WD-40 (WDFC) Valuation Check As Investors Await Earnings After Mixed Revenue And EBITDA Results

WD-40 (WDFC) is back in focus this week as the company prepares to report earnings on Thursday after the bell, a key moment following last quarter’s mixed revenue and EBITDA outcome.

See our latest analysis for WD-40.

At a share price of $198.98, WD-40 has seen a 6.11% 1 month share price return and a 3.25% 3 month share price return, while its 1 year total shareholder return of 15.14% decline contrasts with a 23.31% gain over three years. This suggests that shorter term momentum has softened ahead of this week’s earnings update.

If this earnings release has you rethinking where growth might come from next, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With WD-40 trading at $198.98 and analysts targeting $264.50, plus earnings on deck, you have to ask yourself: is this a rare chance to buy quality at a discount, or is the market already pricing in future growth?

Most Popular Narrative: 24.8% Undervalued

With WD-40 closing at $198.98 against a narrative fair value of $264.50, the current setup reflects a sizable gap in expectations.

The analysts have a consensus price target of $277.5 for WD-40 based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $721.1 million, earnings will come to $83.6 million, and it would be trading on a PE ratio of 52.5x, assuming you use a discount rate of 6.8%.

Want to see how moderate revenue growth, thinner margins, and a much richer future P/E still line up to a higher fair value? The full narrative unpacks the tension between softer earnings expectations and a premium multiple that is usually reserved for faster growing names.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh risks such as weaker Asia Pacific sales and currency swings, which could pressure both revenue assumptions and those premium P/E expectations.

Find out about the key risks to this WD-40 narrative.

Another View: Multiples Paint a Very Different Picture

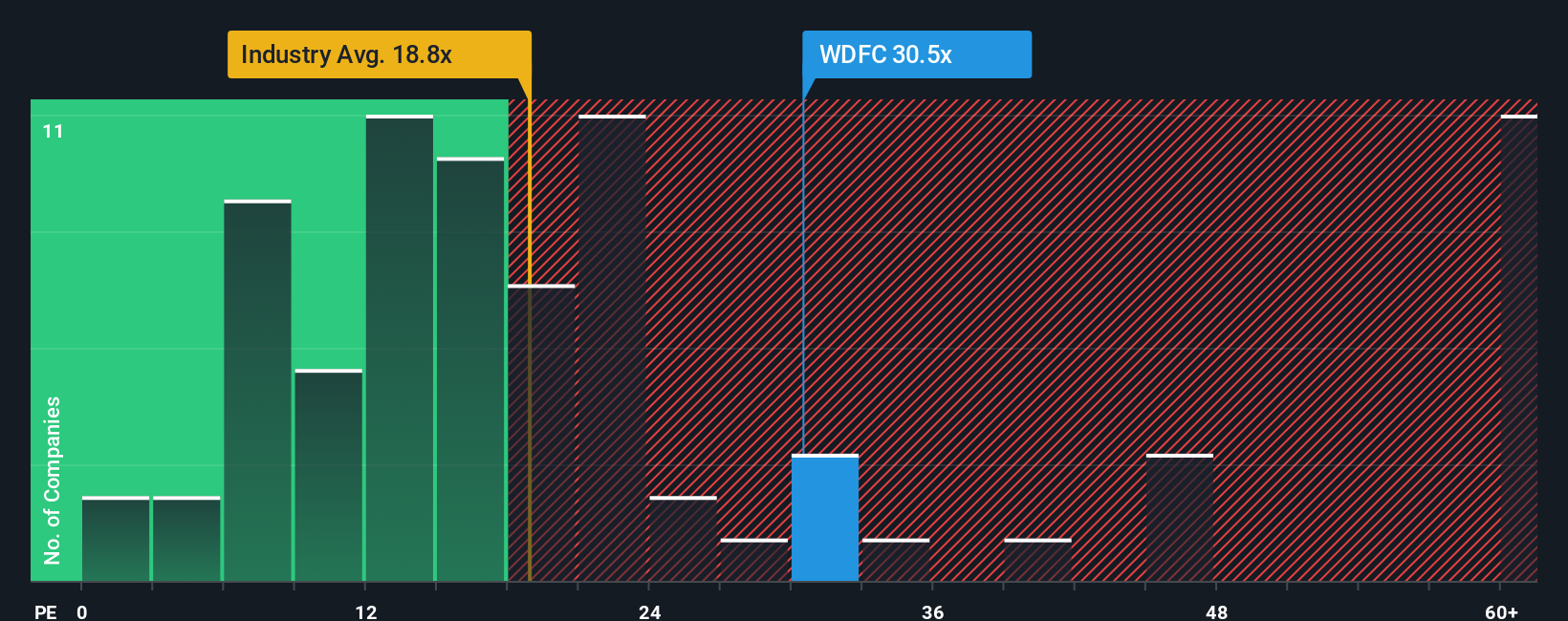

That 24.8% undervaluation story sits awkwardly next to how the market is actually pricing WD-40 today. On a P/E of 29.7x, the shares trade at a strong premium to the Global Household Products industry on 16.4x, the peer average on 12.1x, and even the Simply Wall St fair ratio of 12.5x.

Put simply, the model narrative says underpriced, while the earnings multiple says expensive. Which lens do you trust when the numbers are pulling you in opposite directions?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WD-40 Narrative

If you look at these numbers and come to a different conclusion, or simply prefer to work from your own assumptions and inputs, you can build a custom WD-40 view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WD-40.

Looking for more investment ideas?

If WD-40 has you thinking harder about price versus quality, it is worth lining up a few fresh ideas so you are not caught watching from the sidelines.

- Spot potential value gaps early by scanning these 885 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Tap into powerful tech themes by checking out these 26 AI penny stocks that are building products around artificial intelligence.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal