UK Stocks That May Be Trading Below Their Estimated Value

Amidst the recent downturn in the FTSE 100, driven by weak trade data from China and declining commodity prices, investors are keenly observing the UK market for opportunities. In such a climate, identifying stocks that may be trading below their estimated value can offer potential advantages, particularly when global economic conditions create headwinds for many sectors.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Serabi Gold (AIM:SRB) | £3.24 | £6.27 | 48.4% |

| Nichols (AIM:NICL) | £9.40 | £18.53 | 49.3% |

| Motorpoint Group (LSE:MOTR) | £1.39 | £2.68 | 48.1% |

| Ibstock (LSE:IBST) | £1.372 | £2.66 | 48.4% |

| Gym Group (LSE:GYM) | £1.56 | £2.97 | 47.5% |

| Fevertree Drinks (AIM:FEVR) | £8.08 | £15.87 | 49.1% |

| CAB Payments Holdings (LSE:CABP) | £0.66 | £1.29 | 48.9% |

| Barratt Redrow (LSE:BTRW) | £3.85 | £7.55 | 49% |

| Anglo Asian Mining (AIM:AAZ) | £2.78 | £5.19 | 46.4% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.215 | £4.19 | 47.2% |

Let's uncover some gems from our specialized screener.

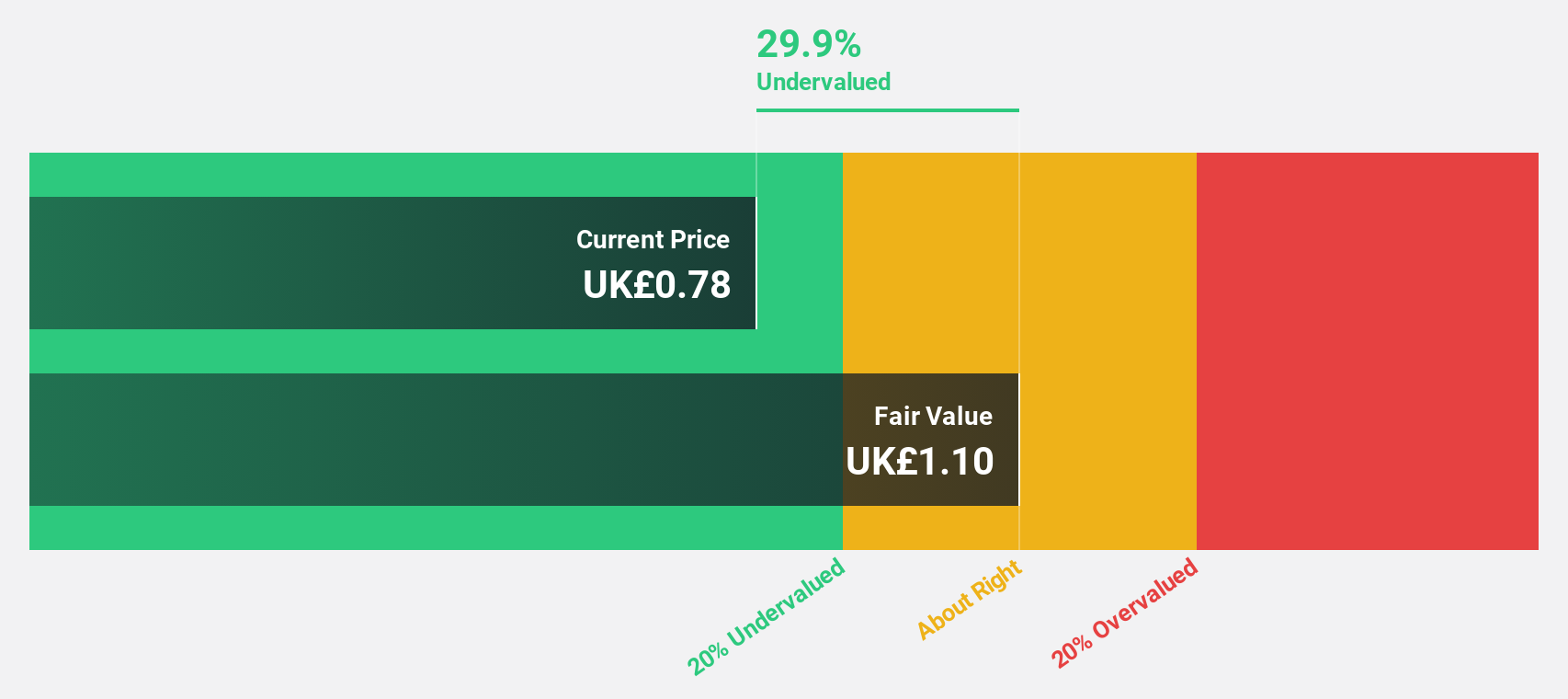

Coats Group (LSE:COA)

Overview: Coats Group plc, with a market cap of £1.63 billion, operates in the manufacturing of threads, structural components for apparel and footwear, and performance materials on a global scale.

Operations: The company's revenue segments include $775.30 million from apparel, $405.20 million from footwear, and $321.80 million from performance materials.

Estimated Discount To Fair Value: 31.9%

Coats Group is trading at £0.85, below its estimated fair value of £1.25, indicating it is undervalued based on cash flows. Despite recent shareholder dilution and a dividend not well covered by free cash flows, the company's earnings are forecast to grow significantly at 27.17% annually, outpacing the UK market's growth rate. However, debt coverage by operating cash flow remains a concern as Coats navigates its financial position amidst ongoing structural changes and acquisitions.

- According our earnings growth report, there's an indication that Coats Group might be ready to expand.

- Unlock comprehensive insights into our analysis of Coats Group stock in this financial health report.

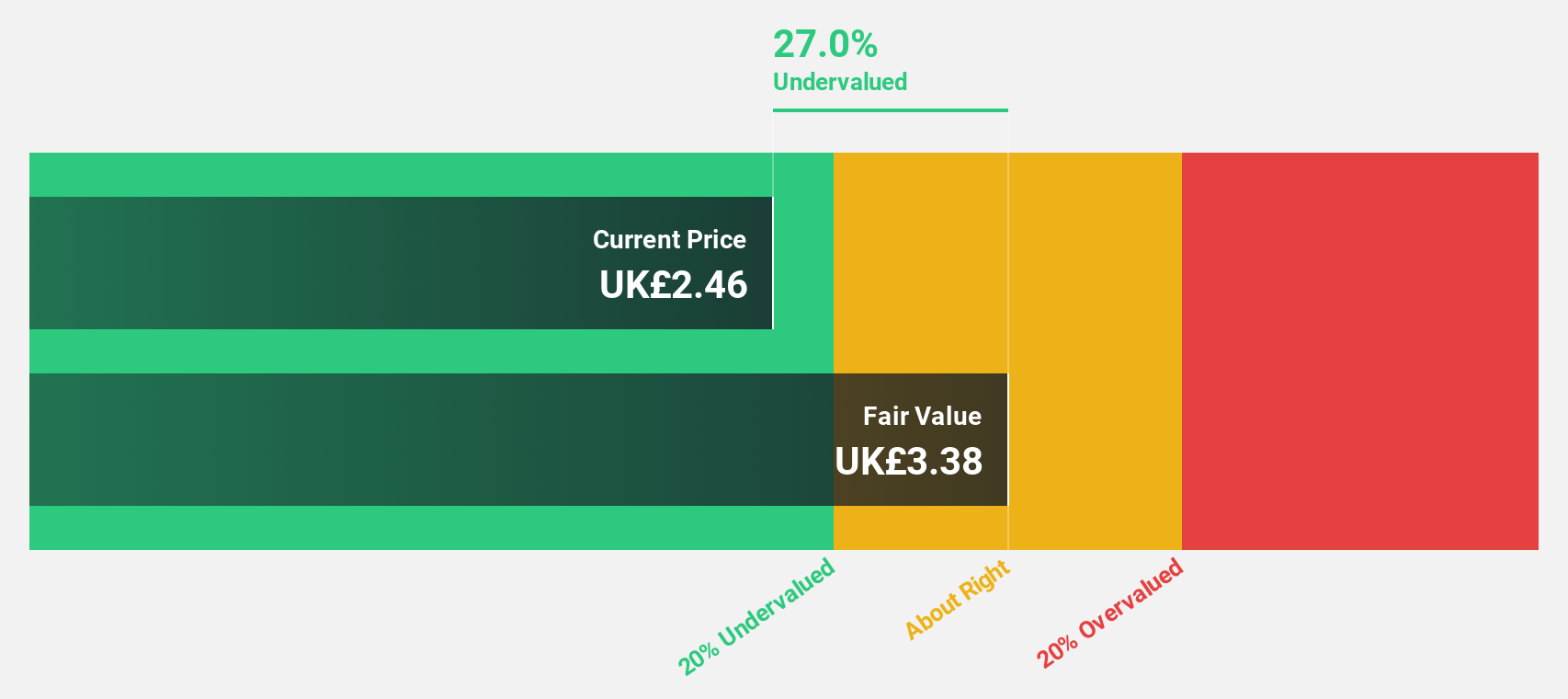

Ocado Group (LSE:OCDO)

Overview: Ocado Group plc operates as an online grocery retailer in the United Kingdom and internationally, with a market cap of £2.27 billion.

Operations: The company's revenue is derived from two main segments: Logistics, contributing £760.70 million, and Technology Solutions, which accounts for £532.40 million.

Estimated Discount To Fair Value: 22.7%

Ocado Group is trading at £2.74, below its estimated fair value of £3.55, highlighting its undervaluation based on cash flows. The company recently secured a $350 million payment from Kroger, enhancing its financial position amidst plans to become profitable within three years with revenue growth outpacing the UK market. However, Ocado's share price remains highly volatile and it is forecast to remain unprofitable in the near term despite expected improvements in operational efficiency and technology deployment.

- Our growth report here indicates Ocado Group may be poised for an improving outlook.

- Take a closer look at Ocado Group's balance sheet health here in our report.

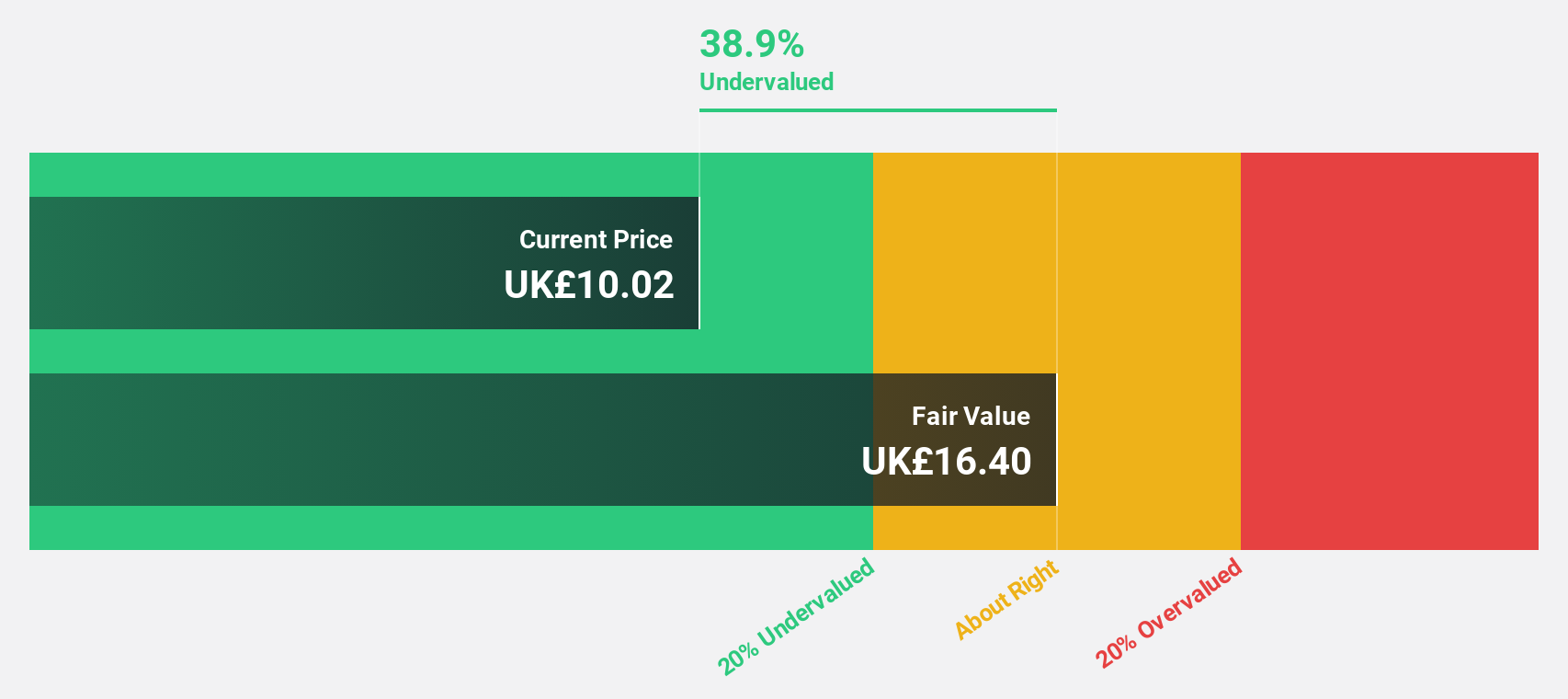

Savills (LSE:SVS)

Overview: Savills plc is a global real estate services provider operating across the UK, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.41 billion.

Operations: The company's revenue is derived from four main segments: £534.90 million from Consultancy, £877.30 million from Transaction Advisory, £91.20 million from Investment Management, and £965.20 million from Property and Facilities Management.

Estimated Discount To Fair Value: 24.5%

Savills is trading at £10.30, significantly below its estimated fair value of £13.63, making it undervalued based on cash flows. The company's earnings are forecast to grow 28.16% annually, outpacing the UK market's growth rate of 13.7%. Recent strategic hires and expansions into the U.S. retail sector enhance its global reach and operational capabilities, though its dividend track record remains unstable amidst these growth initiatives and market positioning efforts.

- Our comprehensive growth report raises the possibility that Savills is poised for substantial financial growth.

- Click here to discover the nuances of Savills with our detailed financial health report.

Taking Advantage

- Embark on your investment journey to our 61 Undervalued UK Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal