Assessing Whether Indra Sistemas (BME:IDR) Shares Reflect The US Air Traffic Radar Contract Win

US radar contract puts Indra Sistemas in focus

The United States awarding Indra Sistemas (BME:IDR) a role in supplying new air traffic control radars, alongside RTX Corp, immediately puts the stock on many investors’ watchlists.

The radar awards sit within a broader US$12.5b modernization program targeting replacement of 612 radars by June 2028, which highlights the scale of potential project activity tied to Indra Sistemas’ air traffic segment.

See our latest analysis for Indra Sistemas.

The radar contract lands after a strong run, with a 6.96% 1 day share price return and 40.49% 90 day share price return, alongside a very large 1 year total shareholder return that is more than triple over three years.

If this contract has you looking across aerospace and defense technology, it could be a good moment to scan aerospace and defense stocks for other ideas on your radar.

After a share price move of 40.49% over 90 days and a very large 1 year total return, together with reported revenue and net income growth, the key question is whether Indra Sistemas still offers value or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 12.6% Overvalued

With Indra Sistemas closing at €57.60 against a narrative fair value of €51.18, the current share price sits well above that reference point.

The analysts have a consensus price target of €40.746 for Indra Sistemas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €47.0, and the most bearish reporting a price target of just €28.0.

Curious how earnings, revenue and margins are combined to support a higher fair value than the consensus target? The narrative leans on detailed multi year forecasts and a richer profit multiple. Want to see the exact assumptions shaping that €51.18 figure and how they differ from the Street view?

Result: Fair Value of €51.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points, including heavy reliance on public sector defense budgets and the execution risk around multiple acquisitions and large hiring plans.

Find out about the key risks to this Indra Sistemas narrative.

Another View: Earnings Multiple Sends A Different Signal

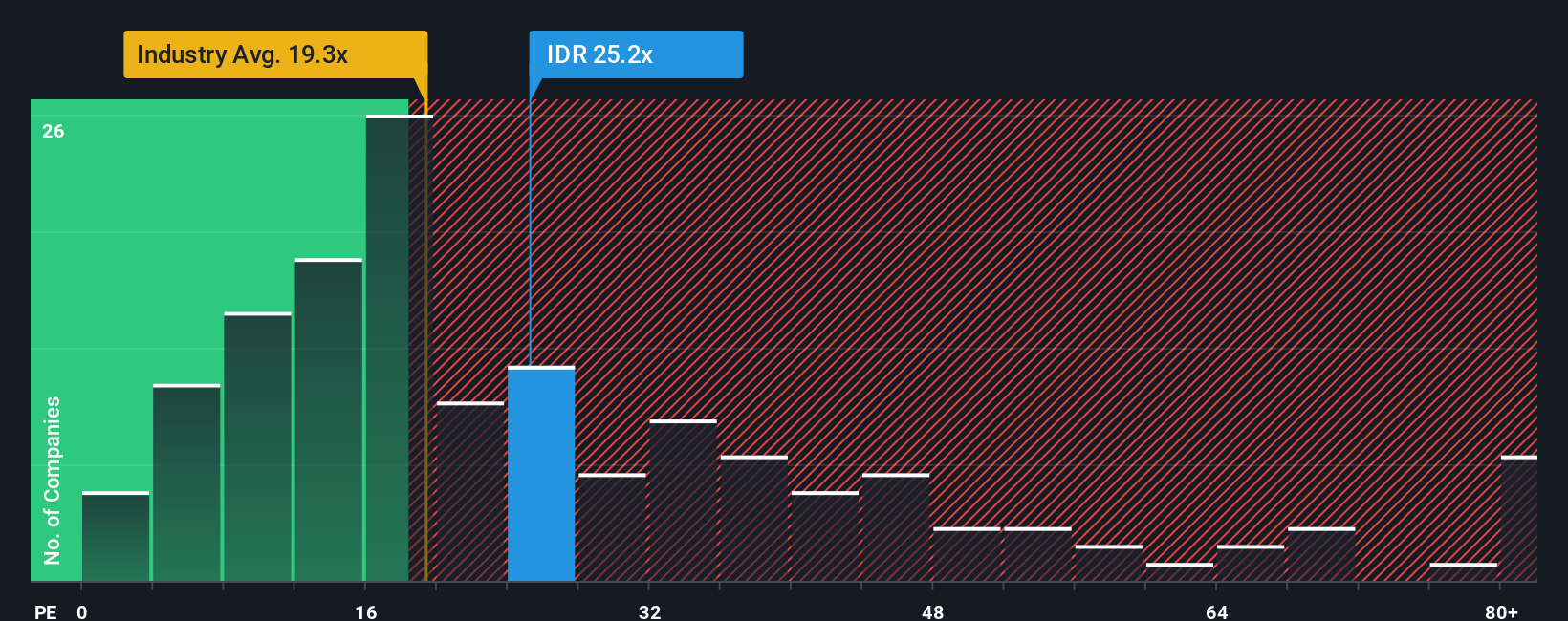

While the narrative fair value of €51.18 points to Indra Sistemas being 12.6% overvalued at €57.60, the earnings multiple tells a more mixed story. The current P/E of 26.3x sits below the peer average of 31.8x, yet above the fair ratio estimate of 24.1x, which suggests the market already bakes in a lot of good news. Where do you think that gap closes first, toward peers or toward the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Indra Sistemas Narrative

If you look at this and think the story should read differently, or you simply want to test your own assumptions, you can build a complete custom view in just a few minutes using Do it your way.

A great starting point for your Indra Sistemas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at just one company, you risk missing other stocks that might fit your style even better, so give yourself options and widen your opportunity set.

- Spot potential value candidates by scanning these 886 undervalued stocks based on cash flows that line up current prices with cash flow based signals.

- Tap into growth themes by checking out these 26 AI penny stocks that are tied to advances in artificial intelligence across sectors.

- Strengthen your income watchlist by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal