Why Dassault Aviation (ENXTPA:AM) Is Up 11.6% After Raising 2025 Sales Guidance Above €7 Billion

- In early January 2026, Dassault Aviation société anonyme raised its 2025 net sales guidance to over €7 billion, while also reporting 78,397,034 shares outstanding and 130,565,879 theoretical voting rights as of December 31, 2025.

- This upgraded sales outlook, combined with clarity on the company’s capital and voting structure, gives investors a more detailed picture of Dassault Aviation’s scale and expected commercial activity.

- We’ll now examine how the higher 2025 net sales guidance could influence Dassault Aviation’s existing investment narrative and future expectations.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dassault Aviation société anonyme Investment Narrative Recap

To own Dassault Aviation, you need to believe in sustained demand for its Rafale fighter program and Falcon business jets, supported by execution on a large backlog. The raised 2025 net sales guidance above €7,000,000,000 reinforces the near term revenue picture, but does not remove key risks such as supply chain fragility or potential trade barriers that could still affect deliveries and margins.

Among recent announcements, the reaffirmed 2025 delivery plan of 40 Falcons and 25 Rafales, with implied net sales around €6,500,000,000, is particularly relevant. The subsequent uplift in guidance to more than €7,000,000,000 suggests stronger expected activity against that delivery framework, sharpening focus on whether Dassault can convert its order book into timely, profitable deliveries despite ongoing supply chain and cost pressures.

However, investors should also be aware that persistent supply chain disruption risk could still...

Read the full narrative on Dassault Aviation société anonyme (it's free!)

Dassault Aviation société anonyme's narrative projects €10.6 billion revenue and €1.6 billion earnings by 2028. This requires 16.4% yearly revenue growth and about a €817.9 million earnings increase from €782.1 million today.

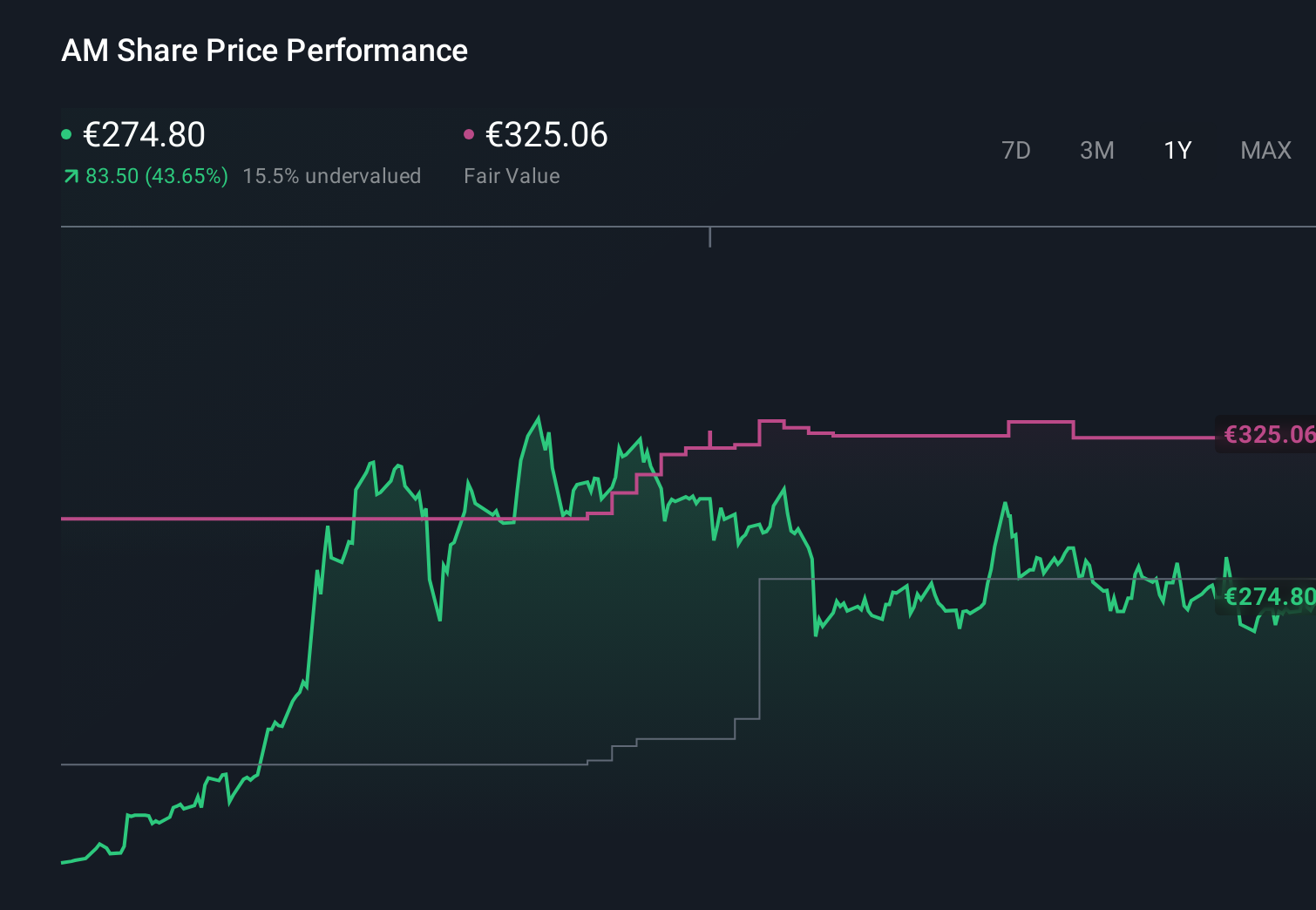

Uncover how Dassault Aviation société anonyme's forecasts yield a €325.06 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community span roughly €243 to €520 per share, showing a wide spread in expectations. Against this backdrop, the upgraded 2025 sales guidance above €7,000,000,000 sits alongside unresolved concerns about supply chain reliability that could influence how these different views play out over time.

Explore 11 other fair value estimates on Dassault Aviation société anonyme - why the stock might be worth as much as 70% more than the current price!

Build Your Own Dassault Aviation société anonyme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dassault Aviation société anonyme research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dassault Aviation société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dassault Aviation société anonyme's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal