints a less generous picture. It sits above the estimated fair ratio of 2.9x and the 2.6x peer and industry averages. This raises a simple question: how much valuation risk are you really comfortable taking here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If you look at the numbers and come to a different conclusion, or just prefer to test your own thesis, you can build a fresh narrative for FIS in a few minutes. To get started, use Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that might suit your goals even better. Keep widening your net with focused screens.

- Target potential value setups by scanning these 887 undervalued stocks based on cash flows, which may be trading below what their cash flows suggest.

- Consider powerful technology shifts by checking out these 26 AI penny stocks, which push artificial intelligence further into everyday products and services.

- Review emerging computing themes by looking at these 29 quantum computing stocks, which are working on next generation hardware and software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal