A Look At Live Oak Bancshares (LOB) Valuation After Financial Restatement And Control Weakness Disclosures

Live Oak Bancshares (LOB) is back in focus after disclosing plans to restate its 2024 annual and 2025 quarterly reports, citing material cash flow misclassifications and a material weakness in internal controls.

See our latest analysis for Live Oak Bancshares.

The restatement announcement comes after a mixed period for the stock, with a 7 day share price return of 3.81% and a 30 day share price return of 8.22%. The 1 year total shareholder return of a 6.54% decline contrasts with a 13.49% gain over three years and a 25.93% loss over five years, suggesting short term momentum has picked up even as longer term outcomes remain uneven.

If this accounting setback has you reassessing your watchlist, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Live Oak trading at $35.66, flags around restatements and internal controls sit alongside an indicated 38% intrinsic discount and nearly 20% gap to analyst targets. Is there genuine upside here, or is the market already accounting for future growth?

Most Popular Narrative: 15.1% Undervalued

With Live Oak Bancshares closing at $35.66 against a narrative fair value of $42, the current price sits well below that reference point.

Robust small business loan origination growth (record Q2 production), deepening of customer relationships (rise in clients with both loan and deposit relationships from 3% to 18%), and double-digit deposit growth signal that Live Oak is successfully capitalizing on the long-term trend of rising entrepreneurship and small business formation in the U.S., which may contribute to above-industry loan growth and fee income.

Curious how that kind of growth story translates into a higher fair value than today’s price, even with a lower future P/E incorporated into the analysis? The narrative focuses on faster revenue expansion, a step change in margins, and a ramp in earnings that would usually be associated with much larger banks. Want to see exactly how those assumptions compare and contribute to that $42 figure?

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still meets some real hurdles, including heavy dependence on government backed lending and ongoing, costly investment in digital and AI platforms that may not pay off as expected.

Find out about the key risks to this Live Oak Bancshares narrative.

Another View: Pricing Looks Tight On Earnings

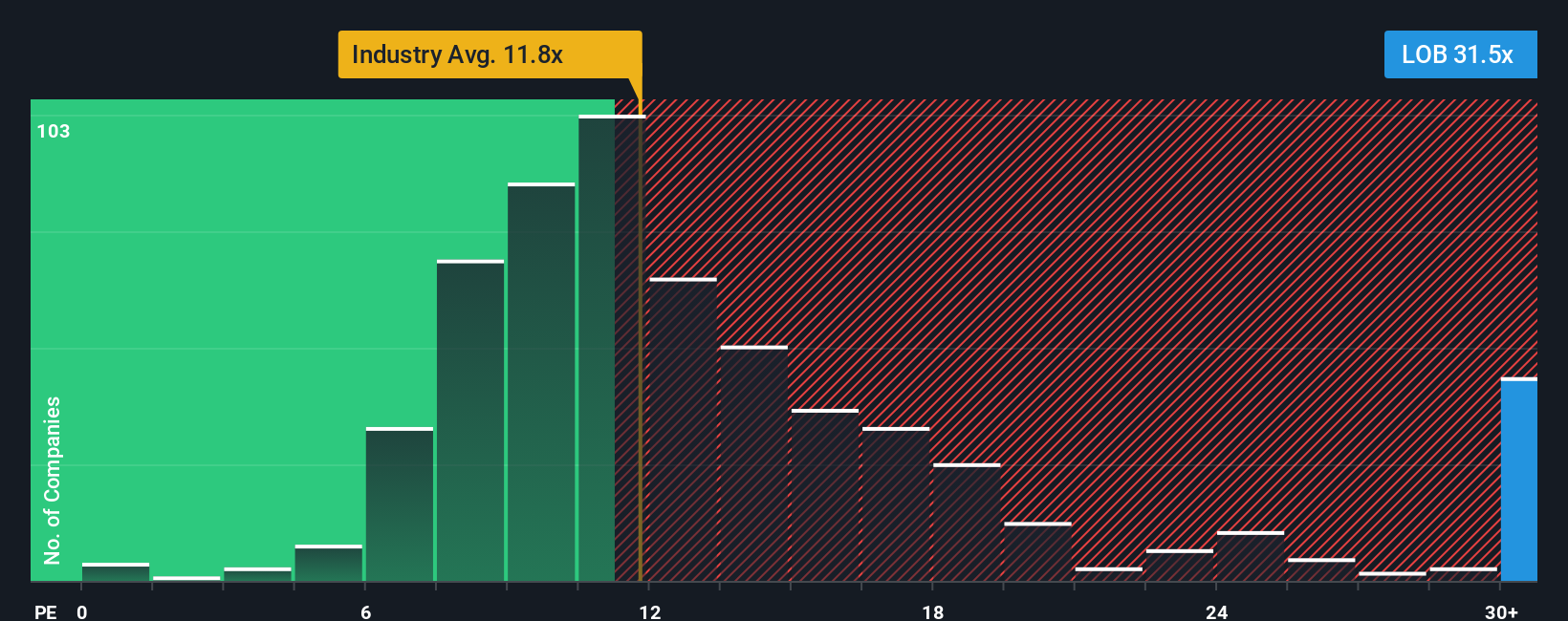

Those upside narratives sit alongside a much less generous signal from the P/E ratio. At 23.8x, Live Oak trades richer than both its peer average of 15.8x and the US Banks industry at 11.9x, and even above its own 21.1x fair ratio. That gap points to valuation risk rather than clear mispricing. How comfortable are you paying up while the growth story plays out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Once you have a view on Live Oak, do not stop there. You may give yourself an edge by lining up a few more high quality ideas.

- Spot potential bargains early by scanning these 886 undervalued stocks based on cash flows that may offer more attractive pricing relative to their cash flows.

- Review structural tech opportunities by checking out these 26 AI penny stocks that are building their businesses around artificial intelligence.

- Explore income opportunities by reviewing these 12 dividend stocks with yields > 3% that could add yield to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal