ASX Penny Stocks To Watch In January 2026

As the Australian share market faces its first downturn of the year, with futures suggesting only a slight dip, investors are keeping a close eye on potential opportunities amid fluctuating global sentiments. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment area despite being considered somewhat outdated. These stocks can offer unique growth prospects at lower price points when backed by strong financial health and solid fundamentals. In this article, we explore three penny stocks that stand out as potential hidden gems in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.91 | A$447.24M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.05 | A$225.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.32 | A$3.79B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.945 | A$136.02M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.33 | A$127.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.51 | A$656.1M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Australian Vanadium (ASX:AVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Australian Vanadium Limited, with a market cap of A$95.36 million, engages in mineral exploration activities in Australia through its subsidiary.

Operations: The company generates revenue from its Downstream - Energy Storage segment with A$0.61 million and its Midstream - Electrolyte Plant segment with A$0.01 million.

Market Cap: A$95.36M

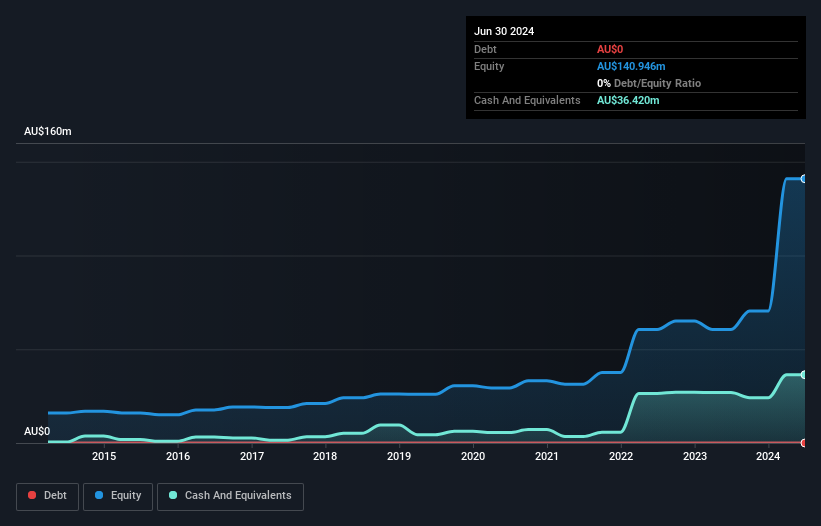

Australian Vanadium Limited, with a market cap of A$95.36 million, remains pre-revenue, generating less than US$1 million annually. The company is debt-free and has received significant government grants totaling A$29.4 million to support its vanadium project development, crucial for its energy storage ambitions. Despite this financial backing, the company's cash runway is under a year if current free cash flow trends persist. The stock has experienced high volatility recently and remains unprofitable with increasing losses over five years. Management's average tenure is 3.3 years, while the board's inexperience may impact strategic direction stability.

- Navigate through the intricacies of Australian Vanadium with our comprehensive balance sheet health report here.

- Explore Australian Vanadium's analyst forecasts in our growth report.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm that invests in and develops online classifieds businesses in emerging markets, with a market cap of A$128.54 million.

Operations: The company's revenue segments include Yapo (A$7.91 million), Avito (A$8.24 million), Moteur (A$1.24 million), Tayara (A$0.72 million), Autodeal (A$2.55 million), Fincaraiz (A$15.12 million), Infocasas (A$12.83 million), Encuentra24 (A$12.67 million), Imyanmarhouse (A$3.96 million) and Lankapropertyweb (A$0.95 million).

Market Cap: A$128.54M

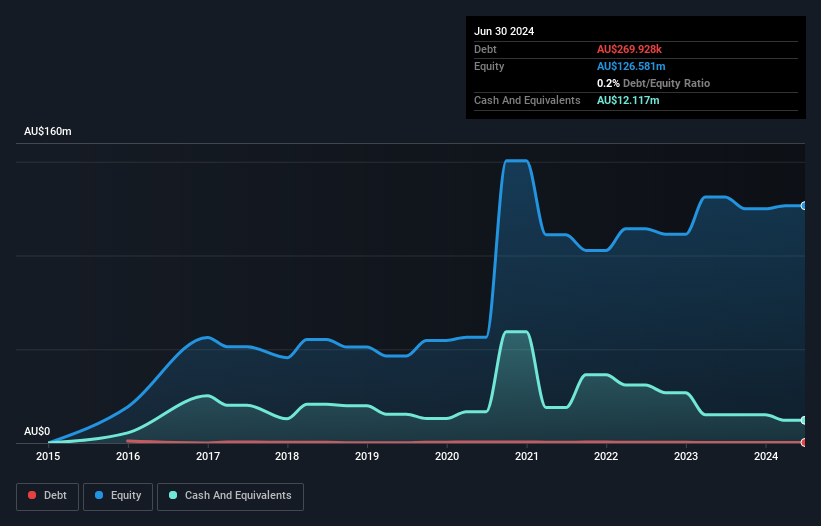

Frontier Digital Ventures Limited, with a market cap of A$128.54 million, operates in the online classifieds sector across emerging markets. Despite being unprofitable, it has effectively managed its finances with short-term assets exceeding both short and long-term liabilities and remains debt-free. Recent board changes include the appointment of Phillip Hains as Interim Non-Executive Director following Mark Licciardo’s resignation. The company trades below its estimated fair value and has not experienced significant shareholder dilution over the past year. While earnings growth is projected at 104.93% annually, management's inexperience may pose strategic challenges moving forward.

- Dive into the specifics of Frontier Digital Ventures here with our thorough balance sheet health report.

- Understand Frontier Digital Ventures' earnings outlook by examining our growth report.

Regal Partners (ASX:RPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.21 billion.

Operations: The company generates revenue of A$245.45 million through its investment management services segment.

Market Cap: A$1.21B

Regal Partners Limited, with a market cap of A$1.21 billion, generates significant revenue of A$245.45 million from investment management services. Despite recent negative earnings growth and declining profit margins, the company maintains financial stability with assets exceeding liabilities and more cash than debt. Its weekly volatility has remained stable over the past year, reflecting consistent performance in a volatile market segment. The management team and board are experienced but face challenges such as low return on equity and unsustainable dividends not covered by earnings or free cash flows. Trading below estimated fair value suggests potential for price correction if fundamentals improve.

- Click here and access our complete financial health analysis report to understand the dynamics of Regal Partners.

- Evaluate Regal Partners' prospects by accessing our earnings growth report.

Where To Now?

- Access the full spectrum of 412 ASX Penny Stocks by clicking on this link.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal