A Look At Vodafone Group (LSE:VOD) Valuation After Its Strong Recent Share Price Momentum

Vodafone Group share performance snapshot

Vodafone Group (LSE:VOD) has drawn investor attention recently as its shares show a mix of short and longer term moves, with the stock’s performance and value metrics prompting closer scrutiny.

See our latest analysis for Vodafone Group.

Vodafone Group’s recent 1 month share price return of 9.73% and 3 month return of 20.93% suggest momentum has been picking up, while the 1 year total shareholder return of 62.58% points to a much stronger payoff for investors factoring in dividends.

If Vodafone’s recent move has you looking wider, this could be a good moment to check out high growth tech and AI stocks for other telecom and digital connectivity ideas that may be riding similar themes.

With a 47.67% estimated intrinsic discount but a share price already well ahead over 1 and 3 years, the key question now is whether Vodafone is still mispriced or if the market is already expecting future growth.

Most Popular Narrative Narrative: 15.1% Overvalued

With Vodafone Group’s last close at £1.03 versus a narrative fair value of £0.90, the current price sits above that narrative framework.

The analysts have a consensus price target of £0.858 for Vodafone Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.36, and the most bearish reporting a price target of just £0.6.

Want to see what earnings path and margin rebuild would need to unfold to support that view? The narrative outlines an approach based on steady sales, rising profitability and a rerating in Vodafone’s earnings multiple. Curious how those moving parts add up to the fair value number on your screen?

Result: Fair Value of £0.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including weak recent performance in Germany and execution risk around large restructuring efforts that could derail the current narrative.

Find out about the key risks to this Vodafone Group narrative.

Another View: Multiples Paint a Very Different Picture

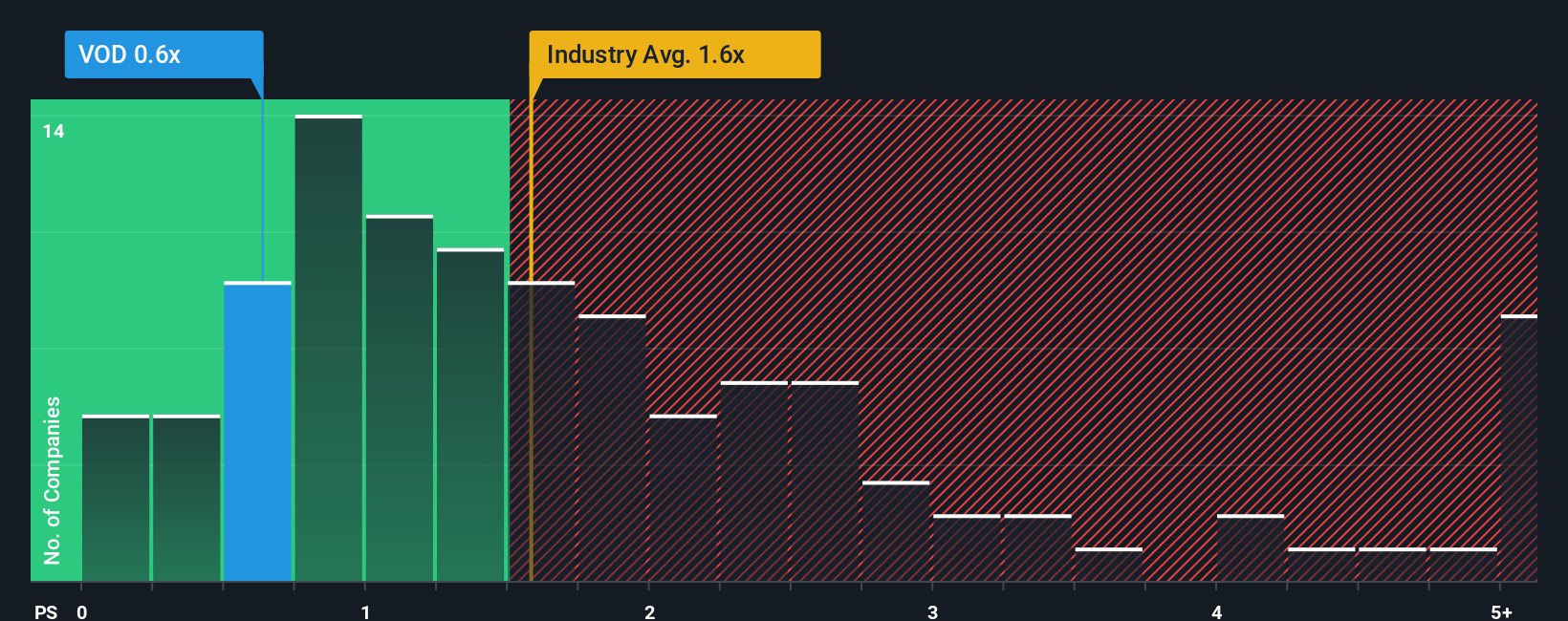

While the analyst narrative frames Vodafone as 15.1% overvalued versus a £0.90 fair value, the simple P/S check reads quite differently. At a P/S of 0.7x versus a fair ratio of 1.6x, the market is pricing Vodafone at less than half the sales multiple our model suggests it could move toward.

That 0.7x is also well below the 1.6x Global Wireless Telecom average and the 2.2x peer average, which points to a clear valuation gap. Is this a genuine opportunity that the narrative framework is missing, or a sign the market still sees real execution and balance sheet risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vodafone Group Narrative

If this storyline does not quite fit how you see Vodafone, you can review the numbers yourself and shape a custom view in minutes: Do it your way.

A great starting point for your Vodafone Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vodafone is already on your radar, do not stop there. Widen your watchlist now so you are not the one hearing about the next idea after it moves.

- Hunt for potential value gaps by scanning these 885 undervalued stocks based on cash flows that might be trading at prices that do not fully reflect their cash flow strength.

- Tap into the AI wave by checking out these 26 AI penny stocks that are building real businesses around artificial intelligence and data driven products.

- Position yourself early in emerging tech by reviewing these 29 quantum computing stocks that are working on quantum computing and next generation hardware.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal