How Investors Are Reacting To Power Corporation of Canada (TSX:POW) After IGM’s Rebound in Fund Flows

- In late 2025, IGM Financial, a key Power Corporation of Canada subsidiary, reported total assets under management and advisement of CA$310.10 billion, up 14.7% year over year, alongside CA$310.00 million of net inflows in December that reversed prior outflows.

- This rebound in fund flows, coupled with record December sales at IG Wealth Management, has reinforced investor confidence in Power Corporation of Canada’s underlying wealth platforms and their contribution to group stability.

- We’ll now examine how IGM Financial’s renewed inflows and operational momentum could influence Power Corporation of Canada’s broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

Power Corporation of Canada Investment Narrative Recap

To own Power Corporation of Canada, you need to be comfortable with a diversified financial holding company whose fortunes are closely tied to the execution of core subsidiaries like IGM Financial and Great West Lifeco. IGM’s strong December assets and inflows support the near term catalyst of stable fee income, but they do not remove the key risk that regulatory or business pressure in wealth and insurance could still weigh on group earnings.

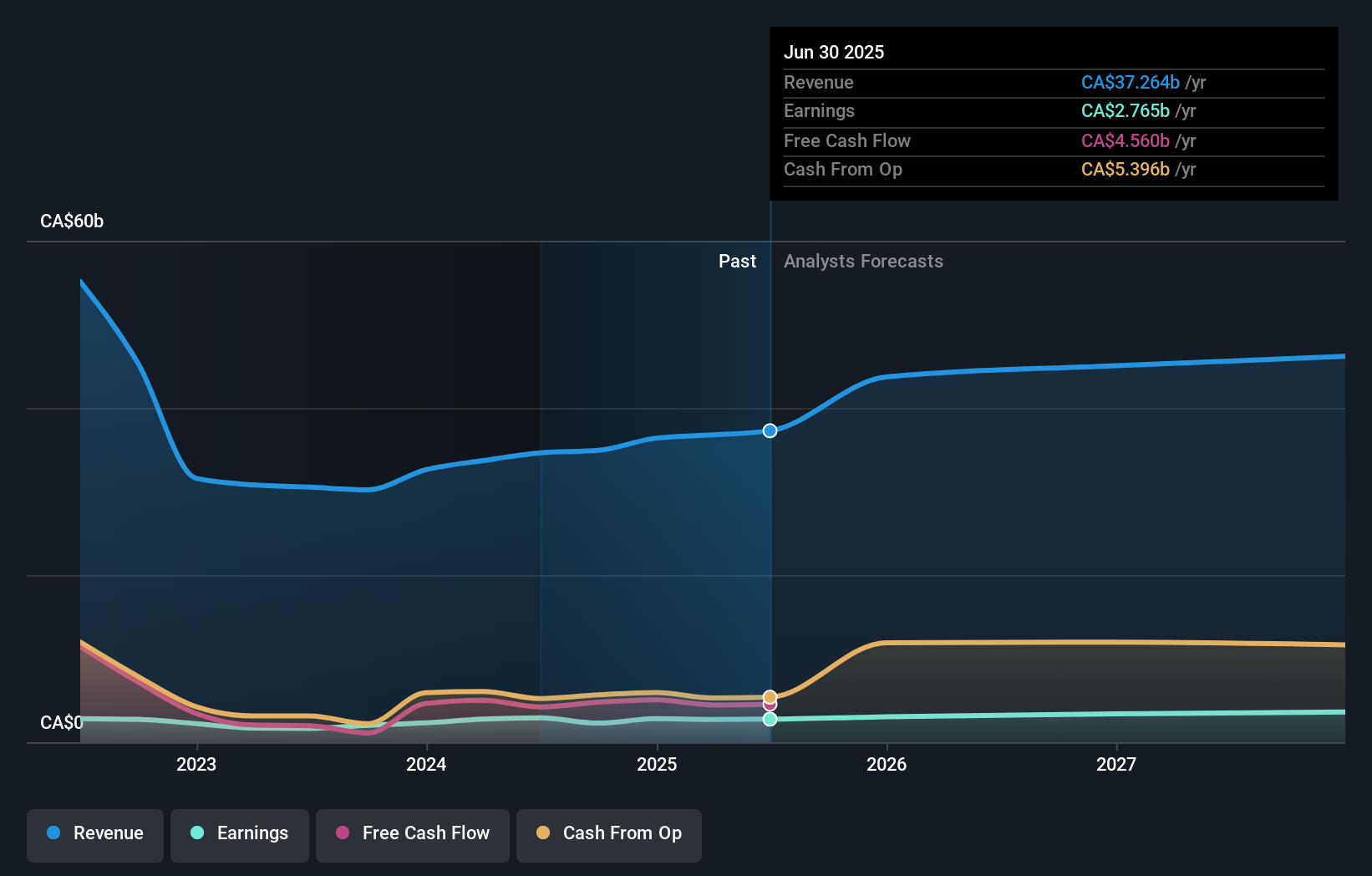

The most relevant recent announcement in this context is Power Corporation’s Q3 2025 result, where net income rose to CA$716 million and nine month earnings also improved year over year. Combined with continuing share buybacks and a reaffirmed dividend, this underlines how subsidiaries like IGM feed into group level cash generation and supports the view that consistent execution at these businesses remains central to the investment case.

Yet, even with healthier flows at IGM, investors should be aware of how concentrated Power’s long term earnings are in just a few core subsidiaries and...

Read the full narrative on Power Corporation of Canada (it's free!)

Power Corporation of Canada's narrative projects CA$47.0 billion revenue and CA$3.5 billion earnings by 2028. This requires 8.1% yearly revenue growth and about a CA$0.7 billion earnings increase from CA$2.8 billion today.

Uncover how Power Corporation of Canada's forecasts yield a CA$62.50 fair value, a 16% downside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community value Power Corporation between CA$56.44 and CA$93.33 per share, highlighting very different expectations for upside. When you set those views against the reliance on Great West Lifeco and IGM Financial for most of the group’s earnings, it becomes clear why comparing multiple perspectives can be helpful before forming your own view.

Explore 4 other fair value estimates on Power Corporation of Canada - why the stock might be worth 24% less than the current price!

Build Your Own Power Corporation of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Corporation of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Power Corporation of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Corporation of Canada's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal