Discover UK Penny Stocks: Diaceutics And 2 More Hidden Opportunities

The United Kingdom's stock market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market uncertainties, investors may find intriguing opportunities in penny stocks—companies that are often smaller or newer and can offer growth potential at lower price points. With a focus on strong balance sheets and solid fundamentals, these stocks present underappreciated opportunities for those looking to explore beyond the well-trodden paths of larger firms.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.31 | £494.97M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.92 | £155.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.85 | £138.03M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.105 | £16.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.72 | $418.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.83 | £75.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.462 | £177.07M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.535 | £74.11M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Diaceutics PLC is a diagnostic commercialization company that offers data, data analytics, and implementation services to pharmaceutical and biotech companies, with a market cap of £121 million.

Operations: The company generates revenue of £34.40 million from its Medical Labs & Research segment.

Market Cap: £121M

Diaceutics PLC, with a market cap of £121 million and revenue of £34.40 million, trades at 31.3% below its estimated fair value despite being unprofitable with a negative return on equity (-4.08%). The company benefits from strong short-term assets (£24.5M) exceeding both short-term (£6.2M) and long-term liabilities (£998K), providing financial stability without debt concerns. Analysts project significant stock price appreciation potential, while the firm maintains a sufficient cash runway for over a year based on current free cash flow levels. However, challenges include an inexperienced board and increased losses over the past five years by 62% annually.

- Take a closer look at Diaceutics' potential here in our financial health report.

- Learn about Diaceutics' future growth trajectory here.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the UK, Continental Europe, the US, and internationally with a market cap of £339.09 million.

Operations: The company generates revenue through four main segments: IP Services (£96.5 million), Language Services (£326.7 million), Regulated Industries (£128.5 million), and Language & Content Technology (£138.4 million).

Market Cap: £339.09M

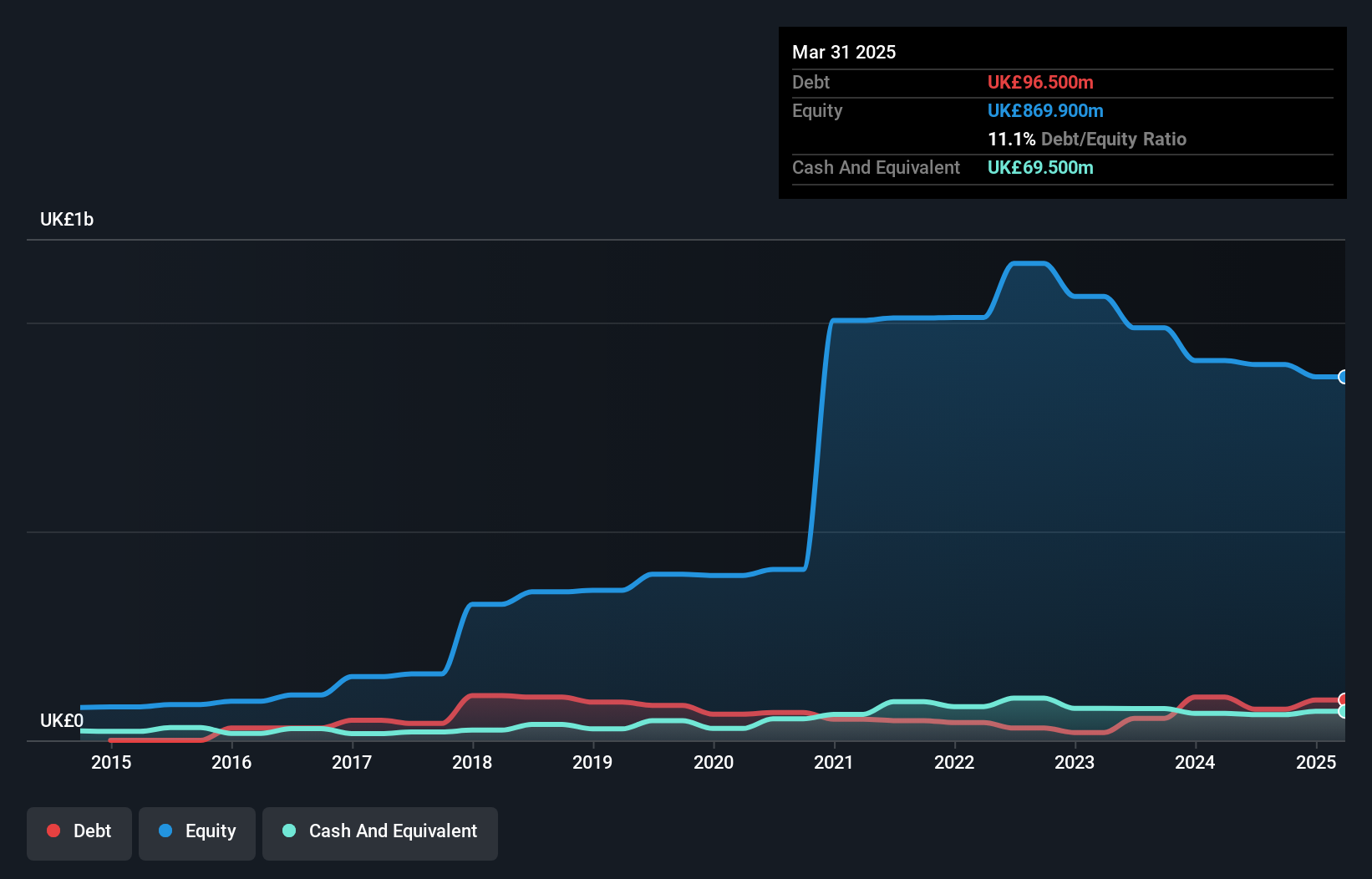

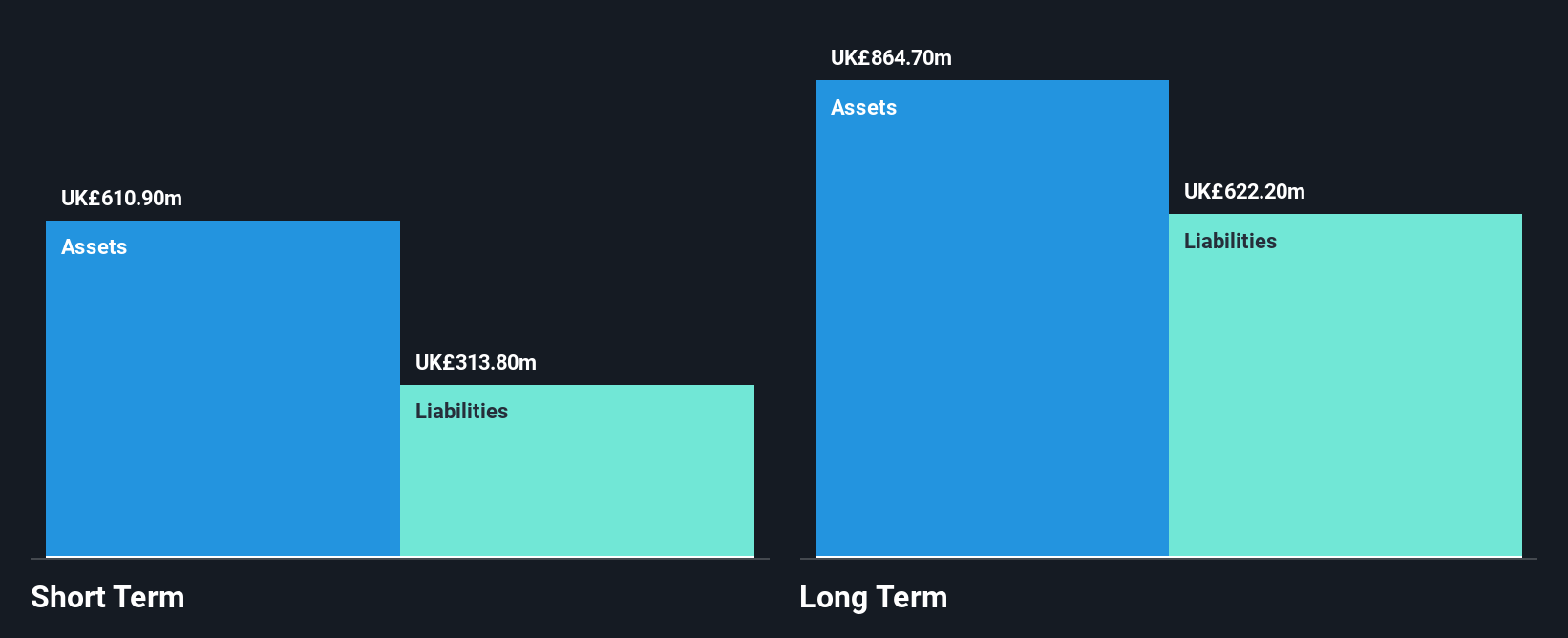

RWS Holdings plc, with a market cap of £339.09 million, is currently unprofitable, reporting a net loss of £99.8 million for the year ended September 2025. Despite this, its short-term assets (£245.8M) cover both short-term (£164.1M) and long-term liabilities (£113.6M), indicating solid financial footing amidst challenges in profitability and revenue decline to £690.1 million from the previous year's £718.2 million. The company has reduced its debt-to-equity ratio significantly over five years and recently secured a US patent for its AI-driven Translation Decision Assistant, which could enhance future growth prospects in content transformation technology.

- Navigate through the intricacies of RWS Holdings with our comprehensive balance sheet health report here.

- Understand RWS Holdings' earnings outlook by examining our growth report.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry with operations in the United Kingdom, Europe, and the United States, and has a market capitalization of approximately £1.13 billion.

Operations: The company generates revenue from its operations in the UK and Europe, amounting to £872.4 million.

Market Cap: £1.13B

Watches of Switzerland Group PLC, with a market cap of £1.13 billion, has demonstrated robust financial performance, reporting half-year sales of £845.1 million and net income growth to £44.4 million from the previous year. The company's earnings have grown significantly by 68.6% over the past year, outpacing industry averages and showing potential for continued expansion through strategic acquisitions in the U.S. Its short-term assets comfortably cover both short and long-term liabilities, while its debt levels are well managed with strong interest coverage and operating cash flow support, despite a recent one-off loss impacting past results.

- Jump into the full analysis health report here for a deeper understanding of Watches of Switzerland Group.

- Evaluate Watches of Switzerland Group's prospects by accessing our earnings growth report.

Seize The Opportunity

- Discover the full array of 294 UK Penny Stocks right here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal