3 Asian Stocks Estimated To Be Undervalued By Up To 49.6%

As global markets experience mixed performances, with Japan's stock markets declining and China's manufacturing sector showing modest improvement, investors are increasingly turning their attention to the potential opportunities within Asian equities. In this environment, identifying undervalued stocks can be a strategic move, as these investments may offer significant upside potential when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WuXi XDC Cayman (SEHK:2268) | HK$68.50 | HK$135.26 | 49.4% |

| Visional (TSE:4194) | ¥10040.00 | ¥19790.82 | 49.3% |

| Suzhou Zelgen Biopharmaceuticals (SHSE:688266) | CN¥99.90 | CN¥199.49 | 49.9% |

| Sino Medical Sciences Technology (SHSE:688108) | CN¥21.89 | CN¥43.45 | 49.6% |

| PeptiDream (TSE:4587) | ¥1738.00 | ¥3437.58 | 49.4% |

| Kuraray (TSE:3405) | ¥1619.00 | ¥3157.04 | 48.7% |

| Fositek (TWSE:6805) | NT$1405.00 | NT$2741.10 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥797.00 | ¥1580.29 | 49.6% |

| ASE Technology Holding (TWSE:3711) | NT$275.00 | NT$540.37 | 49.1% |

| Andes Technology (TWSE:6533) | NT$247.00 | NT$481.04 | 48.7% |

Here's a peek at a few of the choices from the screener.

Nanjing Leads Biolabs (SEHK:9887)

Overview: Nanjing Leads Biolabs Co., Ltd. is a clinical-stage biotechnology company focused on the research, development, and commercialization of novel antibody drugs globally, with a market cap of HK$11.14 billion.

Operations: Nanjing Leads Biolabs Co., Ltd. generates its revenue primarily through the research, development, and commercialization of innovative antibody drugs on a global scale.

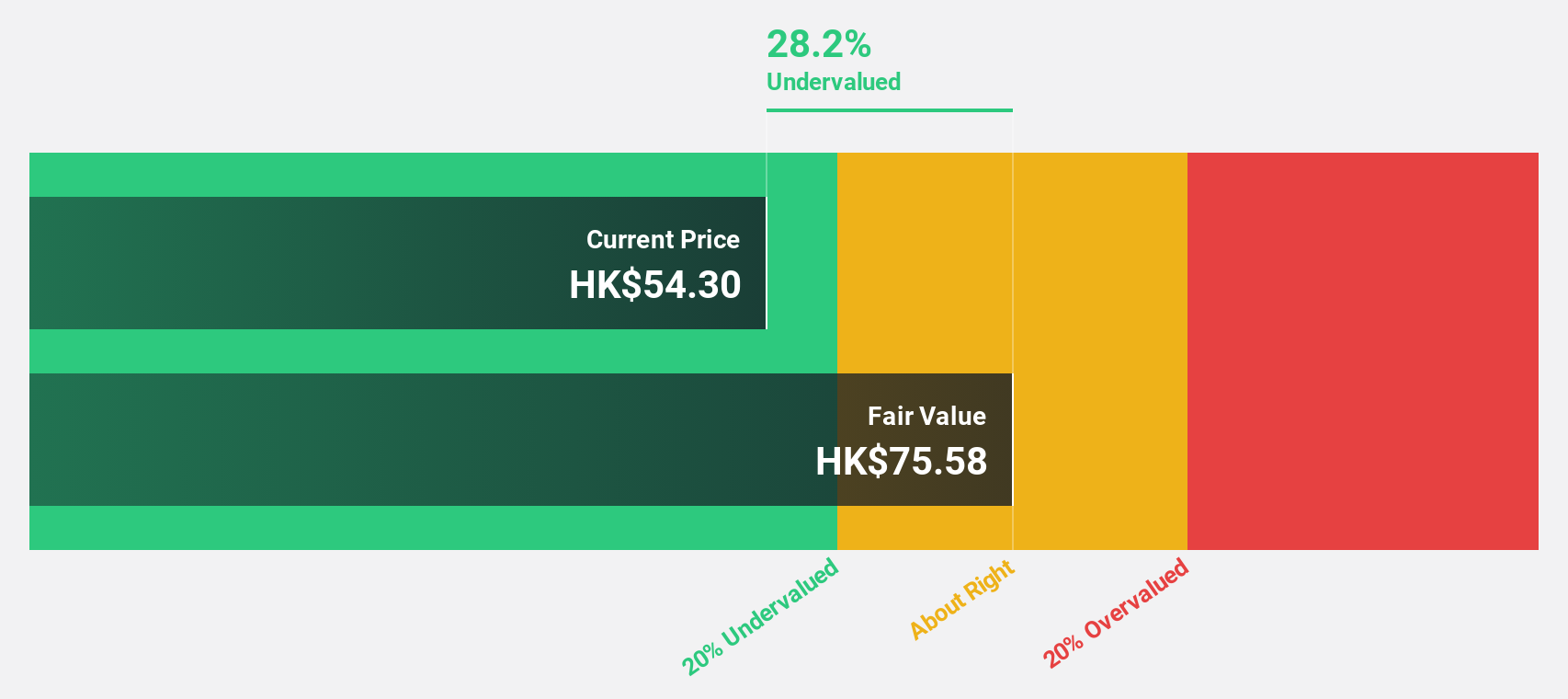

Estimated Discount To Fair Value: 25.7%

Nanjing Leads Biolabs is trading at HK$56, below its estimated fair value of HK$75.33, suggesting undervaluation based on cash flows. The company anticipates becoming profitable in three years with forecasted earnings growth of 40.72% annually and revenue growth of 55.8% per year, surpassing the Hong Kong market average. Recent collaborations and clinical advancements enhance its potential for addressing autoimmune diseases, further supporting its financial outlook amidst ongoing product developments and strategic partnerships valued up to $1 billion.

- In light of our recent growth report, it seems possible that Nanjing Leads Biolabs' financial performance will exceed current levels.

- Click here to discover the nuances of Nanjing Leads Biolabs with our detailed financial health report.

Sino Medical Sciences Technology (SHSE:688108)

Overview: Sino Medical Sciences Technology Inc. is a Chinese medical device company focused on the research, development, production, and distribution of interventional medical devices, with a market cap of approximately CN¥9.11 billion.

Operations: The company's revenue is primarily derived from its medical products segment, which generated CN¥504.11 million.

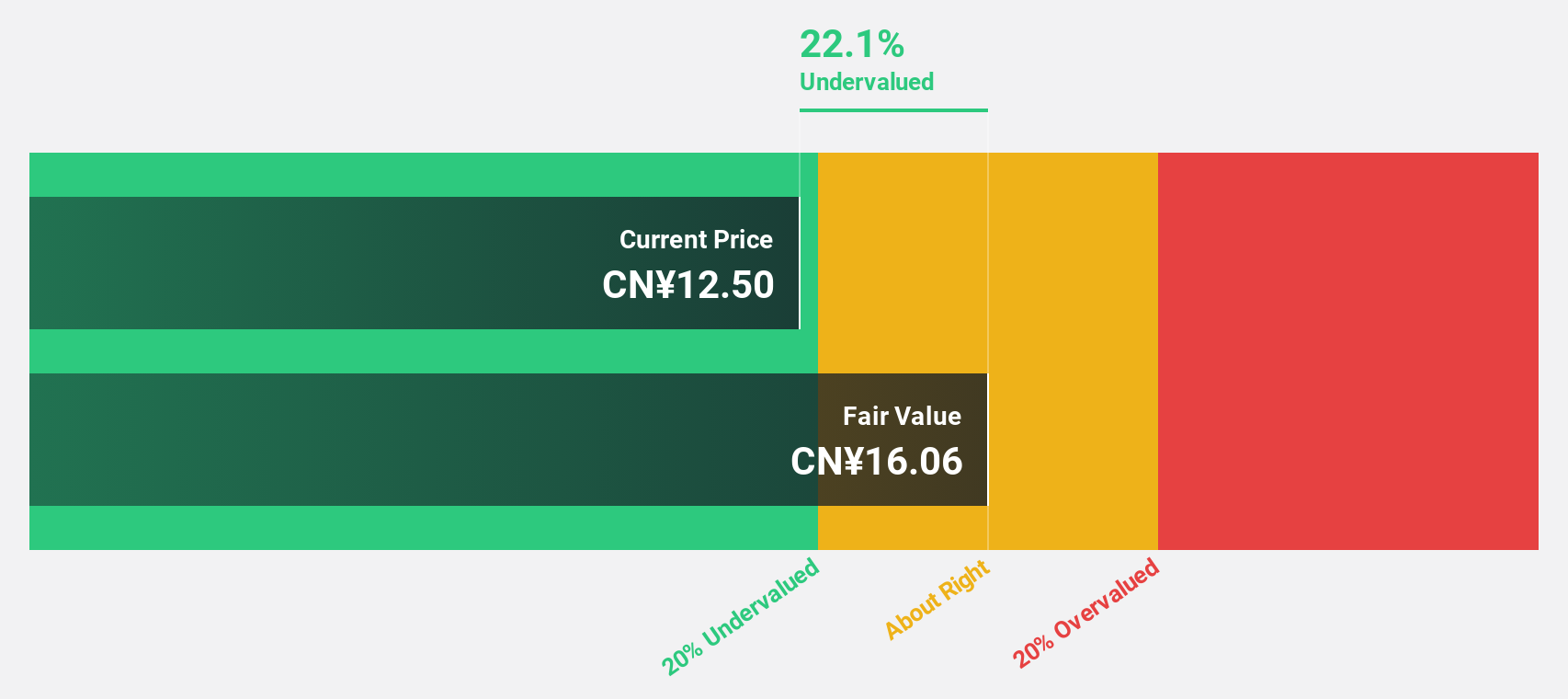

Estimated Discount To Fair Value: 49.6%

Sino Medical Sciences Technology is trading at CN¥21.89, significantly below its estimated fair value of CN¥43.45, highlighting undervaluation based on cash flows. The company recently turned profitable with a net income of CNY 21.12 million for the nine months ending September 2025, reversing a prior loss. Earnings are projected to grow substantially at 63.5% annually over the next three years, outpacing the Chinese market average growth rate and supporting its investment appeal despite share price volatility and low forecasted return on equity.

- Our growth report here indicates Sino Medical Sciences Technology may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Sino Medical Sciences Technology.

Shenzhen Newway Photomask Making (SHSE:688401)

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on the design, development, and production of mask products in China with a market cap of CN¥10.47 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, totaling CN¥1.10 billion.

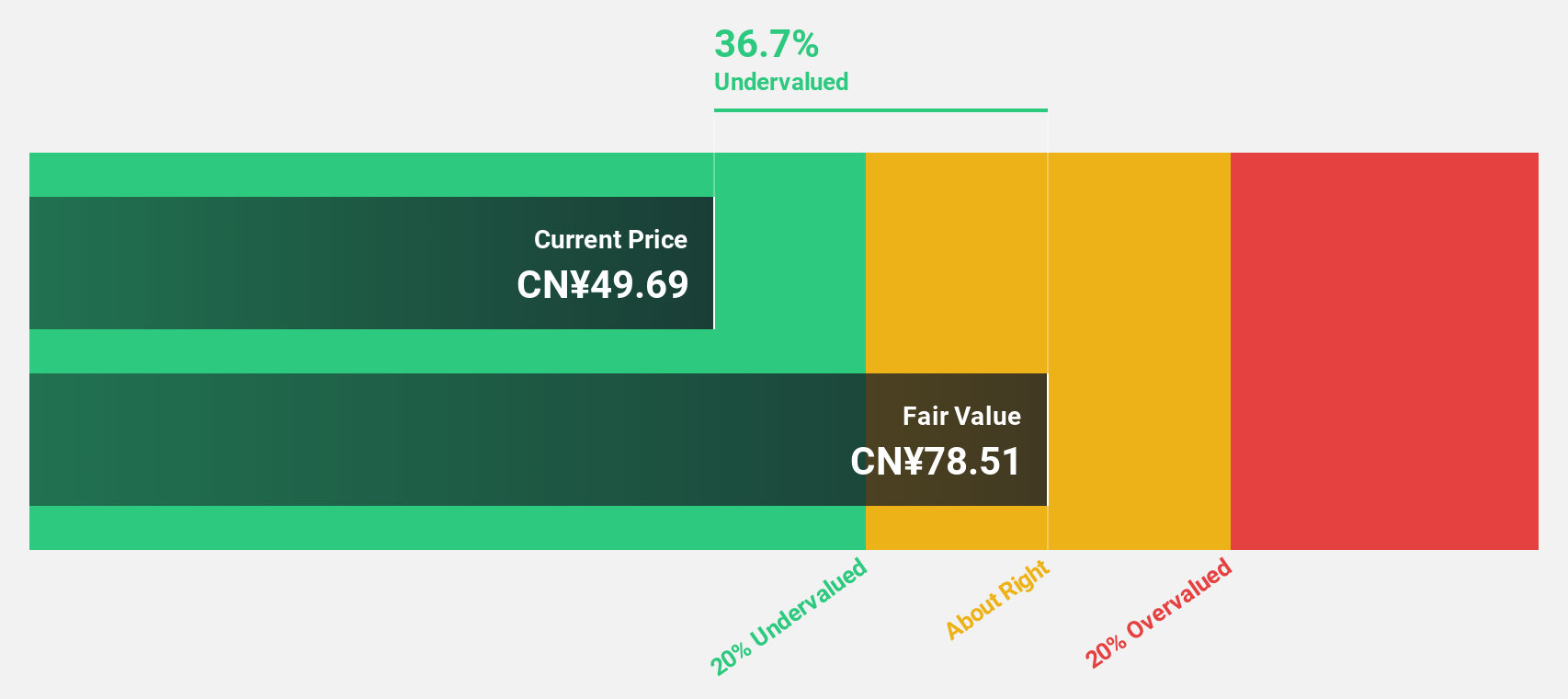

Estimated Discount To Fair Value: 31.5%

Shenzhen Newway Photomask Making, priced at CN¥54.7, is trading 31.5% below its estimated fair value of CN¥79.83, indicating undervaluation based on cash flows. The company's earnings grew by 49.6% over the past year with net income reaching CNY 171.76 million for the nine months ending September 2025. Despite share price volatility and a low dividend coverage by free cash flow, future revenue and earnings are forecast to grow significantly above market averages, enhancing its investment prospects.

- Our expertly prepared growth report on Shenzhen Newway Photomask Making implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Shenzhen Newway Photomask Making stock in this financial health report.

Summing It All Up

- Click this link to deep-dive into the 261 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal