ALMAC Co., Ltd.'s (KOSDAQ:354320) P/S Is Still On The Mark Following 31% Share Price Bounce

ALMAC Co., Ltd. (KOSDAQ:354320) shareholders have had their patience rewarded with a 31% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

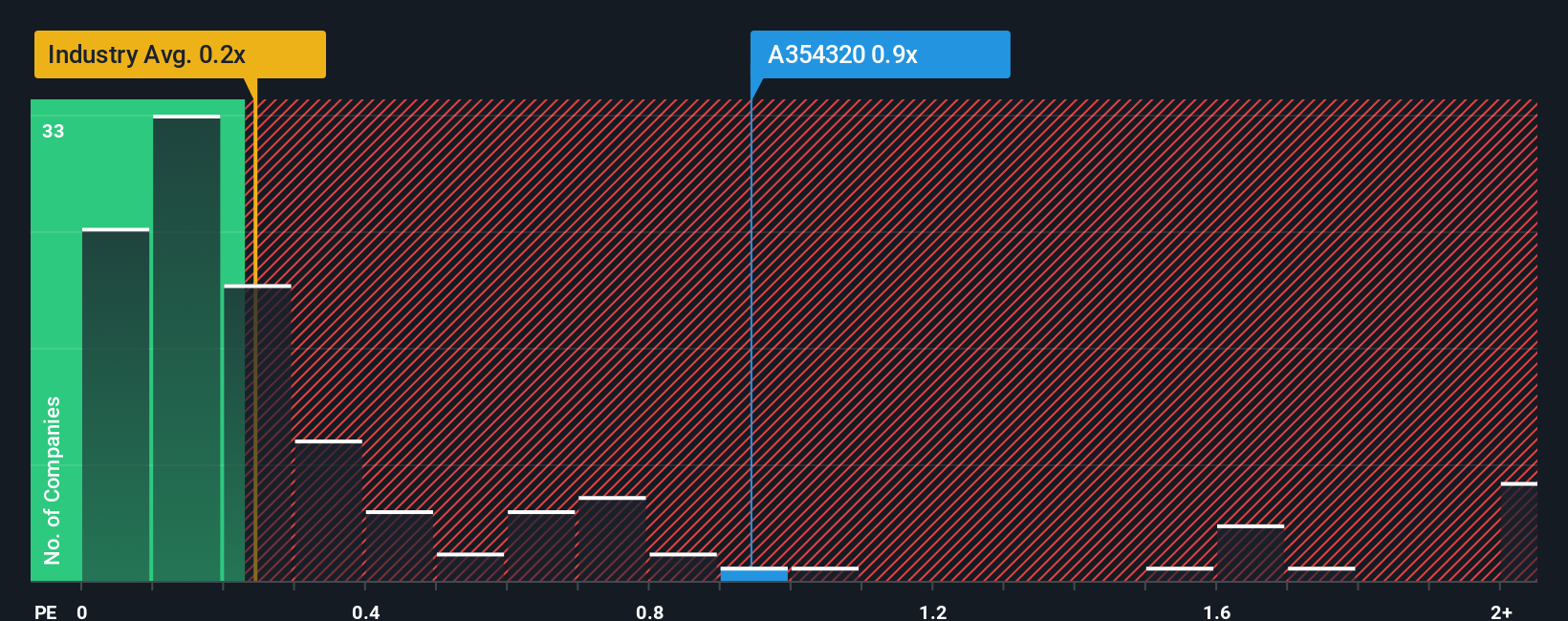

Following the firm bounce in price, when almost half of the companies in Korea's Auto Components industry have price-to-sales ratios (or "P/S") below 0.2x, you may consider ALMAC as a stock probably not worth researching with its 0.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ALMAC

How ALMAC Has Been Performing

Recent times haven't been great for ALMAC as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think ALMAC's future stacks up against the industry? In that case, our free report is a great place to start.How Is ALMAC's Revenue Growth Trending?

ALMAC's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 8.3% gain to the company's revenues. The latest three year period has also seen a 15% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 17% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 8.6%, which is noticeably less attractive.

In light of this, it's understandable that ALMAC's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

ALMAC shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into ALMAC shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with ALMAC.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal