European Stocks That May Be Trading Below Estimated Fair Value

As the pan-European STOXX Europe 600 Index reaches new highs, buoyed by an improving economic environment and closing 2025 with its strongest yearly performance since 2021, investors are increasingly interested in identifying stocks that may be trading below their estimated fair value. In this context of robust market growth, a good stock is often characterized by strong fundamentals and potential for growth that is not yet fully reflected in its current price.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN132.80 | PLN258.95 | 48.7% |

| Streamwide (ENXTPA:ALSTW) | €73.20 | €142.74 | 48.7% |

| Recupero Etico Sostenibile (BIT:RES) | €6.66 | €12.93 | 48.5% |

| KB Components (OM:KBC) | SEK42.80 | SEK82.91 | 48.4% |

| Fodelia Oyj (HLSE:FODELIA) | €5.42 | €10.72 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.08 | 48.7% |

| Elekta (OM:EKTA B) | SEK58.10 | SEK114.27 | 49.2% |

| Dynavox Group (OM:DYVOX) | SEK103.70 | SEK203.92 | 49.1% |

| DEUTZ (XTRA:DEZ) | €9.535 | €18.95 | 49.7% |

| Boliden (OM:BOL) | SEK547.20 | SEK1091.07 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

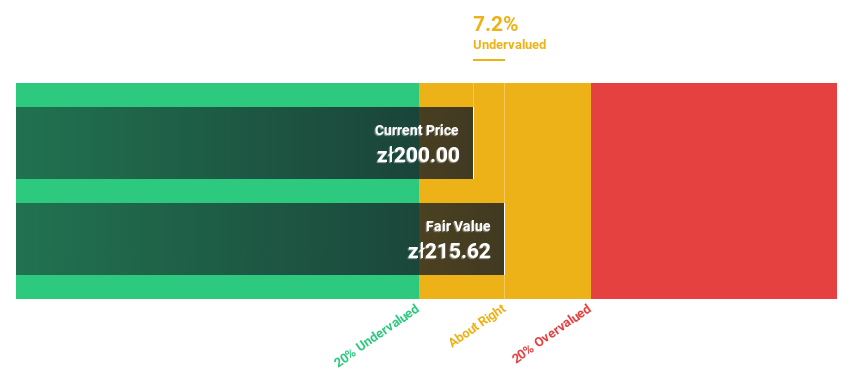

CCC (WSE:CCC)

Overview: CCC S.A. operates in the retail sector, primarily selling footwear and other products across Poland, Central and Eastern Europe, and Western Europe, with a market capitalization of PLN10.94 billion.

Operations: The company's revenue comes from its Halfprice segment, generating PLN2.08 billion.

Estimated Discount To Fair Value: 47.9%

CCC S.A. is trading at PLN 130.95, significantly below its estimated fair value of PLN 251.45, indicating it is highly undervalued based on discounted cash flow analysis. Despite recent earnings decline, with third-quarter net income at PLN 118.2 million compared to PLN 155.4 million last year, CCC's forecasted annual earnings growth of 19.5% surpasses the Polish market average of 14.8%. However, interest payments are not well covered by earnings and shareholder dilution has occurred recently.

- The growth report we've compiled suggests that CCC's future prospects could be on the up.

- Click here to discover the nuances of CCC with our detailed financial health report.

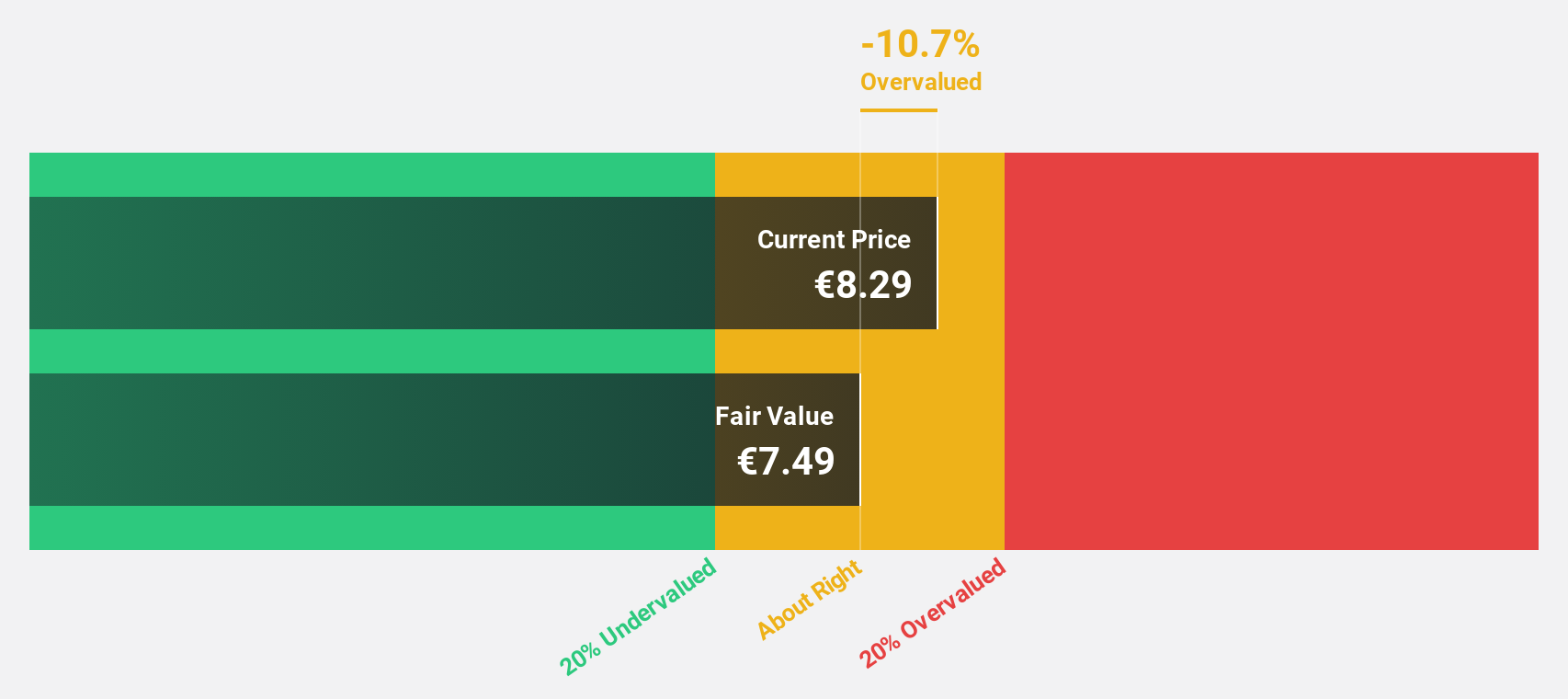

DEUTZ (XTRA:DEZ)

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across several regions including Germany, Europe, the Middle East, Africa, Asia Pacific, and the United States with a market cap of €1.45 billion.

Operations: The company's revenue is primarily derived from its Solutions segment, which accounts for €1.90 billion, and its Engines & Services segment, contributing €110.70 million.

Estimated Discount To Fair Value: 49.7%

DEUTZ Aktiengesellschaft, trading at €9.54, is significantly undervalued compared to its estimated fair value of €18.95 based on discounted cash flow analysis. Despite lowering its 2025 revenue guidance to €2.1 billion amid market challenges, DEUTZ's earnings are forecasted to grow substantially at 59.9% annually over the next three years, outpacing the German market average. However, a low return on equity and an unstable dividend track record present potential concerns for investors.

- Our expertly prepared growth report on DEUTZ implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of DEUTZ here with our thorough financial health report.

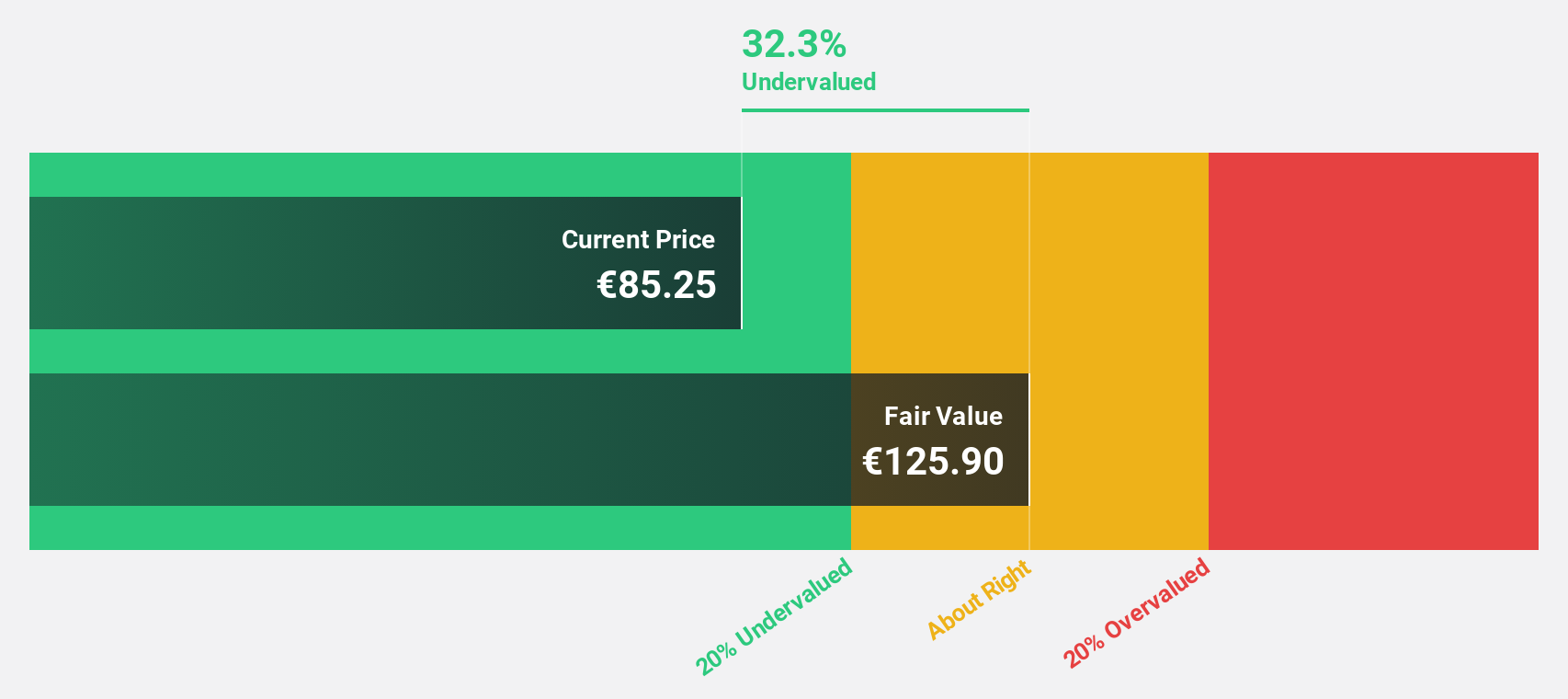

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, along with its subsidiaries, offers sensor solutions for defense and security applications globally and has a market cap of €10.05 billion.

Operations: The company's revenue is derived from its Sensors segment, which accounts for €2.02 billion, and its Optronics segment, contributing €398 million.

Estimated Discount To Fair Value: 45.3%

Hensoldt, trading at €86.85, is significantly undervalued with a fair value estimate of €158.9 based on discounted cash flow analysis. The company anticipates robust earnings growth of 26.5% annually over the next three years, surpassing the German market average. Recent developments in the PEGASUS program enhance its strategic position despite past financial challenges, such as a net loss reduction from €46 million to €30 million for nine months ending September 2025.

- Our comprehensive growth report raises the possibility that Hensoldt is poised for substantial financial growth.

- Get an in-depth perspective on Hensoldt's balance sheet by reading our health report here.

Summing It All Up

- Dive into all 201 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal