A Look At Regal Rexnord (RRX) Valuation As It Shifts Toward Automation And Electrification Markets

Why Regal Rexnord’s repositioning is in focus for investors

Regal Rexnord (RRX) is back on investors’ radar after recent commentary highlighted its push toward less cyclical areas like automation, robotics, data centers, and aviation electrification, while still contending with tariffs and softer residential HVAC demand.

See our latest analysis for Regal Rexnord.

Despite a recent 4.6% one day share price decline to around $150.43, Regal Rexnord’s 7 day share price return of 7.2% and 3 year total shareholder return of 15.2% suggest momentum is rebuilding around its repositioning story.

If you are watching how industrial automation and motion control themes are playing out beyond Regal Rexnord, it could be a useful moment to scan high growth tech and AI stocks for other ideas on your radar.

With Regal Rexnord trading around $150.43, a value score of 3, an implied discount to a US$181 price target, and an intrinsic value gap flagged, investors may wonder whether there is still a buying opportunity or if the market is already pricing in the future growth story.

Most Popular Narrative: 15.4% Undervalued

With Regal Rexnord last closing at US$150.43 against a narrative fair value of US$177.73, the valuation case hinges on a detailed earnings and margin reset.

The accelerating adoption of energy-efficient and electrification solutions across industrial and commercial sectors continues to drive incremental demand for high-efficiency motors, subsystem solutions, and customized powertrain products, particularly in segments where Regal Rexnord is gaining traction, supported by regulatory tailwinds and sustainability initiatives. This is described as positioning the company for outsized revenue growth and improved pricing power over the medium and long term.

Want to see what sits behind that confidence in revenue, margins, and the future P/E reset, and how the discount rate shapes today’s fair value?

Result: Fair Value of $177.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to watch for rare earth magnet supply chain disruption and prolonged weakness in mature markets like residential HVAC, as these factors could pressure margins and cash generation.

Find out about the key risks to this Regal Rexnord narrative.

Another View: What Earnings Multiples Are Signalling

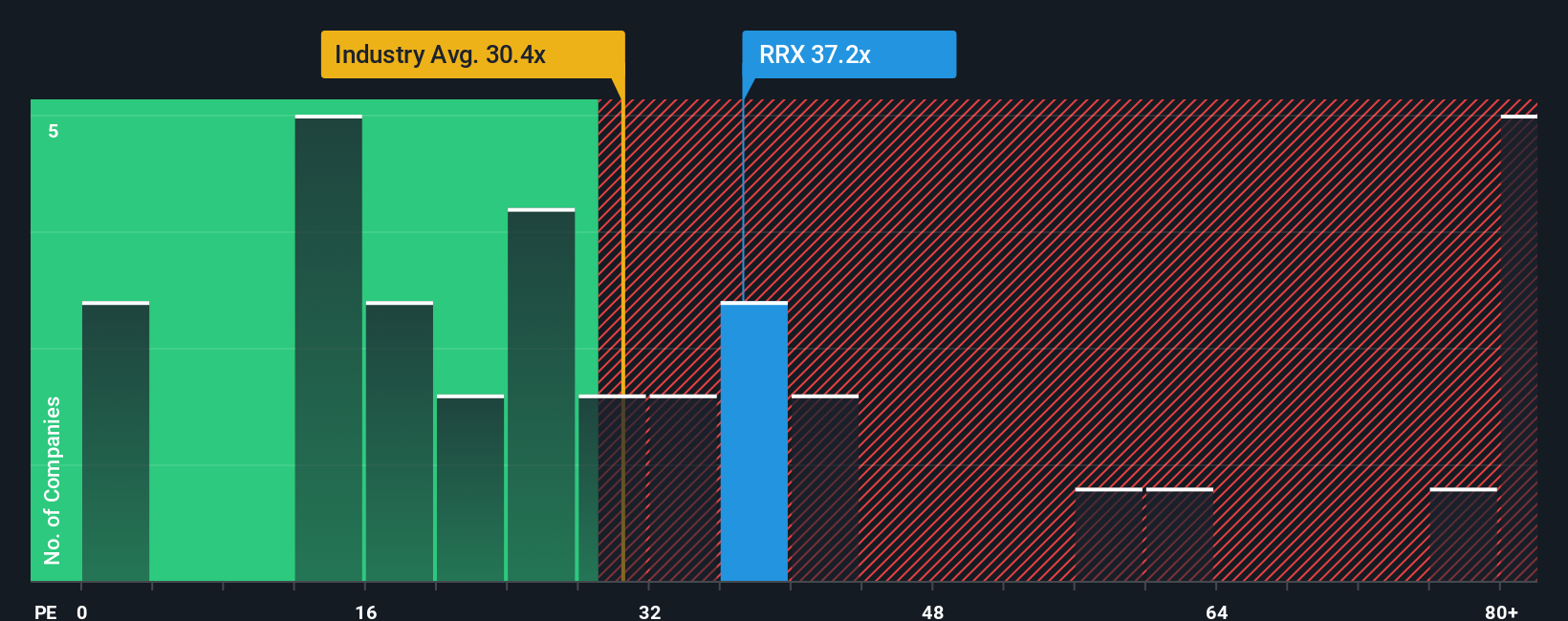

While the narrative fair value of US$177.73 points to Regal Rexnord as 15.4% undervalued, the earnings multiple sends a cooler message. The shares trade on a P/E of 38.8x, compared with 31.7x for the US Electrical industry and 32.4x for peers, while the fair ratio is 39.9x.

That means the current price already sits above sector and peer averages, yet slightly below where our fair ratio suggests the P/E could settle. Investors are therefore weighing a narrow margin between potential upside and valuation risk. Which signal feels more convincing to you right now: the earnings multiple or the narrative fair value gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regal Rexnord Narrative

If you would rather weigh the numbers yourself and come to your own conclusion, you can build a personalised Regal Rexnord view in just a few minutes with Do it your way.

A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger watchlist, now is the time to broaden your search using focused screeners that surface specific types of opportunities.

- Spot potential value candidates by checking out these 885 undervalued stocks based on cash flows that may offer a gap between current prices and underlying cash flow expectations.

- Target emerging themes in artificial intelligence by scanning these 26 AI penny stocks where growth stories are closely tied to real product adoption and data driven services.

- Tap into income focused opportunities by reviewing these 12 dividend stocks with yields > 3% that might suit investors who prioritise steady cash returns alongside capital appreciation potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal