A Look At Kinsale Capital Group (KNSL) Valuation After Recent Share Pullback And Ongoing Performance Scrutiny

Executive share grant and recent pullback put Kinsale in focus

Kinsale Capital Group (KNSL) has attracted fresh attention after its share price pullback and a new equity grant of 460 restricted shares to its president and COO, which vests after one year of service.

See our latest analysis for Kinsale Capital Group.

The recent pullback, including a 16.35% 3 month share price return and a 1 year total shareholder return decline of 5.43%, comes after a strong 3 year total shareholder return of 40.95% and 5 year total shareholder return of 87.59%. This suggests longer term momentum but more cautious near term sentiment, even with the share price at $398.46 and a 30 day share price return of 12.37%.

If this kind of executive alignment catches your eye, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With Kinsale trading at $398.46, sitting at a 24.57% intrinsic discount and 14.59% below the current analyst price target, you have to ask: is there real value here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 13.6% Undervalued

With Kinsale Capital Group’s fair value in the most followed narrative sitting at $461 against a last close of $398.46, the story centers on earnings strength and what investors are willing to pay for it.

The analysts have a consensus price target of $499.111 for Kinsale Capital Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $560.0, and the most bearish reporting a price target of just $448.0.

Curious how a relatively modest revenue growth outlook and slightly lower future margins still support a premium P/E multiple and higher fair value? The full narrative explains the earnings path, valuation multiple and discount rate that need to align for this $461 figure to make sense.

Result: Fair Value of $461 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if competition continues to pressure commercial property premiums or if catastrophe exposed homeowners lines experience heavier than expected losses.

Find out about the key risks to this Kinsale Capital Group narrative.

Another View: Richer Multiple Puts Pressure On The Story

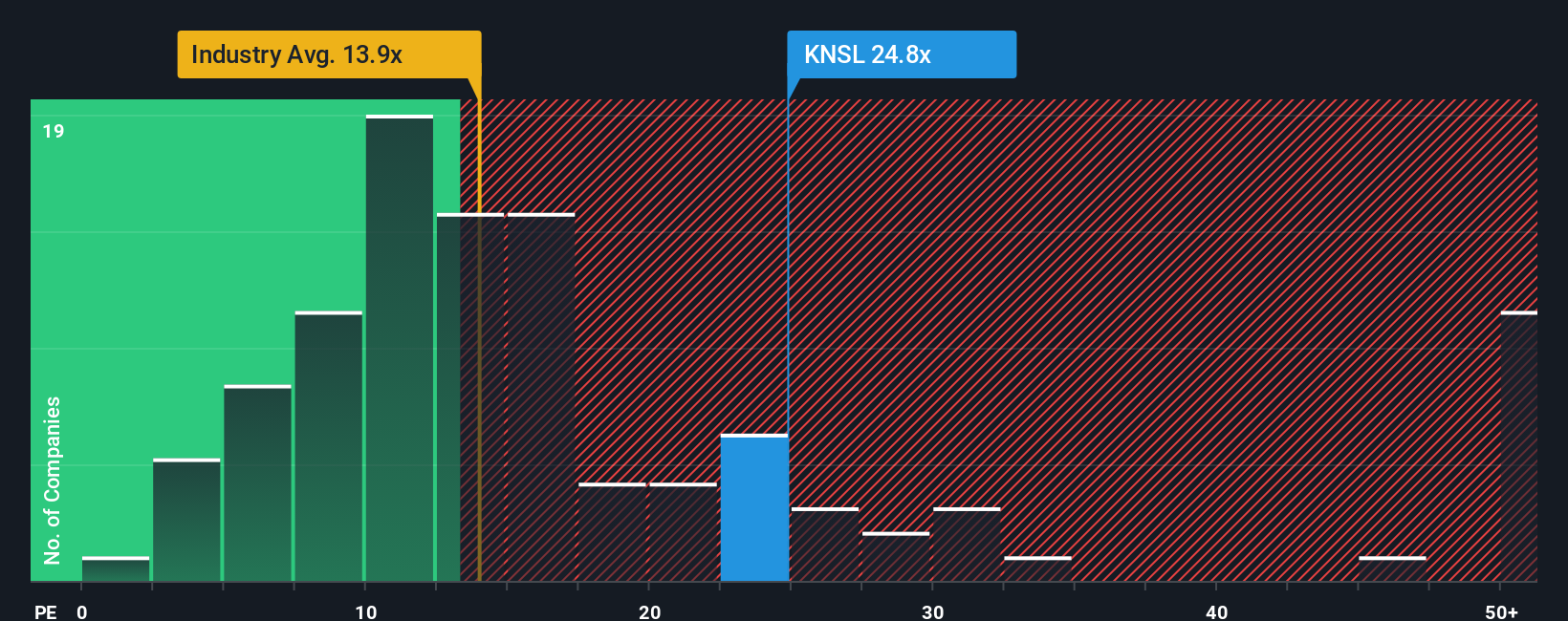

While the narrative and fair value work suggest upside, the current P/E of 19.6x stands above both the US Insurance industry at 12.9x and the peer average at 18.3x. It also sits well above the fair ratio of 13.2x. That kind of gap can point to valuation risk if sentiment cools.

The big question for you is whether Kinsale’s quality and growth outlook justify that premium, or whether the share price could drift toward that lower fair ratio over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

If you look at the numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a tailored view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for more investment ideas?

If Kinsale has sparked your interest, do not stop here. Broaden your watchlist now so you are not hearing about the next opportunity after it has moved.

- Spot potential mispricing by scanning these 885 undervalued stocks based on cash flows that appear cheap relative to their cash flows and could warrant a closer look.

- Tap into long term themes with these 26 AI penny stocks that are tied to artificial intelligence and could reshape how entire industries operate.

- Add income angles to your research by filtering for these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal