Assessing Commerce Bancshares (CBSH) Valuation After Recent Mixed Share Price Performance

Event context and why Commerce Bancshares is on the radar

Commerce Bancshares (CBSH) has recently drawn attention after a mixed return pattern, with gains over the past month but a decline over the past 3 months, prompting investors to reassess the bank's current valuation.

See our latest analysis for Commerce Bancshares.

Stepping back, Commerce Bancshares' 7 day share price return of 2.64% contrasts with a 90 day share price return decline of 3.65% and a 1 year total shareholder return decline of 8.47%, which points to some recent momentum after a weaker stretch.

If Commerce Bancshares has you rethinking your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

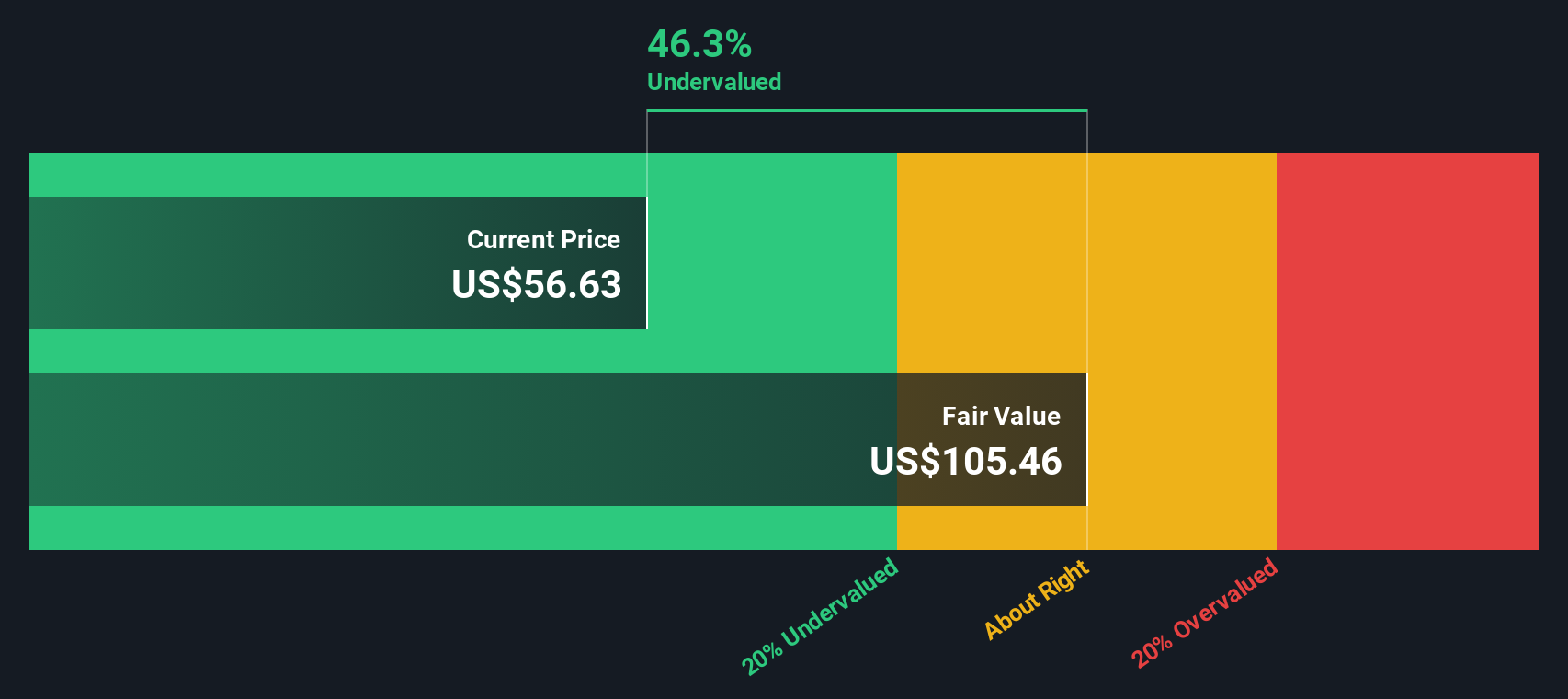

So with Commerce Bancshares trading at $53.72 and an indicated intrinsic discount of about 26%, plus mixed recent returns, are you looking at a genuine value opportunity here, or is the market already pricing in future growth?

Price-to-Earnings of 13.4x: Is it justified?

On a P/E of 13.4x at a last close of $53.72, Commerce Bancshares screens as more expensive than the broader US Banks industry, yet slightly cheaper than its closest peer group.

The P/E ratio compares the current share price to earnings per share, so for a bank like Commerce Bancshares it reflects what investors are currently willing to pay for each dollar of earnings.

Here, the stock trades above the US Banks industry average P/E of 11.9x. This suggests the market is accepting a premium price for its earnings, possibly reflecting factors such as CBSH's record of 4.9% per year earnings growth over the past 5 years, recent 12.4% earnings growth, high quality earnings, and improved profit margins.

At the same time, the P/E of 13.4x sits slightly below the peer average of 13.9x and above the estimated fair P/E of 12.3x. This points to a valuation that is richer than what the regression based fair ratio implies but not stretched versus similar banks.

Explore the SWS fair ratio for Commerce Bancshares

Result: Price-to-Earnings of 13.4x (OVERVALUED)

However, you still need to weigh risks such as the 8.47% 1-year total return decline and the 3-year total return decline of 4.62% against that apparent discount.

Find out about the key risks to this Commerce Bancshares narrative.

Another view using our DCF model

While the 13.4x P/E makes Commerce Bancshares look a bit rich compared to the US Banks industry at 11.9x and slightly cheap versus peers at 13.9x, our DCF model points in a different direction altogether, with an estimated fair value of $73.08 versus the current $53.72.

That 26.5% gap suggests the market could be applying a heavier discount than our cash flow assumptions. This raises a simple question for you: is the market being cautious for good reasons, or is sentiment holding the stock below what its cash flows imply?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Commerce Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Commerce Bancshares Narrative

If you see the numbers differently or prefer to test your own assumptions, you can quickly build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Commerce Bancshares.

Looking for more investment ideas?

If Commerce Bancshares has you thinking more carefully about value and quality, do not stop here. Broaden your opportunity set before the next move passes you by.

- Target potential mispricings by scanning these 885 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into future focused themes by reviewing these 26 AI penny stocks that are linked to artificial intelligence trends.

- Strengthen your income stream by checking out these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal