Assessing National Vision Holdings (EYE) Valuation After Mixed Return Trends And Undervaluation Signals

Why National Vision Holdings is on investors’ radar

With no single headline event driving attention today, National Vision Holdings (EYE) is drawing interest as investors weigh its current share price of US$26.49 against recent return trends and underlying financial figures.

See our latest analysis for National Vision Holdings.

Recent trading has been choppy, with a 1-day share price return showing a 2.18% decline and a 30-day share price return showing a 6.23% decline. However, the 1-year total shareholder return of 151.33% contrasts with weaker 3- and 5-year total shareholder returns.

If this kind of mixed performance has you thinking about diversification, it could be a moment to scan other US retail and healthcare names through healthcare stocks.

With shares trading at US$26.49, alongside a mixed return history, positive annual revenue and net income growth figures, and an indicated intrinsic discount of about 31%, you might ask: is National Vision undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 19.3% Undervalued

With National Vision Holdings last closing at US$26.49 and the most followed narrative pointing to a fair value of about US$32.82, the story centers on how future earnings and margins might bridge that gap.

Investments in CRM, omnichannel marketing, and personalization, enabled by the new Adobe platform, are expected to improve customer targeting, retention, and conversion, particularly in higher income and mid-funnel cohorts, which should translate into increased customer lifetime value and improved comp sales growth.

Curious what kind of revenue climb, margin shift, and future earnings multiple justify that higher value estimate? The narrative leans on specific growth assumptions and a richer profit profile that go well beyond recent results.

Result: Fair Value of $32.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on store traffic and margins holding up, and online eyewear competitors or tighter managed care economics could easily challenge those expectations.

Find out about the key risks to this National Vision Holdings narrative.

Another View: What P/S Is Saying

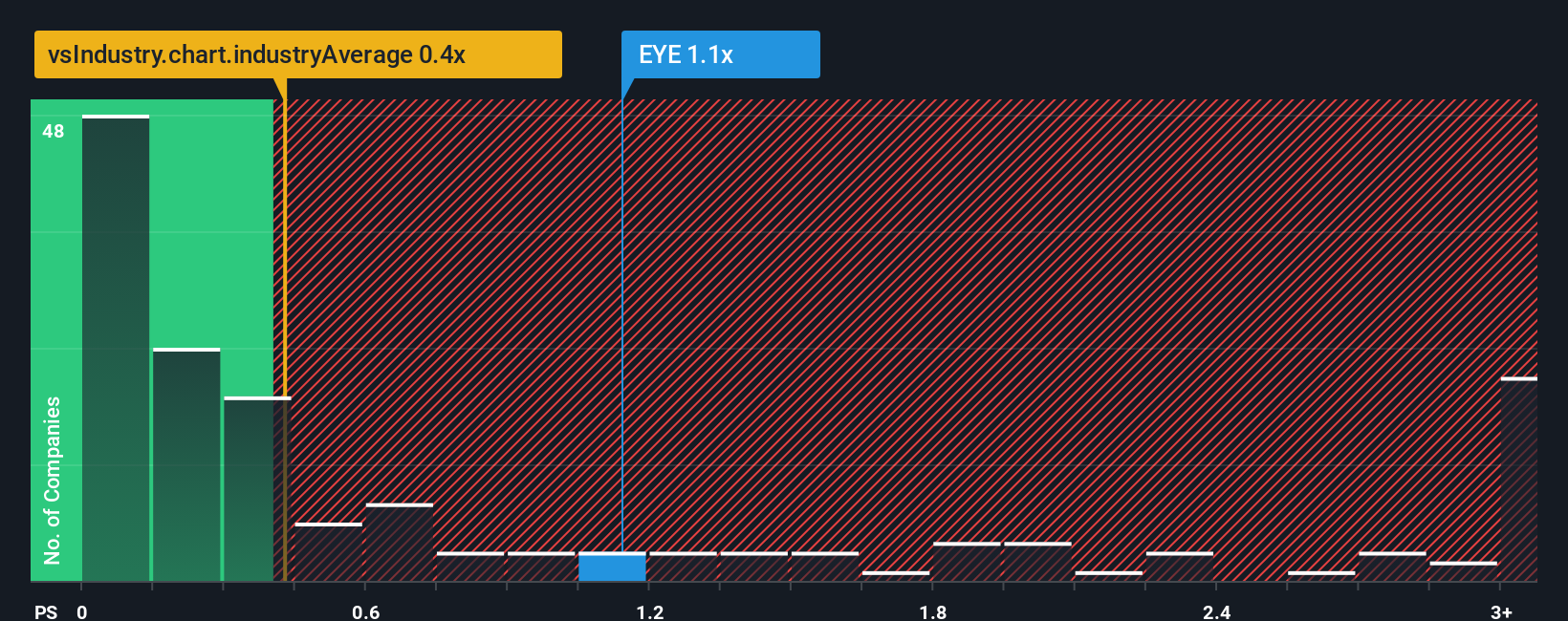

While narratives and fair value models point to upside, the current P/S of 1.1x tells a different story when you compare it with the US Specialty Retail industry at 0.5x. Against peers at 5.7x and a fair ratio of 1.1x, you get a mix of relative expensiveness and apparent balance. This raises the question of whether there is a margin of safety or if the easier gains are already reflected in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Vision Holdings Narrative

If you see the story differently, or prefer to work from the raw numbers yourself, you can build a custom view in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding National Vision Holdings.

Looking for more investment ideas?

If National Vision has caught your eye, do not stop here. Broader context from other themes can sharpen your thinking and highlight opportunities you might otherwise miss.

- Spot potential value setups early by checking out these 885 undervalued stocks based on cash flows that align with your return and risk expectations.

- Follow where cutting edge automation and data trends are heading through these 26 AI penny stocks that are already on investors’ watchlists.

- Balance growth ambitions with income potential by reviewing these 12 dividend stocks with yields > 3% that could complement a long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal