Asian Growth Leaders With Insider Ownership January 2026

As we enter 2026, Asian markets are navigating a complex landscape marked by mixed performances and cautious optimism, with China's manufacturing sector showing signs of recovery and South Korea's exports reaching new heights. In this environment, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Phison Electronics (TPEX:8299) | 10.8% | 30.2% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Modetour Network (KOSDAQ:A080160) | 12.7% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| FUNDINNOInc (TSE:462A) | 34.4% | 53.7% |

Here we highlight a subset of our preferred stocks from the screener.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning business, with a market cap of HK$49.86 billion.

Operations: Kingdee International Software Group Company Limited generates revenue from its enterprise resource planning business.

Insider Ownership: 19.9%

Revenue Growth Forecast: 14.6% p.a.

Kingdee International Software Group is positioned for growth, with analysts predicting a 36.8% stock price increase and trading at 29.1% below its estimated fair value. While revenue growth is expected to be 14.6% annually, faster than the Hong Kong market average, profit growth forecasts are robust at 39.45% per year over the next three years as it approaches profitability. Despite low forecasted return on equity (6%), insider activity remains stable without significant buying or selling recently.

- Take a closer look at Kingdee International Software Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Kingdee International Software Group is priced lower than what may be justified by its financials.

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Lion Electronics Co., Ltd specializes in the research, development, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips both in China and internationally, with a market capitalization of approximately CN¥27.75 billion.

Operations: The company generates revenue through its semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips segments.

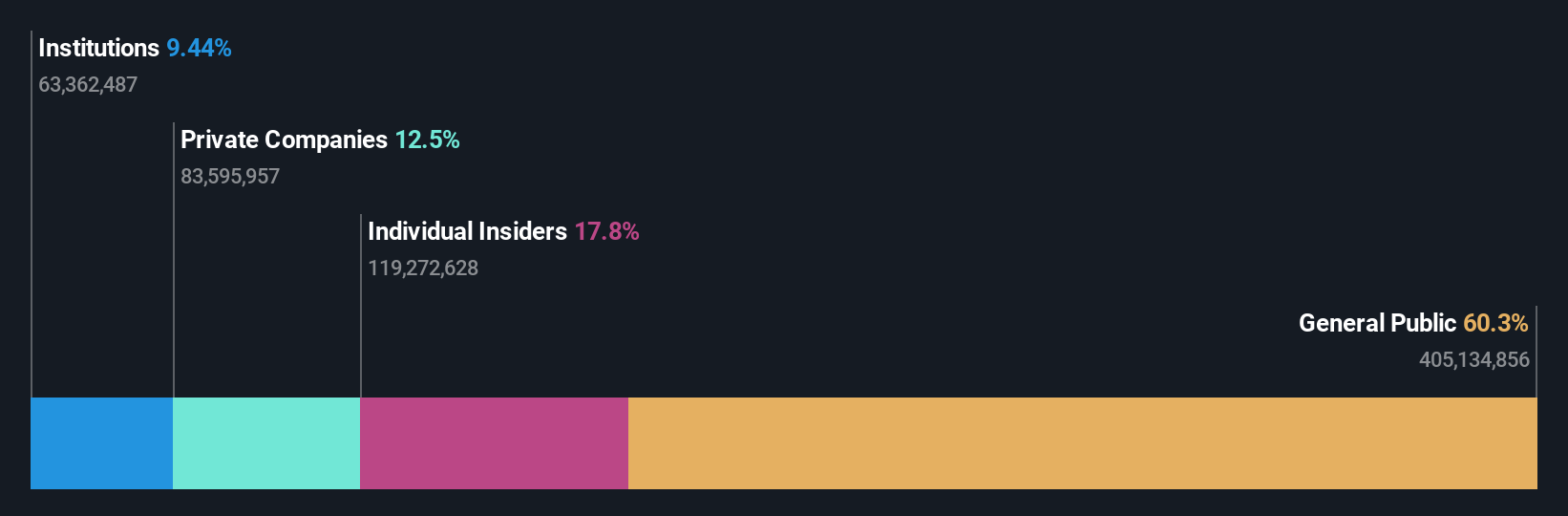

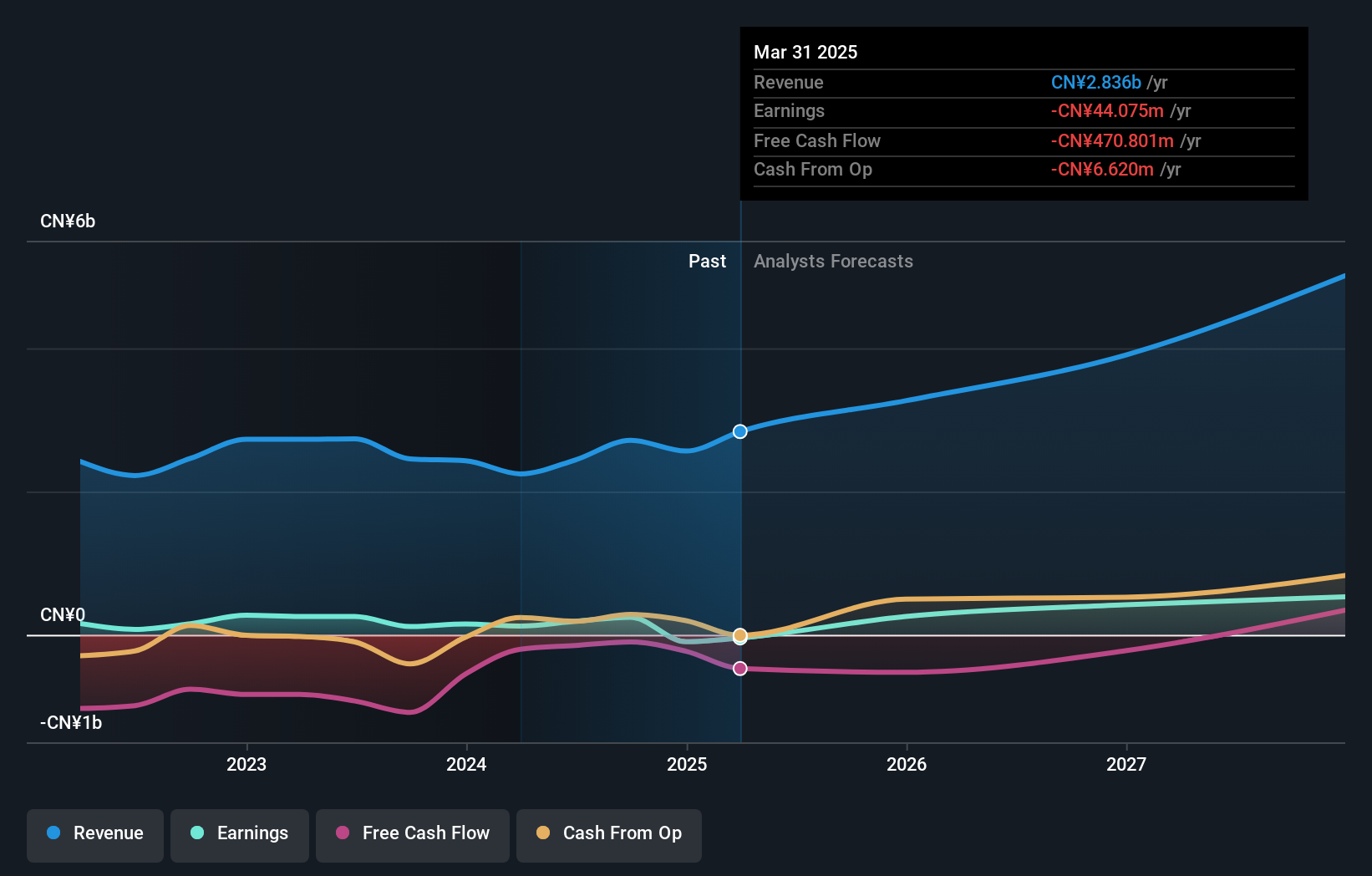

Insider Ownership: 17.8%

Revenue Growth Forecast: 22.9% p.a.

Hangzhou Lion Electronics is set for robust growth, with revenue projected to increase by 22.9% annually, outpacing the Chinese market average. Despite a volatile share price and net losses widening to CNY 107.96 million for the nine months ending September 2025, it is anticipated to achieve profitability within three years. However, return on equity remains low at a forecasted 3.8%, and debt coverage by operating cash flow is inadequate, indicating financial challenges ahead.

- Navigate through the intricacies of Hangzhou Lion ElectronicsLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Hangzhou Lion ElectronicsLtd's shares may be trading at a premium.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd researches, develops, produces, and sells display, semiconductor, and new energy equipment with a market cap of CN¥30.65 billion.

Operations: The company generates revenue from its Electron Product segment, amounting to CN¥3.01 billion.

Insider Ownership: 36.5%

Revenue Growth Forecast: 22.9% p.a.

Wuhan Jingce Electronic Group is positioned for significant growth, with revenue forecasted to rise 22.9% annually, surpassing the Chinese market average. The company reported CNY 2.27 billion in sales for the nine months ending September 2025, up from CNY 1.83 billion the previous year. Despite a volatile share price and low projected return on equity of 10.5%, it is expected to achieve profitability within three years, indicating strong growth potential amidst financial restructuring efforts.

- Get an in-depth perspective on Wuhan Jingce Electronic GroupLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Wuhan Jingce Electronic GroupLtd shares in the market.

Key Takeaways

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 626 more companies for you to explore.Click here to unveil our expertly curated list of 629 Fast Growing Asian Companies With High Insider Ownership.

- Seeking Other Investments? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal