A Look At WisdomTree (WT) Valuation As Analyst Optimism Builds Around Its Growth Profile

Recent analyst coverage has put WisdomTree (WT) in focus after highlighting its 17.4% annual revenue growth and 57.1% annual earnings per share growth over the past two years, alongside projections for additional double-digit expansion.

See our latest analysis for WisdomTree.

At a share price of $13.66, WisdomTree has seen short term momentum build, with a 1 month share price return of 18.89% and year to date share price return of 9.19%. Its 1 year total shareholder return of 41.36% and 5 year total shareholder return of 181.43% point to longer term compounding alongside recent enthusiasm around its growth profile and ETF franchise.

If WisdomTree’s recent run has you thinking about other opportunities, this could be a moment to widen your search with fast growing stocks with high insider ownership.

With the shares at $13.66 and analyst targets implying some upside, plus strong recent returns already on the board, the key question now is whether WisdomTree still offers a mispriced opportunity or if the market is already factoring in that growth.

Most Popular Narrative: 7.7% Undervalued

The most followed narrative currently points to a fair value of about $14.79 per share versus the last close at $13.66, framing WisdomTree as modestly mispriced while hinging that view on specific growth and margin assumptions.

The continued global shift from active to passive investing remains a powerful driver for WisdomTree's core ETF business, as evidenced by broad-based net inflows, growing international scale, and record AUM, which should translate to higher revenue and improved operating leverage.

Curious what kind of revenue climb and margin reset are baked into that tag of value, and how the future P/E is expected to compress from here? The most followed narrative ties those expectations into a detailed path for earnings and profitability that might surprise you.

Result: Fair Value of $14.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the chance that fee compression across ETFs or slower traction in digital and tokenized products could keep margins and earnings below what this narrative assumes.

Find out about the key risks to this WisdomTree narrative.

Another View: SWS DCF Flags a Richer Price

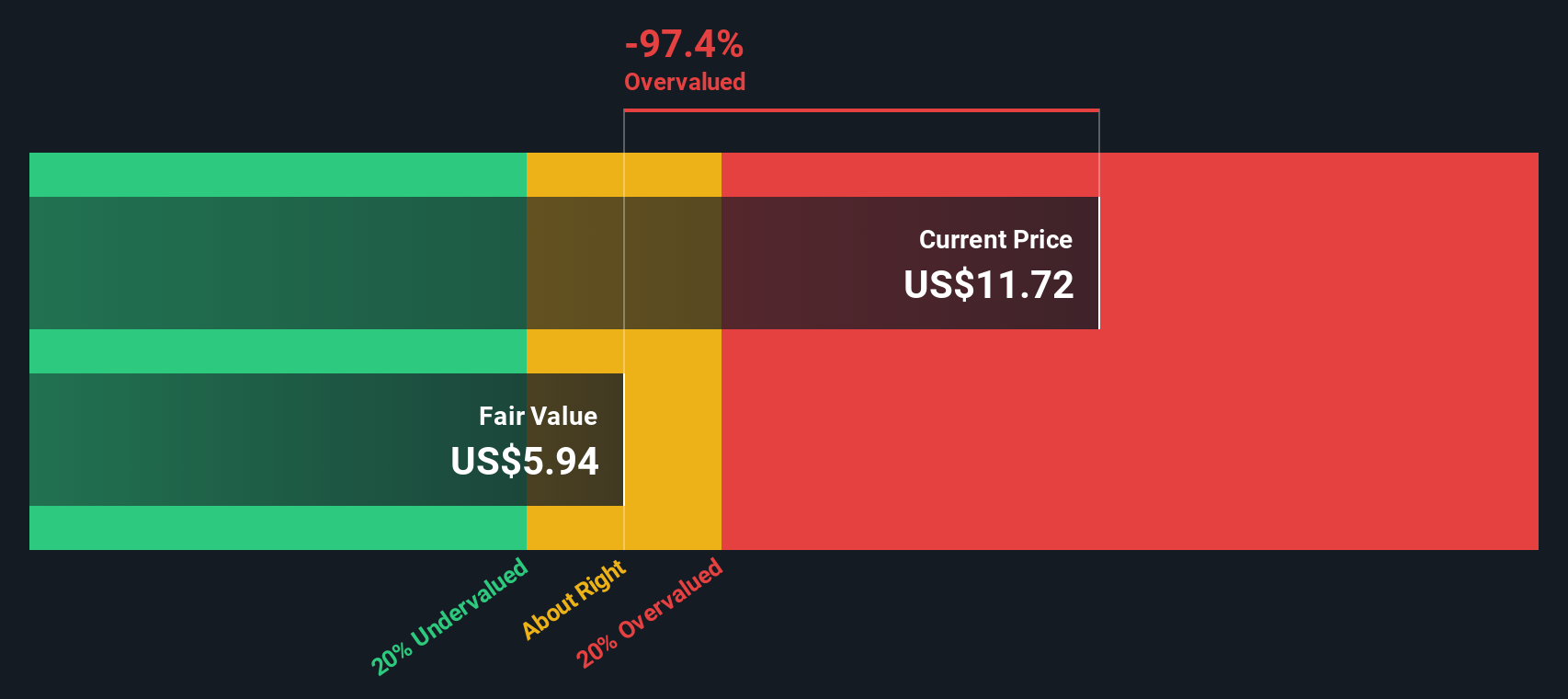

There is a very different read when you look at our DCF model. On that basis, WisdomTree’s fair value is $6.20 per share, while the stock trades at $13.66. That gap suggests limited margin for error if the growth or margin story falls short. Which narrative do you think feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WisdomTree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WisdomTree Narrative

If you are not fully on board with either of these views, or you simply prefer to interrogate the numbers yourself, you can build a custom thesis in minutes with Do it your way.

A great starting point for your WisdomTree research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If WisdomTree is on your radar, do not stop there. Broaden your watchlist with a few focused stock ideas that could sharpen your next move.

- Spot potential mispricings early by running your filters across these 876 undervalued stocks based on cash flows, where price and fundamentals sit side by side.

- Zero in on growth stories at the edge of mainstream attention with these 3557 penny stocks with strong financials that already show solid financial underpinnings.

- Position yourself ahead of emerging trends by scanning these 29 healthcare AI stocks that link data science with real world medical applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal