Assessing Sandfire Resources (ASX:SFR) Valuation After Record Production And Lower Costs

Why Sandfire Resources Is Back on Investor Radars

Sandfire Resources (ASX:SFR) is attracting attention after record copper equivalent production, lower operating costs across key mines, and a 69% cut in net debt, alongside technical signals pointing to a strong share price uptrend.

See our latest analysis for Sandfire Resources.

The recent production records, cost efficiencies and debt reduction appear to be feeding into strong price momentum, with a 30 day share price return of 12.55% and a one year total shareholder return of 104.41% suggesting interest has been building over both shorter and longer horizons.

If Sandfire’s recent run has you thinking about what else could be gaining traction, it might be worth scanning fast growing stocks with high insider ownership as a starting point for other ideas.

With A$1,189.453 in revenue, A$93.251 in net income, an intrinsic value estimate suggesting a discount, yet a share price above the analyst target, you have to ask: is Sandfire undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 24.2% Overvalued

The most followed narrative places Sandfire’s fair value at A$15.30, below the last close of A$19.01. This sets up a clear valuation gap for investors to weigh.

The fair value estimate has risen slightly from A$14.66 to A$15.30 per share, reflecting a modest uplift in intrinsic valuation.

The discount rate has increased marginally from 7.74% to 7.79%, implying a slightly higher required return on equity.

Curious why a higher fair value still points to downside from today’s price? Revenue, margins and the future earnings multiple all pull in different directions.

Result: Fair Value of A$15.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher unit costs and lumpy capital spending could squeeze margins and free cash flow, which may challenge the upbeat earnings assumptions built into today’s valuation.

Find out about the key risks to this Sandfire Resources narrative.

Another Angle on Value: Earnings Multiple vs Fair Ratio

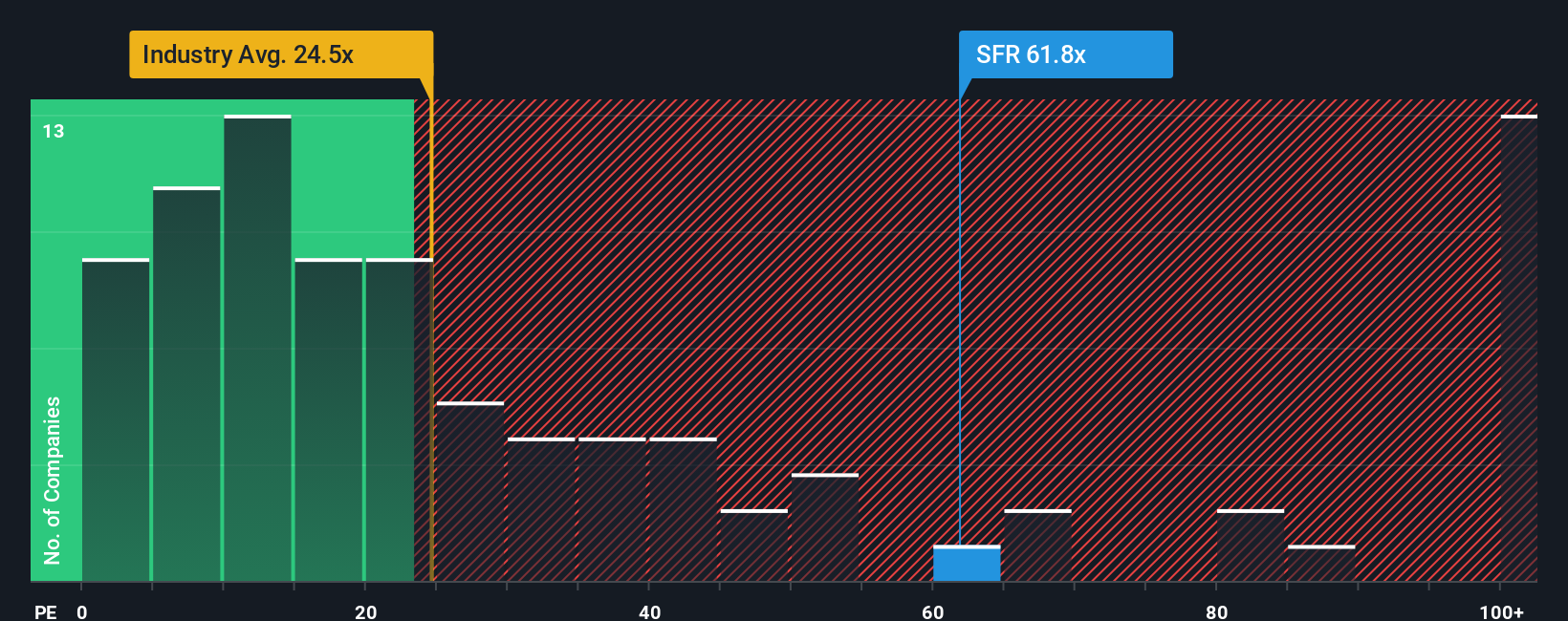

On earnings, Sandfire screens as expensive. Its current P/E of 63.5x is much higher than the Australian Metals and Mining average of 24x, the peer average of 23.2x, and the estimated fair ratio of 28.4x, which the market could eventually move toward.

That gap suggests a lot of optimism is already reflected in the price, with less room for disappointment if growth or margins fall short. If sentiment cools, could the share price drift closer to that fair ratio, or do you think the premium will hold?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandfire Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandfire Resources Narrative

If you see the numbers differently or simply prefer to run your own checks, you can build a tailored view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sandfire Resources.

Looking for more investment ideas?

If Sandfire has sharpened your focus, do not stop here. Use the Simply Wall St Screener to spot other opportunities before they move without you.

- Zero in on potential value opportunities by checking out these 885 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride major tech shifts early by scanning these 26 AI penny stocks that are tied to artificial intelligence themes.

- Target income-focused opportunities with these 12 dividend stocks with yields > 3% that offer yields above 3% while you assess their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal