Assessing AAON (AAON) Valuation After Strong Revenue Growth And Earnings Beat

AAON (AAON) has attracted fresh attention after reporting 17.4% year on year revenue growth and beating analyst estimates on both revenue and earnings, highlighting share gains, margin improvement, and continued operational progress.

See our latest analysis for AAON.

At a share price of $81.67, AAON’s 7 day share price return of 3.88% sits against a 30 day share price decline of 6.69% and a 90 day share price decline of 20.28%. The 1 year total shareholder return of 31.88% decline contrasts with a 3 year total shareholder return of 64.17% and 5 year total shareholder return of 76.02%. This suggests longer term holders have still seen substantial gains even as recent momentum has cooled around the time of its strong quarterly update and expanded credit facility.

If AAON’s recent earnings beat has you rethinking your watchlist, this could be a good moment to broaden your search with aerospace and defense stocks.

With revenue and net income growth in double digits, a share price well below the average analyst target, and an estimated intrinsic discount, you have to ask yourself: is AAON undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 29.1% Undervalued

AAON’s most followed narrative pegs fair value at US$115.25 versus the last close of US$81.67, setting up a clear gap for investors to assess.

Ongoing investments in new manufacturing capacity and automation (e.g., the Memphis facility) are expected to nearly double BasX capacity by year-end, removing current operational constraints and shifting from near-term cost drag to profit contribution by 2026 as orders ramp, supporting long-term operating leverage. (Impacts margins and earnings)

Curious what kind of revenue trajectory and margin profile need to materialize to justify that fair value gap, and what earnings multiple anchors the story? The most popular narrative lays out a full set of growth, profitability, and valuation assumptions that connect AAON’s current price to that US$115.25 figure. Want to see exactly how those moving parts fit together?

Result: Fair Value of $115.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on AAON managing ERP rollout hiccups and cash-hungry capacity expansions, which could squeeze margins and delay the earnings path behind that fair value story.

Find out about the key risks to this AAON narrative.

Another View: Multiples Paint a Very Different Picture

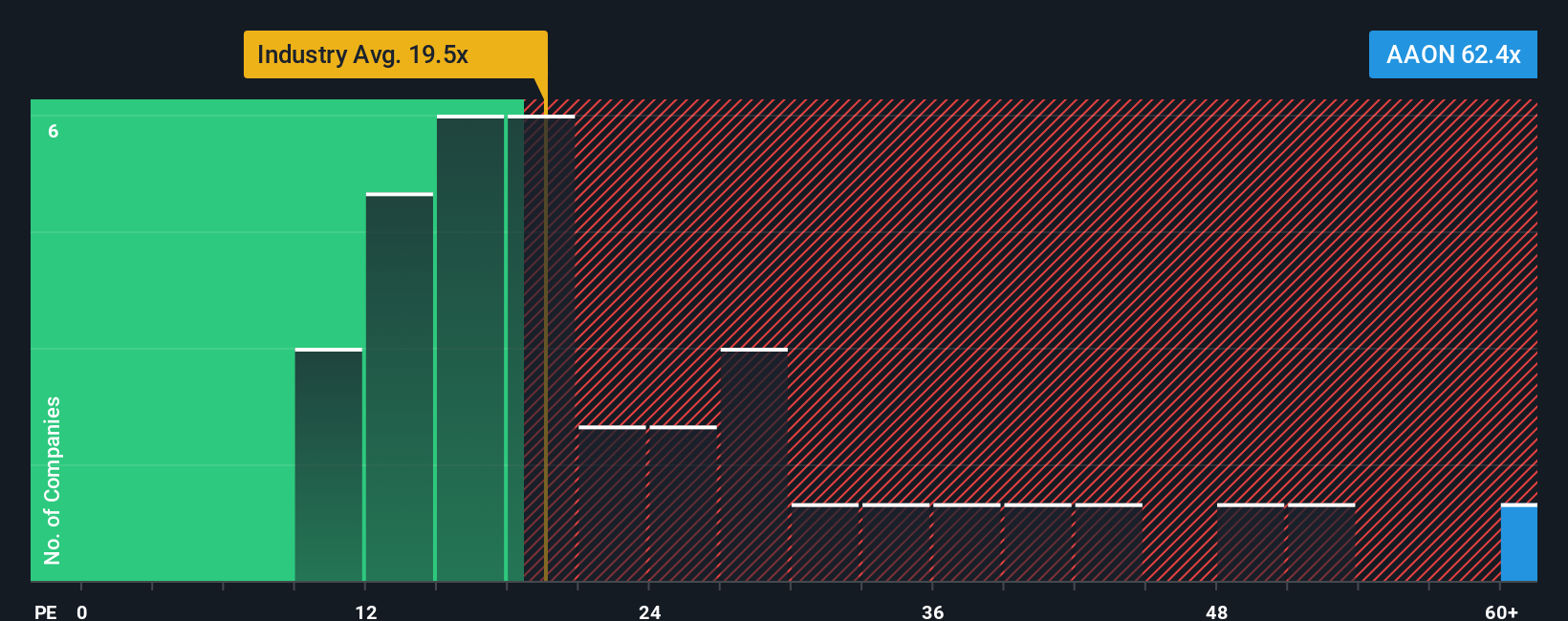

That 29.1% discount to fair value sits awkwardly next to AAON’s current P/E of 66.4x. This is far above the US Building industry at 19.8x, the peer average at 28.3x, and even its own fair ratio of 43.4x. That gap points to valuation risk rather than clear upside, so which signal would you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAON Narrative

If you see AAON’s story differently, or want to evaluate the assumptions yourself, you can create a custom narrative in minutes with Do it your way.

A great starting point for your AAON research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If AAON has sharpened your thinking, do not stop here. Widen your watchlist with a few focused stock ideas that match the kind of opportunities you care about.

- Target potential mispricings by scanning these 876 undervalued stocks based on cash flows that combine strong cash flow support with prices that may not fully reflect their fundamentals.

- Explore advances in machine learning and automation by zeroing in on these 26 AI penny stocks positioned at the heart of real world AI applications.

- Look for potential income streams by filtering for these 11 dividend stocks with yields > 3% that might offer more reliable yield than leaving cash idle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal