Cui Dongshu: In 2025, promotions and downgrades in the passenger car industry all returned to rational price reduction, and the phenomenon of price reduction was clearly weakened

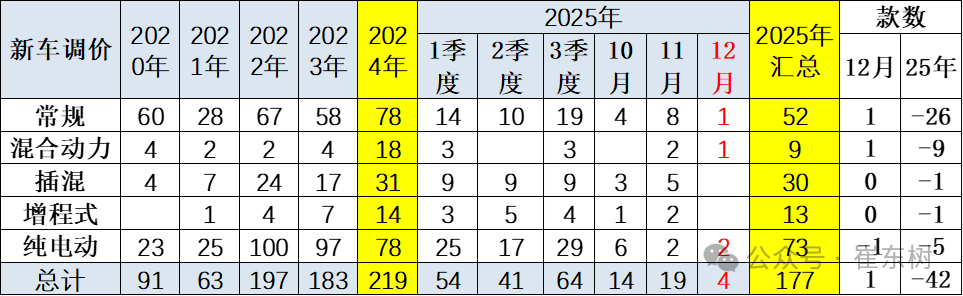

The Zhitong Finance App learned that Cui Dongshu published an article stating that in 2025, promotions and downgrades in the passenger car industry will return to rationality, and the market order will improve markedly. From January to December 2025, the price reduction was 177 models, 42 fewer than the same period, including 52 conventional fuel vehicles, 26 fewer than the same period; 9 hybrid fuel vehicles, 9 fewer than the same period; 30 plug-in hybrid fuel vehicles, 1 less than the same period; 13 extended-range models, 1 less than the same period; 73 pure electric models, 5 fewer than the same period.

The scale of the price reduction in December 2025 was 4 models, 1 more than in the same period. Among them, there is 1 fuel vehicle, 1 more than the same period; 1 hybrid fuel vehicle, 1 more than the same period; there are no plug-in hybrid or extended-range models; and 2 pure electric models, 1 less than the same period.

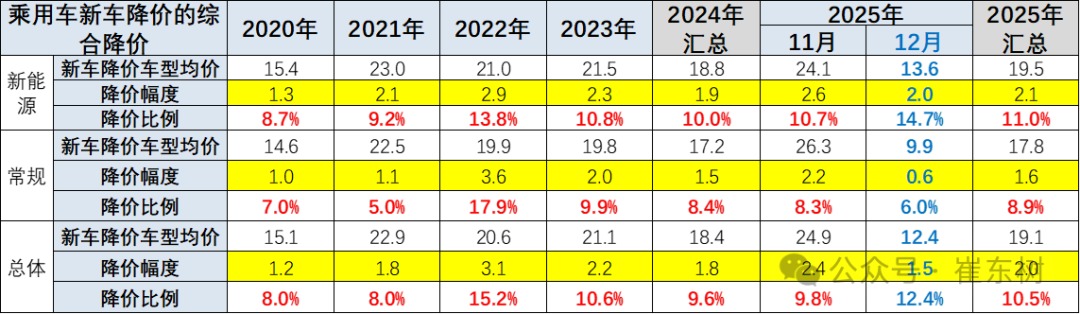

From January to December 2025, the average price reduction of 195,000 yuan for new NEV models reached an arithmetic average of 21,000 yuan, and the price reduction reached 11%. In December, the average price reduction of 136,000 yuan for new energy vehicles and models reached an arithmetic average of 20,000 yuan, and the price reduction reached a high level of 14.7%.

From January to December 2025, the average price reduction of 178,000 yuan for new models of conventional fuel vehicles reached an arithmetic average of 16,000 yuan, and the price reduction reached 8.9%. In December, the average price reduction of 99,000 yuan for new models of conventional fuel vehicles reached an arithmetic average of 60,000 yuan, and the price reduction reached 6%.

From January to December 2025, the average price reduction of 191,000 yuan for new car models in the overall passenger car market reached an arithmetic average of 20,000 yuan, reaching a price reduction of 10.5%. In December, the average price reduction of 124,000 yuan for new car models in the overall passenger car market reached an arithmetic average of 15,000 yuan, reaching a price reduction of 12.4%.

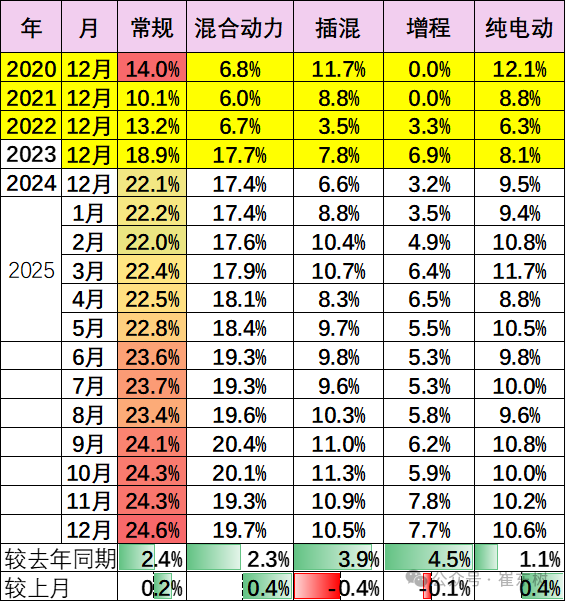

In 2025, the promotion pressure for conventional fuel vehicles and hybrids was less intense, while promotions for new energy were relatively intense. This year, plug-in hybrid promotions fluctuated greatly. In December, sales increased 3.9 points year over year, down 0.4 percentage points from month to month; overall, the promotion of extended-range models increased by about 4.5 points compared to December 2024. The overall promotion of pure electric power increased by about 1.1 points compared to December 2024, and the promotion increased by about 0.4 points compared to the previous month.

The effects of the national trade-in policy have been outstanding. Market sales have increased, the price reduction phenomenon has clearly weakened, the operating pressure on the industry has improved, and the profit margin of the automobile industry rebounded to a low of 4.4% in January-November. This is also a good sign of the rise in the scale of the industry and the stabilization of price promotions.

I. Overall price reduction tracking

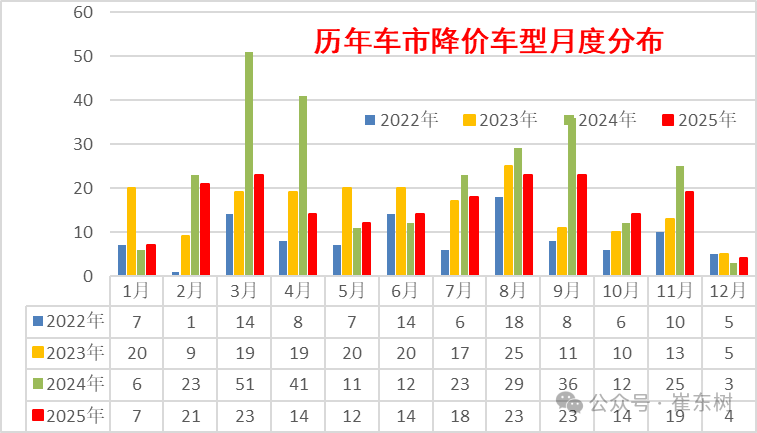

1. Monthly price reduction status tracking

The price reduction analysis mainly focuses on the situation where a new car is launched and breaks through the lower price limit in the early period, which is a more covert price reduction. Here, it mainly defines a price reduction within two years. However, some new cars started selling very cheap two years ago, then announced price increases due to lithium carbonate prices, then announced price cuts now. Although they did not break through the reserve price at the time of launch, in order to reflect the price reduction phenomenon, they are also considered price cuts in this analysis.

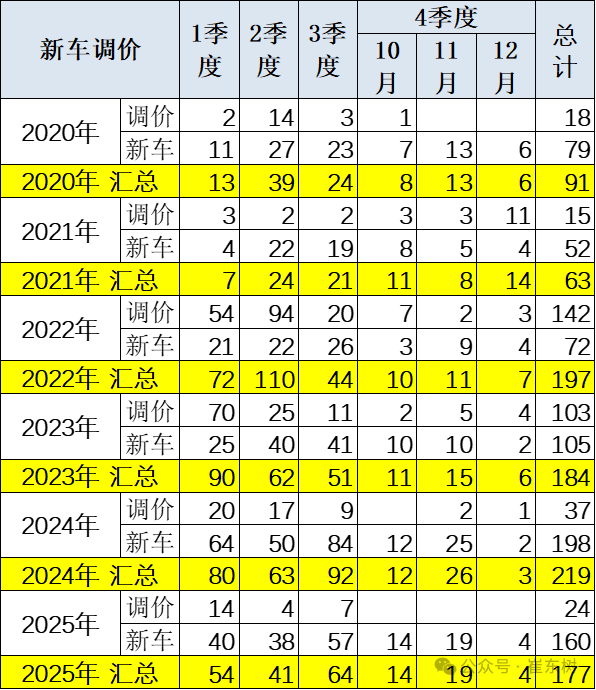

Since some models segmented by power had multiple price adjustments during the year, according to the non-repetitive calculation method, the number of models was not simply added up, but repeated models were combined.

Judging from the pace of price reduction, there were generally many price cuts in 2023, and price cuts in 2024 reached a strong level in March-April. This year, some car companies' phased package promotions for the 2nd quarter included factors such as subsidies, etc., and there was no clear announcement of a reduction to the new price. Therefore, currently, it can only be processed according to the promotion and is not included in the category of this year's discounted models. This will be reflected in the promotion range below.

The intensity of price reduction promotions was drastically reduced in 2025. In particular, the price reduction models from April to October were drastically reduced. Prices of 4 models were reduced in December 2025. Compared with the 19 models in November and the 3 models in December last year, the market remained relatively stable in December this year.

2. Model lowest price analysis

In the January-December period of 2020-2021, the price cuts of car companies from January to December were less intense. From January to December 2025, they dropped to 177 models. The scale of price cuts for new cars from January to December this year was relatively moderate. The current price competition is mainly due to the launch of new cars directly breaking through the lower limit of the original price, rather than a model of adding additional allocations without reducing the price. There are no models that were directly reduced in price in December, and adding new cars and reducing prices is a better way to improve cost performance.

There were generally few models with reduced prices from 2025 to December, mainly new energy vehicles, concentrated in the first half of the year. Price cuts were moderate in the 3rd quarter, and were still more restrained in December.

From January to December 2025, the price reduction was 177 models, 42 fewer than the same period, including 52 conventional fuel vehicles, 26 fewer than the same period; 9 hybrid fuel vehicles, 9 fewer than the same period; 30 plug-in hybrid fuel vehicles, 1 less than the same period; 13 extended-range models, 1 less than the same period; 73 pure electric models, 5 fewer than the same period.

The scale of the price reduction in December 2025 was 4 models, 1 more than in the same period. Among them, there is 1 fuel vehicle, 1 more than the same period; 1 hybrid fuel vehicle, 1 more than the same period; there are no plug-in hybrid or extended-range models; and 2 pure electric models, 1 less than the same period.

3. Comprehensive price reduction margin

From January to December 2025, the average price reduction of 195,000 yuan for new NEV models reached an arithmetic average of 21,000 yuan, and the price reduction reached 11%. In December, the average price reduction of 136,000 yuan for new energy vehicles and models reached an arithmetic average of 20,000 yuan, and the price reduction reached a high level of 14.7%.

From January to December 2025, the average price reduction of 178,000 yuan for new models of conventional fuel vehicles reached an arithmetic average of 16,000 yuan, and the price reduction reached 8.9%. In December, the average price reduction of 99,000 yuan for new models of conventional fuel vehicles reached an arithmetic average of 60,000 yuan, and the price reduction reached 6%.

From January to December 2025, the average price reduction of 191,000 yuan for new car models in the overall passenger car market reached an arithmetic average of 20,000 yuan, reaching a price reduction of 10.5%. In December, the average price reduction of 124,000 yuan for new car models in the overall passenger car market reached an arithmetic average of 15,000 yuan, reaching a price reduction of 12.4%.

4. Models with increased prices for imported cars

II. Auto Market Promotion Tracking

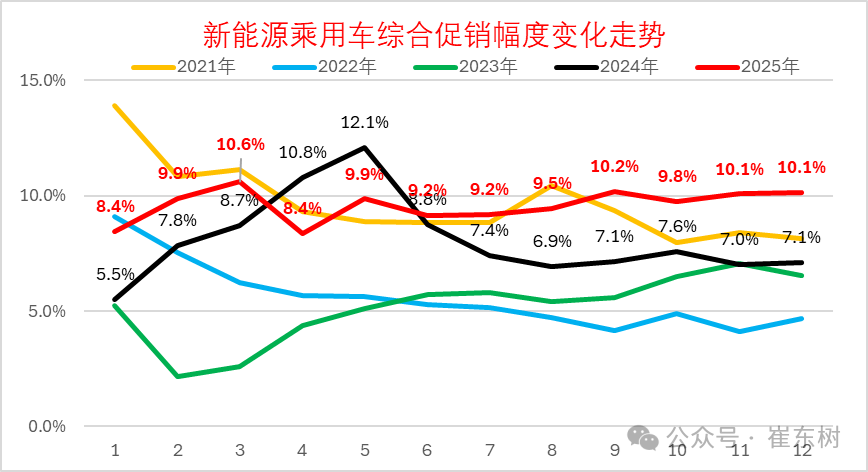

1. The promotion of new energy vehicles has increased dramatically

The NEV promotion in December 2025 rebounded to a medium high of 10.1%, an increase of 3 points over the same period, and remained the same as last month. Promotions have been stable in recent months. With the moderation of price cuts, the promotion system has also been recycled, and it has now reached the medium to high level of normal promotion.

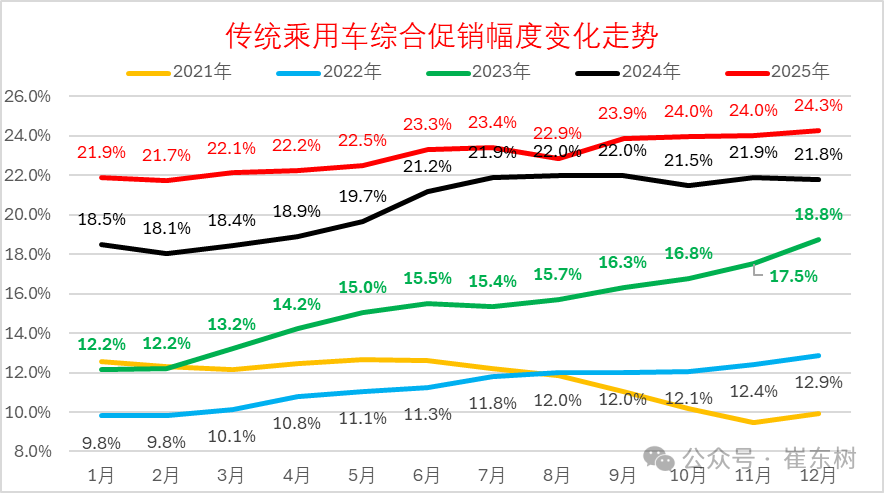

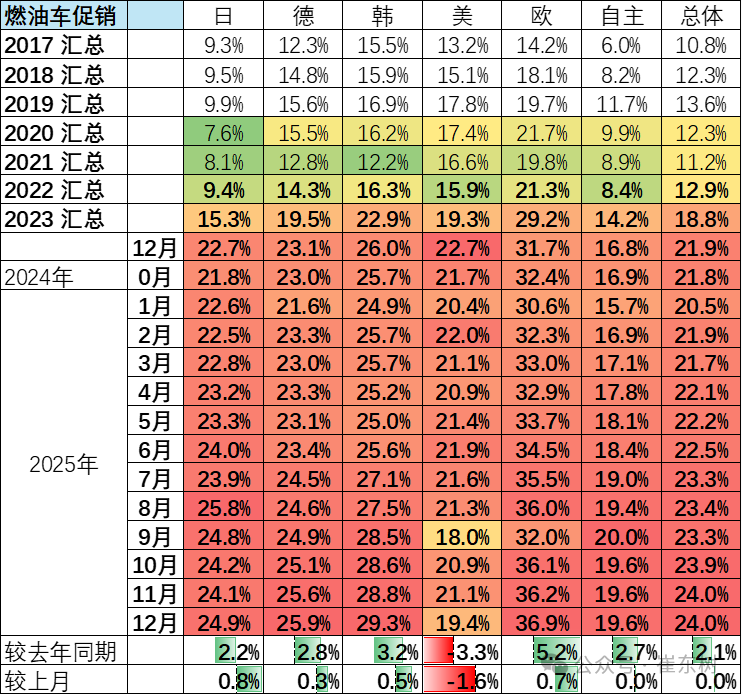

2. Fuel vehicle promotion trend

The promotion of traditional fuel vehicles stabilized at 24.3% in December 2025, a slight increase of 0.3 percentage points from the previous month and an increase of 2.5 percentage points over the same period. The promotion of fuel vehicles remained around 24% for 4 consecutive months. The promotion of traditional fuel vehicles hovered at a recent high level of 22% from July to December 2024. The national subsidy policy promoted a steady trend in the fuel vehicle industry in 2025, but the promotion of car companies that began in September 2025 increased slightly.

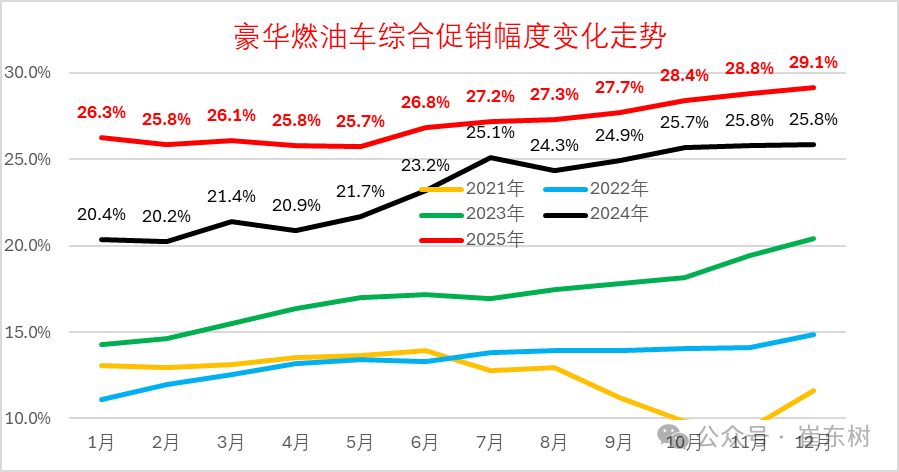

3. Luxury car promotion trends

In December 2025, luxury car promotions gradually reached a high of 29.1%, an increase of 0.3 points over the previous month and an increase of 3.3 percentage points over the same period. Although consumption upgrades have driven strong high-end demand, luxury car promotions have been relatively stable since July 2024, and will continue to increase after September 2025.

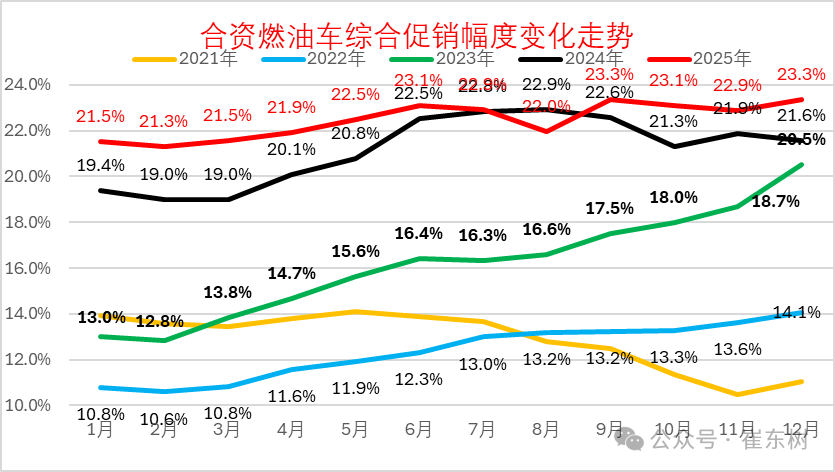

4. Mainstream joint venture vehicle promotion trends

In December 2025, the promotion of joint venture fuel vehicles gradually reached a low of 23.3%, an increase of 0.4 points over the previous month and an increase of 1.7 percentage points over the same period. Joint venture promotions have been stable recently.

The promotion of joint venture fuel vehicles rebounded from a low of 13% in 2023 to a peak of 23.3% in September 2025. With strong price cuts for new vehicles, there have been slight fluctuations in the past three months, and the promotion intensity has increased relatively steadily.

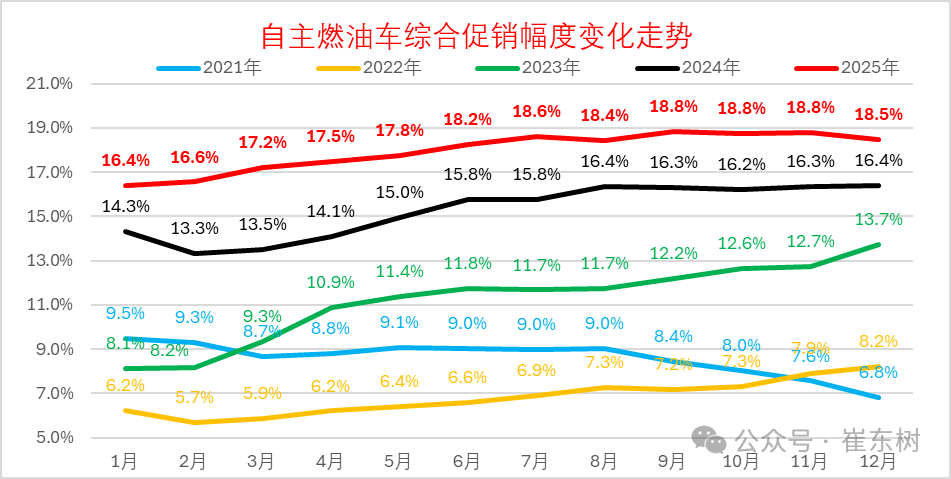

5. Autonomous fuel vehicle promotion trend

Due to strong autonomous new energy sources and good fuel vehicle exports, the promotion of autonomous fuel vehicles was generally stable in 2025.

In December 2025, the promotion of autonomous fuel vehicles gradually reached a high of 18.5%, an increase of 2.1 percentage points over the same period. Autonomous car companies' promotions increased rapidly from March to December 2024, then generally stabilized in September-December.

6. Tracking the intensity of promotion by motivation

In 2025, the promotion pressure for conventional fuel vehicles and hybrids was less intense, while promotions for new energy were relatively intense. This year, plug-in hybrid promotions fluctuated greatly. In December, sales increased 3.9 points year over year, down 0.4 percentage points from month to month; overall, the promotion of extended-range models increased by about 4.5 points compared to December 2024. The overall promotion of pure electric power increased by about 1.1 points compared to December 2024, and the promotion increased by about 0.4 points compared to the previous month.

Car market promotions were relatively stable in December, and dealers also promoted steadily to ensure profits. Currently, European promotions are quite large. Other joint ventures generally promote around 25%, which is not much of a difference. Autonomous car companies became the least promoted.

3. Specific price reduction model tracking - December

1. Analysis of price reduction for new energy vehicles

In December 2025, the price reduction for new energy models was strong. In particular, the price reduction of the guide price for some models reached 35%. According to the scale of the NEV promotion of 10%, the price reduction is still astonishing.

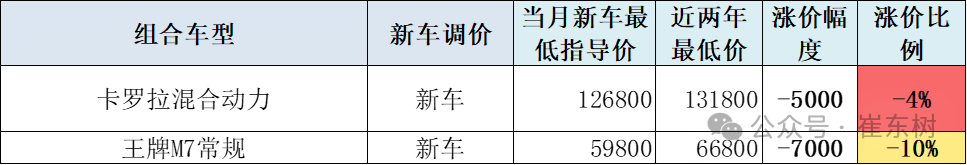

2. Analysis of fuel vehicle price reduction

There were many price cuts for new fuel models in December 2025, breaking through the guide price line for the original models. No price cuts were announced. The average price reduction for models with reduced prices was lower, and the price reduction for new cars reached 6%. Price cuts for fuel vehicles are difficult to change the passive situation, so there are few price cuts. Recently, Toyota's hybrid promotions have increased slightly.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal