Exploring European Undervalued Small Caps With Insider Buying In January 2026

As European markets continue to thrive, the pan-European STOXX Europe 600 Index recently reached a new high, buoyed by a favorable economic backdrop and closing 2025 with its strongest annual performance since 2021. In this environment of optimism, small-cap stocks in Europe are garnering attention for their potential value, particularly those with insider buying which may indicate confidence in their growth prospects amidst these robust market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.1x | 1.6x | 49.45% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 44.95% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 39.76% | ★★★★★☆ |

| Norcros | 14.6x | 0.8x | 37.45% | ★★★★☆☆ |

| Eurocell | 16.1x | 0.3x | 40.21% | ★★★★☆☆ |

| Eastnine | 12.4x | 7.8x | 47.93% | ★★★★☆☆ |

| J D Wetherspoon | 11.9x | 0.4x | -10.97% | ★★★☆☆☆ |

| CVS Group | 49.5x | 1.4x | 20.81% | ★★★☆☆☆ |

| Senior | 28.2x | 0.9x | 17.17% | ★★★☆☆☆ |

| Linc | NA | NA | 0.07% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

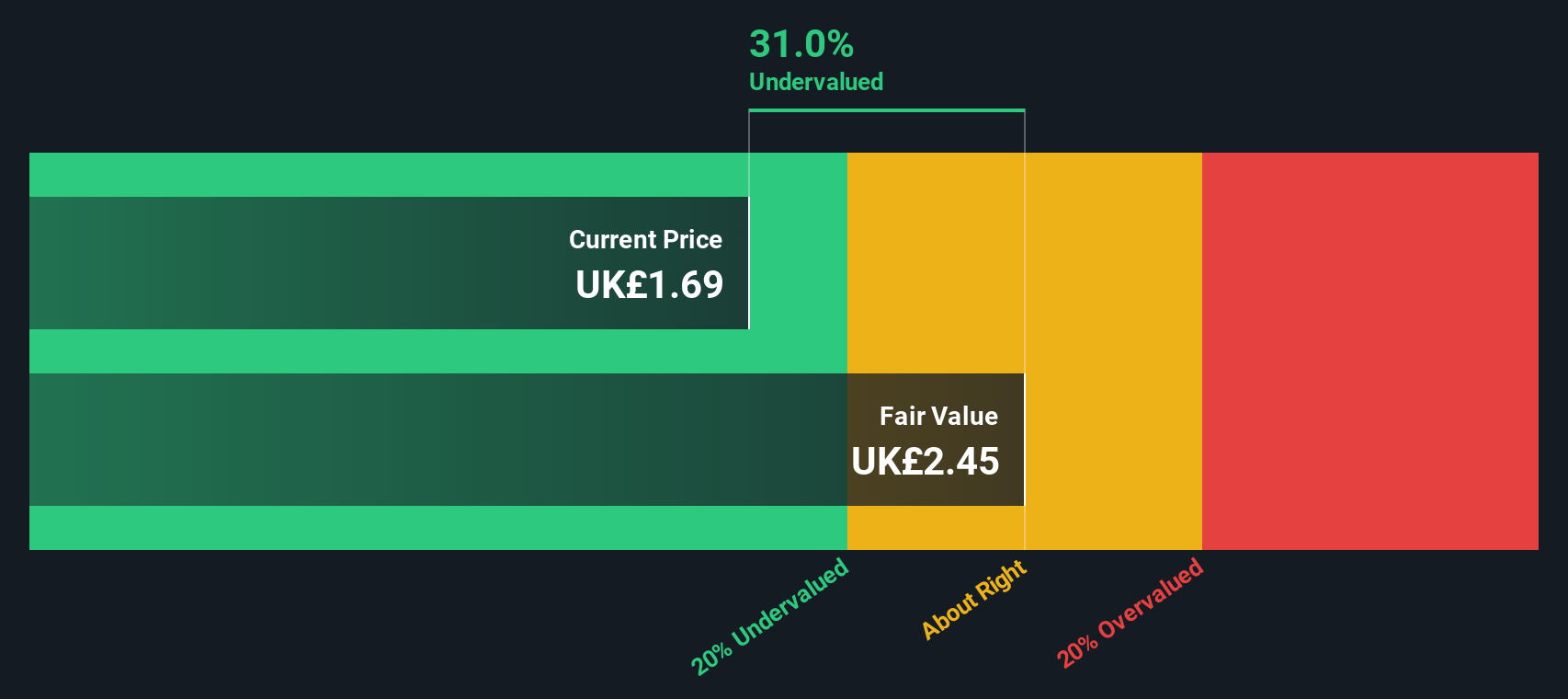

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes is a leading Irish homebuilder focused on building and property development, with a market cap of approximately €0.64 billion.

Operations: The primary revenue stream is from building and property development, with the most recent revenue reported at €778.20 million. The company has experienced fluctuations in its gross profit margin, which reached 22.81% in the latest period. Operating expenses have been consistently rising, with general and administrative expenses being a significant component.

PE: 13.0x

Cairn Homes, a notable player in Europe's construction sector, has caught attention due to insider confidence with share purchases over the past year. Despite its small cap status, the company shows potential with earnings projected to grow 15% annually. However, its financial position reveals some concerns; operating cash flow does not fully cover debt and liabilities are entirely from external borrowing. These factors suggest both opportunities and challenges for investors considering this stock's future trajectory.

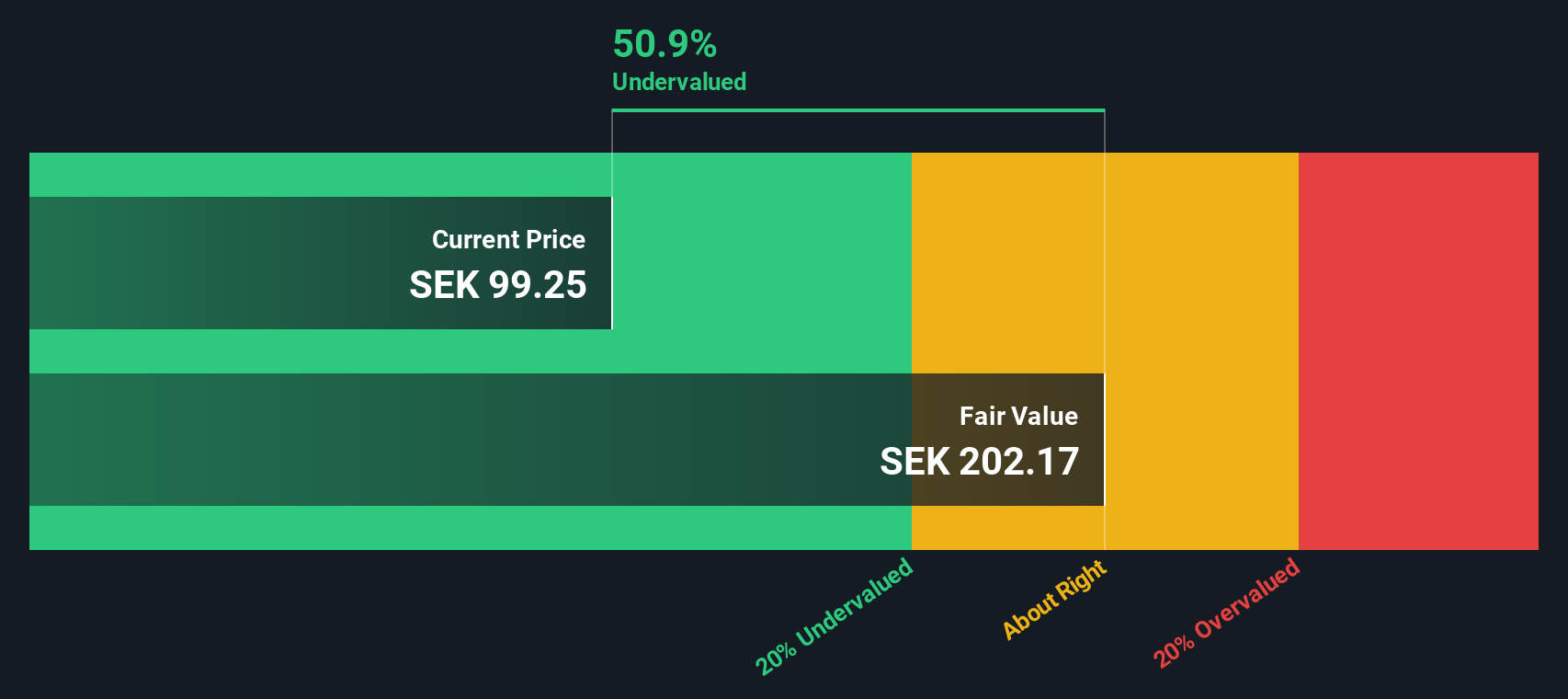

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing commercial properties across several regions, with a market cap of approximately SEK 8.68 billion.

Operations: The company's revenue streams are distributed across several regions, with Dalarna and Luleå contributing the highest amounts. Over recent periods, the gross profit margin has shown an upward trend, reaching 68.69% by September 2024. Operating expenses have remained relatively stable around SEK 85 million to SEK 100 million in recent quarters. Non-operating expenses have varied significantly, impacting net income margins which have fluctuated from positive to negative values during this period.

PE: 12.1x

Diös Fastigheter, a Swedish property company, has been actively securing new leases with notable clients like Bonnier News and WSP, enhancing its portfolio's appeal. The company's recent financial performance shows a significant turnaround with a net income of SEK 303 million in Q3 2025 compared to last year's loss. Insider confidence is evident as an insider increased their stake by 27%, purchasing shares worth approximately SEK 987,450. Despite relying on external borrowing for funding, Diös maintains growth potential with forecasted earnings growth of 11.71% annually.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dynavox Group operates in the computer hardware sector with a focus on producing specialized communication devices, and it has a market capitalization of SEK 4.25 billion.

Operations: Dynavox Group's revenue primarily stems from computer hardware sales, with a gross profit margin reaching 68.81% as of the latest period. The company incurs significant operating expenses, including sales and marketing, R&D, and general administrative costs. Over recent periods, net income margins have shown variability but recently stood at 6.05%.

PE: 77.1x

Dynavox Group, a European small-cap company, showcases potential with its forecasted earnings growth of 38.35% annually despite relying solely on external borrowing for funding. Recent insider confidence is evident as executives increased their share holdings in the past year. For the third quarter ending September 2025, sales rose to SEK 606 million from SEK 483 million year-on-year, though net income dipped slightly to SEK 38 million. This blend of financial dynamics positions Dynavox for intriguing future prospects within its industry context.

- Click here and access our complete valuation analysis report to understand the dynamics of Dynavox Group.

Gain insights into Dynavox Group's past trends and performance with our Past report.

Where To Now?

- Click here to access our complete index of 68 Undervalued European Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal