Nordea Bank Abp (HLSE:NDA FI) Valuation Check After Strong Multi Year Shareholder Returns

Why Nordea Bank Abp (HLSE:NDA FI) just drew investor attention

With no single headline event driving Nordea Bank Abp (HLSE:NDA FI) today, investor focus is instead on how the bank’s recent share performance and current valuation metrics might align with its earnings profile.

See our latest analysis for Nordea Bank Abp.

At a share price of €16.21, Nordea’s 16.67% 90 day share price return sits alongside a 59.80% 1 year total shareholder return and 244.31% 5 year total shareholder return, suggesting momentum has been building over time.

If this kind of performance has your attention, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With Nordea trading at €16.21 against a €15.65 analyst target, but with an estimated 38% intrinsic discount, is the market mispricing the bank or already factoring in its future growth story?

Most Popular Narrative: 3.5% Overvalued

With Nordea Bank Abp trading at €16.21 against a narrative fair value of €15.65, the current price sits slightly above that central estimate.

Nordea is investing heavily in digital capabilities (including technology, data, AI, and cybersecurity) and seeing strong, rising digital channel usage. This positions the bank to leverage increased digitalization, drive cost efficiencies, and expand customer reach, which is likely to benefit future net margins and customer-driven fee income.

Want to see what kind of revenue path and margin profile this assumes, and why a higher future P/E is baked in? The full narrative lays out the earnings, fee income and share count assumptions that underpin that €15.65 fair value, plus how a relatively modest discount rate ties those cash flows back to today.

Result: Fair Value of €15.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Nordic economic resilience and contained legal outcomes, as weaker regional growth or heavier money laundering penalties could quickly challenge those optimistic assumptions.

Find out about the key risks to this Nordea Bank Abp narrative.

Another View: Market Ratios Paint A Richer Picture

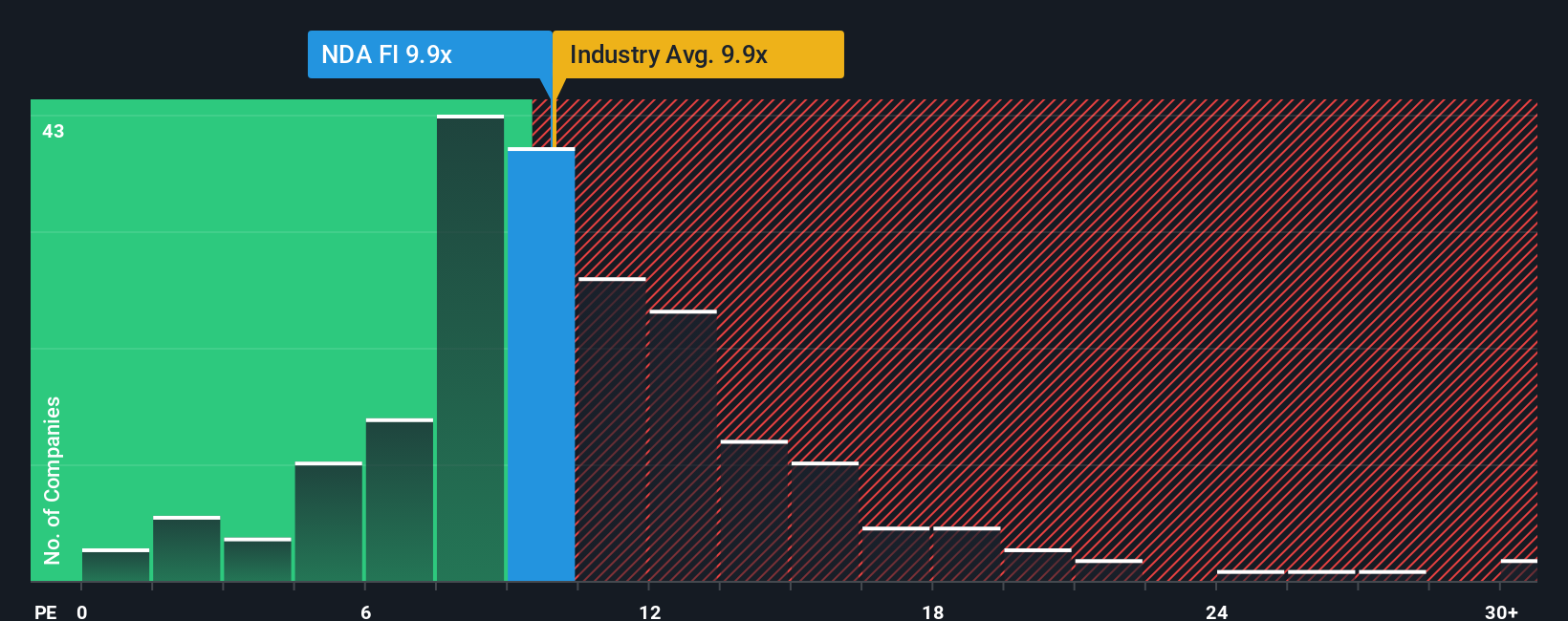

While the narrative fair value of €15.65 suggests Nordea is only slightly overvalued, the current 11.6x P/E is higher than both the European banks average of 11x and the peer average of 10.3x, and also above its own 10.8x fair ratio.

That gap means you are paying a premium compared to similar banks, with less of a margin for error if earnings or sentiment soften. The question is whether Nordea’s business strengths and buybacks justify that richer multiple, or whether patience might be the better option.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nordea Bank Abp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nordea Bank Abp Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to rely on your own work, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Nordea Bank Abp research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Nordea has sharpened your focus, do not stop here. A broader watchlist can help you spot opportunities you would otherwise miss.

- Zero in on potential mispricings by scouting these 886 undervalued stocks based on cash flows that might offer more attractive entry points based on their cash flow profiles.

- Ride long term growth themes by examining these 26 AI penny stocks that are shaping how data, automation, and intelligent systems get used across industries.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that already yield more than 3% and could complement banks in a diversified portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal