Assessing Tapestry (TPR) Valuation As Growth Stays Weak And Returns On Capital Shrink

Recent commentary on Tapestry (TPR) has focused on weak constant currency growth over the past two years, pressure from higher expenses, and shrinking returns on capital, raising fresh questions about how efficiently the business is being run.

See our latest analysis for Tapestry.

Despite the recent focus on weaker constant currency growth and rising costs, Tapestry’s share price has moved higher over the past quarter. It has a 30 day share price return of 11.68% and a 90 day share price return of 15.41%, alongside a very large 5 year total shareholder return that points to strong long run compounding but also a risk of sentiment cooling if operational issues persist.

If this kind of mixed story has you reassessing your options, it could be a good moment to widen the lens and check out fast growing stocks with high insider ownership as potential alternatives.

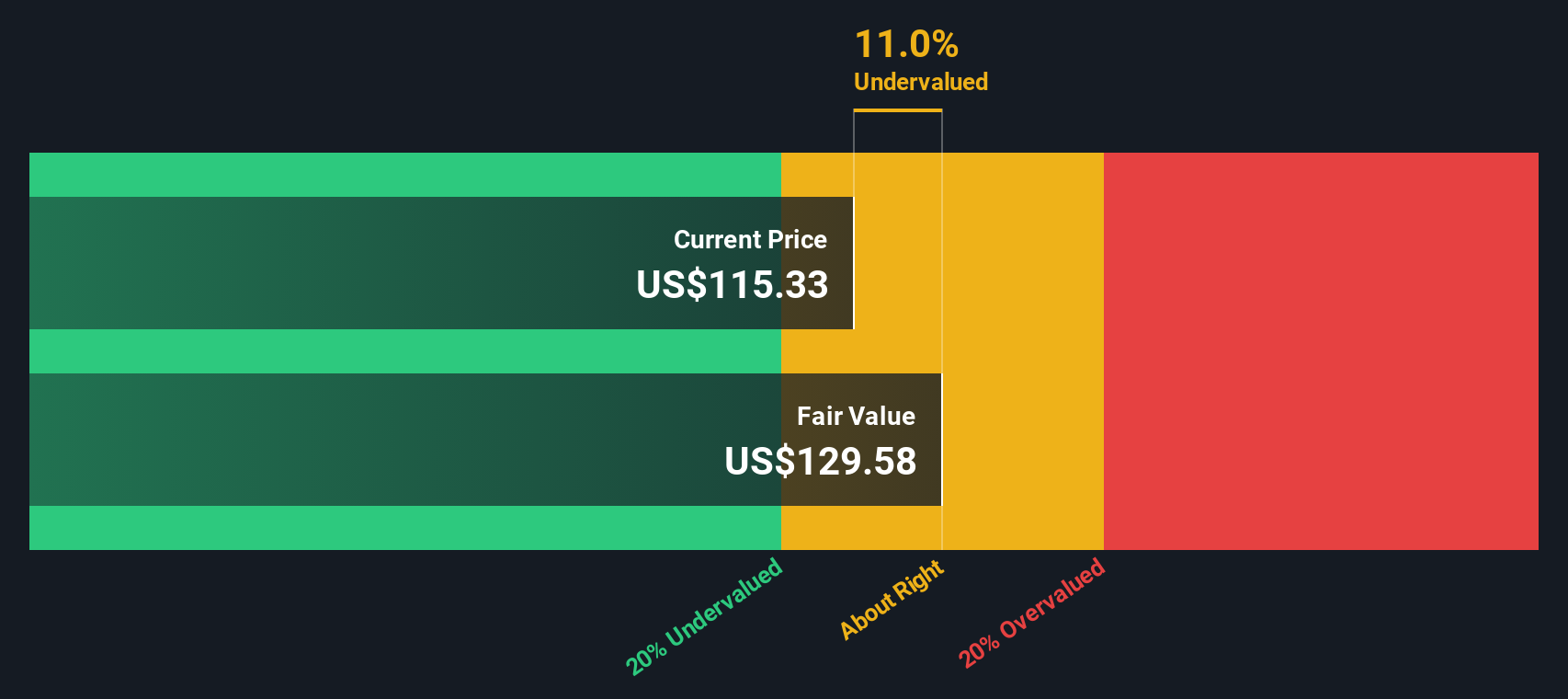

So with Tapestry showing weak constant currency growth, rising costs and shrinking returns on capital, yet a strong recent share price run, is the current valuation leaving upside on the table or already baking in optimistic future growth?

Most Popular Narrative: 4.6% Overvalued

The most followed narrative puts Tapestry’s fair value at about US$125 per share, slightly under the last close of US$130.97, which helps frame the current optimism.

• The analysts have a consensus price target of $114.556 for Tapestry based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $139.0, and the most bearish reporting a price target of just $66.0.

Curious what kind of earnings ramp, margin lift, and future P/E these analysts are baking in to reach that higher fair value band? The narrative lays out a detailed revenue glide path, a shift in profitability that reshapes today’s thin margins, and an earnings power figure that has to line up with a lower multiple than many high growth names enjoy. If you want to see exactly which financial building blocks are doing the heavy lifting in this valuation, the full story is worth a closer read.

Result: Fair Value of $125.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if Kate Spade’s turnaround stalls or if tariff and duty headwinds hit margins harder than analysts currently expect.

Find out about the key risks to this Tapestry narrative.

Another View: SWS DCF Says Undervalued

While the popular narrative sees Tapestry as about 4.6% overvalued at roughly US$125 fair value, our DCF model lands in a different place. It gives a fair value estimate of US$139.88 versus the current US$130.97. That gap suggests the cash flow story might still have some room, but are the inputs realistic enough for you to rely on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tapestry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tapestry Narrative

If you are not fully on board with this story or prefer to dig into the numbers yourself, you can build a custom view in minutes. To get started, use Do it your way.

A great starting point for your Tapestry research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Tapestry has you thinking harder about where to put your money next, do not stop here. The screener can surface ideas you might wish you had found earlier.

- Hunt for value by checking out these 885 undervalued stocks based on cash flows that could offer more attractive cash flow profiles at current prices.

- Target growth by zeroing in on these 26 AI penny stocks that are closely linked to artificial intelligence themes.

- Strengthen your income focus with these 12 dividend stocks with yields > 3% that may fit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal