Redcare Pharmacy (XTRA:RDC) Valuation After Strong 2025 Sales Update Attracts Fresh Investor Attention

Redcare Pharmacy stock after 2025 sales update

Redcare Pharmacy (XTRA:RDC) has drawn fresh attention after reporting group sales of €794 million for the fourth quarter of 2025 and full year sales of €2.9b, compared with €675 million and €2.4b a year earlier.

See our latest analysis for Redcare Pharmacy.

The sales update comes after a mixed share price performance, with a 30 day share price return of 8.69%. This compares with a 90 day share price return decline of 23.72% and a 1 year total shareholder return decline of 44.48%, alongside a 3 year total shareholder return of 15.58%.

If Redcare Pharmacy's latest numbers have you reconsidering healthcare exposure, it could be a good moment to scan the wider market through healthcare stocks and see what else stands out.

With sales at €2.9b, a recent share price setback and a wide gap to analyst price targets, the key question now is whether Redcare Pharmacy is trading below its worth or whether markets are already pricing in future growth.

Most Popular Narrative: 56.5% Undervalued

Against a last close of €66.90, the most followed narrative points to a fair value that is significantly higher and built on detailed long term assumptions.

Significant operational leverage is materializing from investments in distribution center automation and e-Rx technology, supporting improving EBITDA margins (mid to long-term target above 8%) as scale and efficiency gains kick in (impact: EBITDA margin and net profit).

Curious how margin expansion, faster top line growth and a premium future earnings multiple combine to support that value gap? The full narrative lays out the revenue ramp, the earnings swing from loss to profit and the valuation multiple needed to get there, all tied together using a 5.09% discount rate.

Result: Fair Value of €153.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth regulatory progress and strong digital prescription adoption, so any setbacks there could quickly weaken the bullish revenue and margin story.

Find out about the key risks to this Redcare Pharmacy narrative.

Another View: What the P/S ratio is saying

The narrative and analyst targets point to a large gap between Redcare Pharmacy's share price and their fair value estimates. Yet on a simple P/S basis, the picture is less one sided.

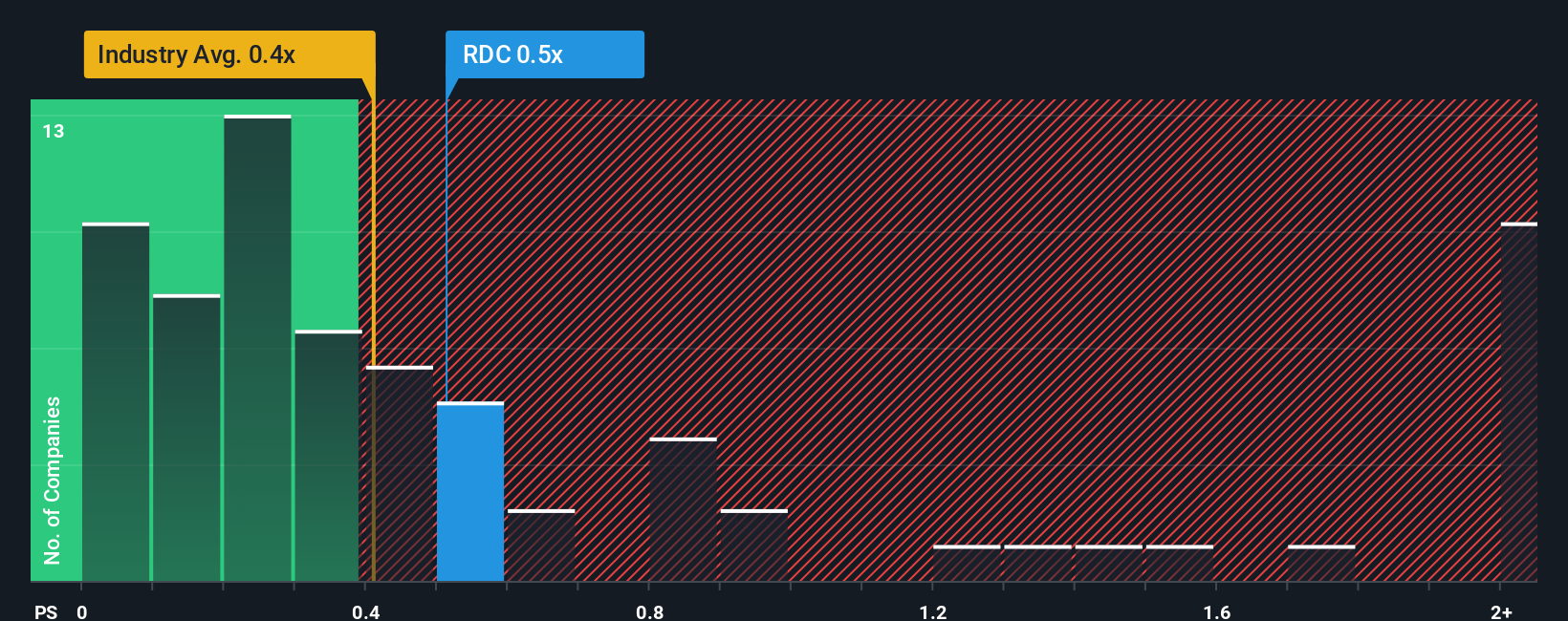

Redcare trades on a P/S of 0.5x, compared with 0.4x for the broader European Consumer Retailing group and 0.2x for its closest peers. Our fair ratio estimate sits at 0.3x. In plain terms, the share price already sits at a premium to both the sector and peers, and above the fair ratio the market could move toward. This raises the question of how comfortable an investor might be paying more for a business that is still loss making today.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redcare Pharmacy Narrative

If you interpret the numbers differently or prefer to test your own assumptions, you can build a custom Redcare Pharmacy narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Redcare Pharmacy.

Looking for more investment ideas?

If Redcare Pharmacy has sharpened your thinking, do not stop here. Use the Simply Wall St screener to spot other opportunities that could suit your approach.

- Target income potential with these 12 dividend stocks with yields > 3% that offer higher yields while you assess whether their payouts look sustainable to you.

- Chase future growth themes by scanning these 26 AI penny stocks that are tied to artificial intelligence and related technologies.

- Hunt for mispriced opportunities through these 886 undervalued stocks based on cash flows that might be trading below what their cash flows suggest to you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal