Assessing Inspire Medical Systems (INSP) Valuation As Inspire V Lawsuits And Rollout Issues Weigh On Sentiment

What the Inspire V rollout issues mean for Inspire Medical Systems

Inspire Medical Systems (INSP) is under pressure after multiple class action lawsuits and critical investor letters focused on the troubled Inspire V device rollout and the company’s launch communications.

These legal actions and fund exits have put the stock in the spotlight for investors trying to assess how product execution, disclosure practices, and future demand expectations might influence the risk profile of INSP shares.

See our latest analysis for Inspire Medical Systems.

INSP has been volatile, with a 7 day share price return of 7.4% and a 90 day gain of 23.6%. However, a 30 day share price decline of 31.2% and a 1 year total shareholder return of a 53.7% loss suggest momentum has been fading as the Inspire V rollout and lawsuits reshape market expectations.

If the Inspire V headlines have you reassessing healthcare risk, this could be a useful moment to scan healthcare stocks for potential alternatives in the same space.

With the share price down 53.7% over 1 year and the stock trading about 41% below the current analyst price target, the key question for you is whether this legal and execution overhang is an opportunity or simply the market correctly pricing future growth.

Most Popular Narrative: 29.3% Undervalued

With Inspire Medical Systems last closing at $99.03 against a narrative fair value of $140.13, the current price sits well below that estimate, setting up a clear gap between market pricing and the narrative outlook.

The analysts have a consensus price target of $144.533 for Inspire Medical Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $97.0.

Curious what kind of revenue climb, margin shift, and future P/E level need to line up to support that gap between today’s price and the narrative fair value? The answer leans on a specific growth runway, a higher than average earnings multiple, and a discount rate that incorporates all of it into one number. If you want to see exactly how those moving parts connect, the full narrative breaks out the assumptions in detail.

Result: Fair Value of $140.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a real chance that further Inspire V rollout hiccups or shifts in sleep apnea treatment options could challenge these upbeat analyst assumptions.

Find out about the key risks to this Inspire Medical Systems narrative.

Another View: Earnings Multiple Sends A Very Different Signal

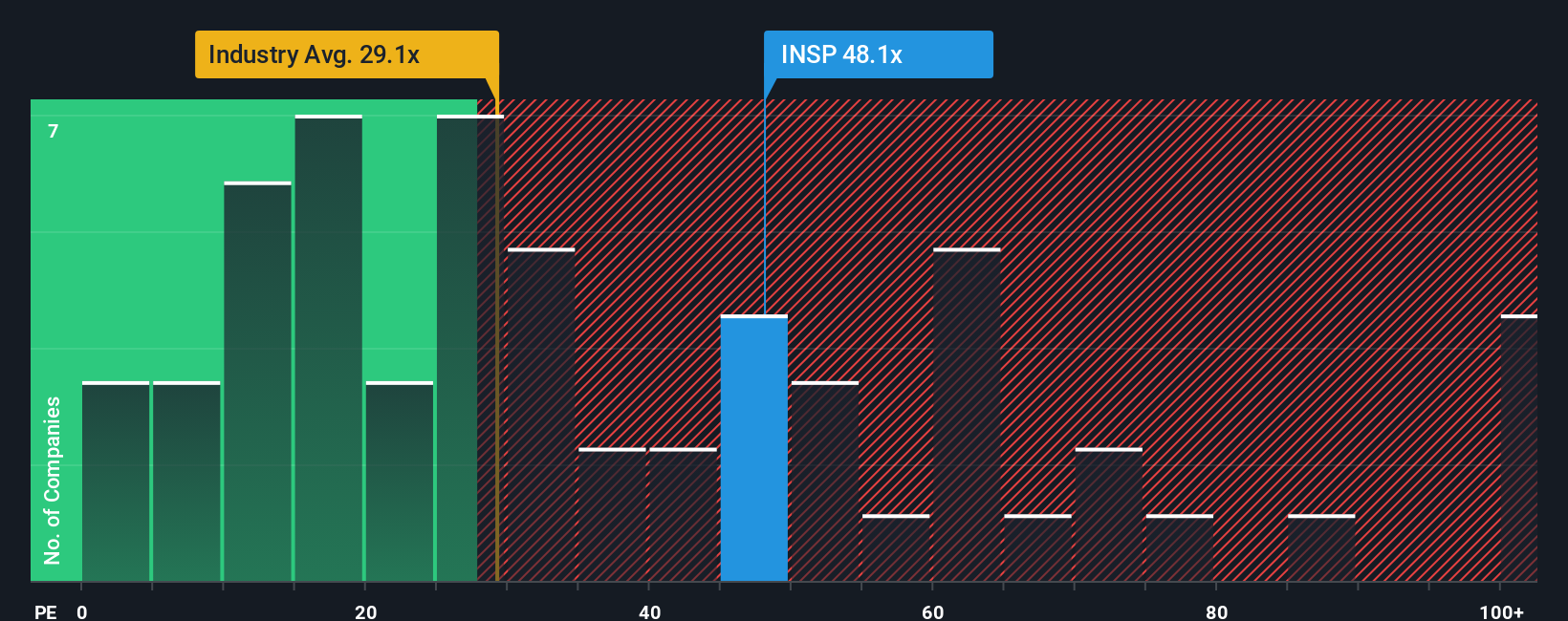

The fair value narrative points to 29.3% undervaluation, but the current price of $99.03 sits on a P/E of 64.6x, versus a fair ratio of 24.4x, the US Medical Equipment industry at 30.7x, and peers at 58.5x. That is a rich premium, which could mean extra valuation risk if sentiment turns or growth expectations ease. Which story do you think is closer to how the market will price INSP over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If parts of this story do not sit right with you, or you prefer to lean on your own work, you can test the numbers, adjust the assumptions, and build a version that reflects your view in just a few minutes with Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next idea?

If INSP has you rethinking your watchlist, do not stop here. The next move you make could matter more than whether you ever buy this stock.

- Target potential mispricings by scanning these 885 undervalued stocks based on cash flows that align with your preferred balance of growth expectations and risk.

- Spot fast changing themes early by checking out these 26 AI penny stocks that sit at the intersection of technology and long term adoption trends.

- Capture income ideas by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside business models you understand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal