Revenues Not Telling The Story For Modern Times Group MTG AB (STO:MTG B)

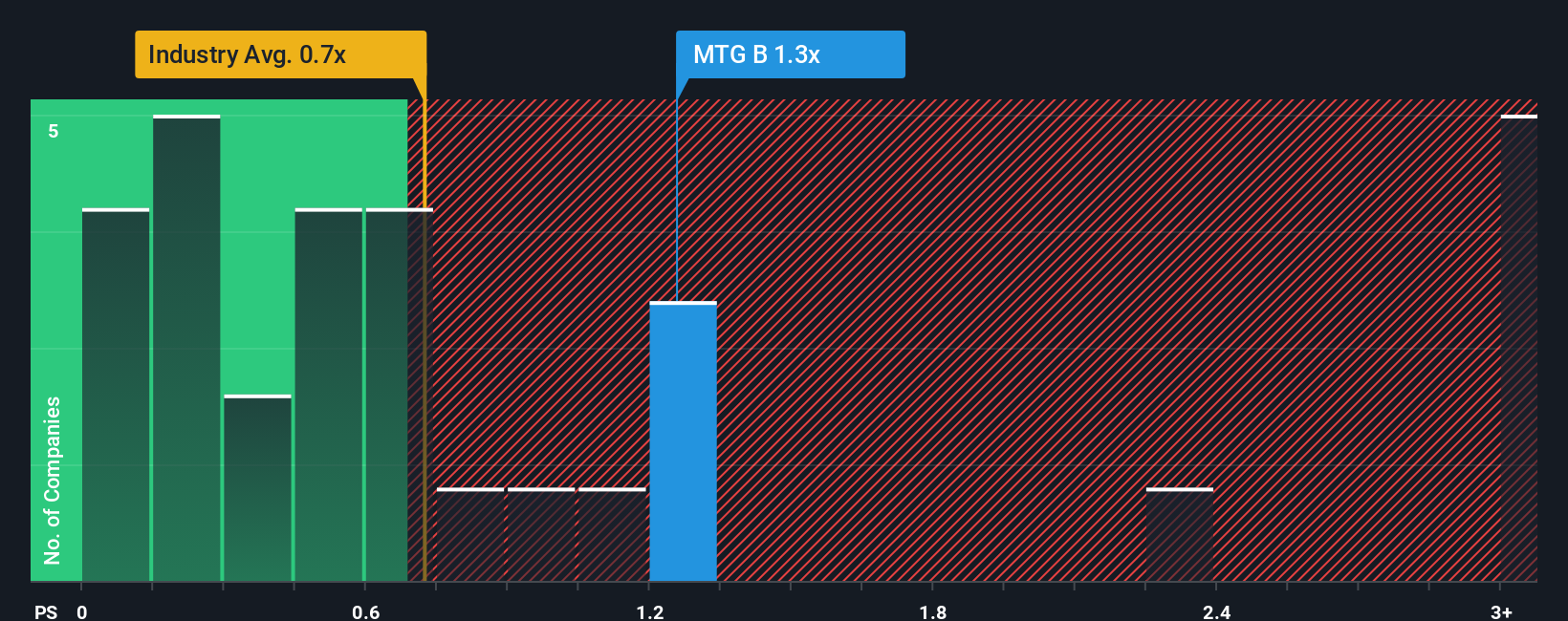

When close to half the companies in the Entertainment industry in Sweden have price-to-sales ratios (or "P/S") below 0.7x, you may consider Modern Times Group MTG AB (STO:MTG B) as a stock to potentially avoid with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Modern Times Group MTG

What Does Modern Times Group MTG's P/S Mean For Shareholders?

Modern Times Group MTG certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Modern Times Group MTG's future stacks up against the industry? In that case, our free report is a great place to start.How Is Modern Times Group MTG's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Modern Times Group MTG's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 72% last year. Pleasingly, revenue has also lifted 87% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10.0% per annum during the coming three years according to the four analysts following the company. With the industry predicted to deliver 9.4% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's curious that Modern Times Group MTG's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Modern Times Group MTG's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Modern Times Group MTG's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Modern Times Group MTG with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal