Assessing Tyson Foods (TSN) Valuation As Recent Share Moves Contrast With Earnings Multiple Signals

Tyson Foods (TSN) has been drawing attention after recent share price moves, with the stock showing mixed returns over the past week, month, and past 3 months as investors reassess expectations.

See our latest analysis for Tyson Foods.

Looking beyond the latest pullback, Tyson Foods’ 90 day share price return of 6.77% contrasts with a year to date share price decline of 3.57%, while the 1 year total shareholder return of 4.28% points to modestly improving sentiment.

If recent moves in Tyson have you reassessing your watchlist, it could be a good time to widen your research and check out fast growing stocks with high insider ownership.

With Tyson trading at $55.97 and sitting at what is described as roughly a 40% intrinsic discount, and below the average analyst price target, the key question is whether this signals a genuine opportunity or if the market is already factoring in future growth.

Most Popular Narrative: 10.7% Undervalued

With Tyson Foods’ fair value estimate of $62.67 sitting above the last close at $55.97, the most followed narrative points to a valuation gap that hinges on expectations for earnings strength and margin recovery.

The analysts have a consensus price target of $63.091 for Tyson Foods based on their views regarding its future earnings, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the highest price target at $80.0 and the lowest at $55.0.

Curious what sits behind that fair value uplift? Revenue projections, margin rebuild and a re-rated earnings multiple all play a part, but the exact mix might surprise you.

Result: Fair Value of $62.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value uplift could be challenged if cattle supply constraints keep Beef segment earnings under pressure, or if raw material cost inflation squeezes Prepared Foods margins again.

Find out about the key risks to this Tyson Foods narrative.

Another View: Multiples Paint A Very Different Picture

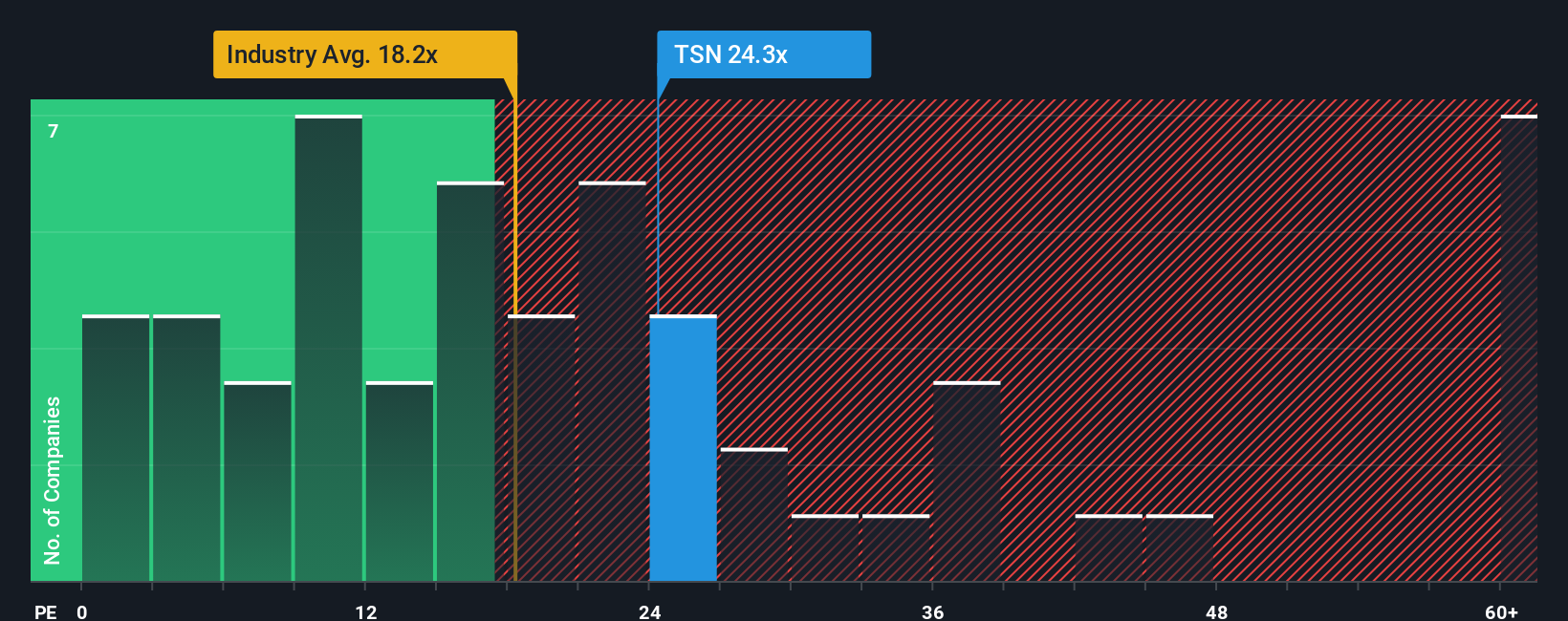

Those fair value estimates suggesting Tyson Foods is undervalued sit alongside a very different signal from its current P/E of 41.7x. That is more than double the US Food industry average of 19.7x, well above peers at 16.4x, and ahead of a fair ratio of 28.6x.

In plain terms, the market is already asking you to pay a premium multiple for earnings today, despite mixed growth and margin history. That gap could point to valuation risk rather than a clear discount. The real question is which story you trust more: the earnings multiple or the fair value models?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to stress test the data yourself, you can build a custom Tyson view in just a few minutes with Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Tyson has sharpened your focus on valuation and risk, do not stop here. Broaden your watchlist with a few targeted idea generators built for stock pickers.

- Spot potential turnaround stories early by scanning these 3557 penny stocks with strong financials that already show stronger financial foundations than many expect at this price range.

- Zero in on companies tied to artificial intelligence tailwinds through these 26 AI penny stocks and see which names match your view on future earnings drivers.

- Hunt for price dislocations with these 876 undervalued stocks based on cash flows that highlight businesses where cash flow based models suggest a gap between current price and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal