3 Asian Dividend Stocks Yielding Up To 4.8%

As Asian markets navigate a landscape marked by mixed economic signals and cautious optimism, investors are increasingly turning their attention to dividend stocks as a reliable income source. In this context, identifying stocks with strong fundamentals and consistent dividend yields can provide stability amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 3.60% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.86% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.63% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.48% | ★★★★★★ |

Click here to see the full list of 994 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Coal Energy (SEHK:1898)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited engages in the mining, production, processing, trading, and sale of coal both within the People’s Republic of China and internationally, with a market cap of HK$183.90 billion.

Operations: China Coal Energy Company Limited generates revenue through its activities in mining, producing, processing, trading, and selling coal within China and on the international market.

Dividend Yield: 4.3%

China Coal Energy's dividend payments have been volatile over the past decade, with a payout ratio of 32.7% indicating dividends are well-covered by earnings, though cash flow coverage is higher at 84.2%. Despite being valued below its estimated fair value, the dividend yield of 4.32% is lower than top-tier Hong Kong market payers. Recent sales and production data show mixed results across coal and chemical products, reflecting operational challenges amidst leadership changes with the resignation of its president in November 2025.

- Take a closer look at China Coal Energy's potential here in our dividend report.

- Upon reviewing our latest valuation report, China Coal Energy's share price might be too pessimistic.

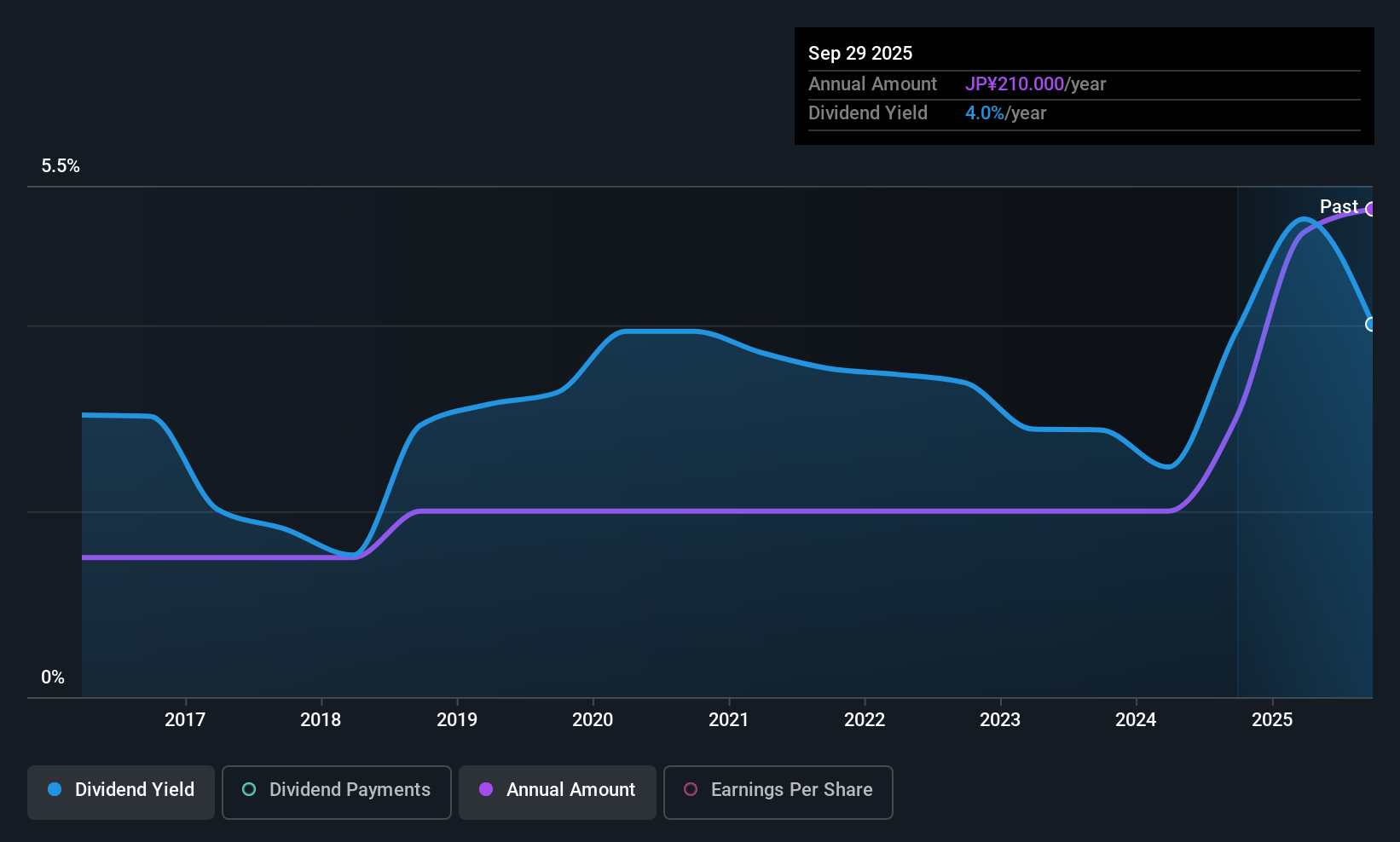

Tokyo Printing Ink Mfg (TSE:4635)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokyo Printing Ink Mfg. Co., Ltd. is a Japanese company that manufactures and sells specialty chemicals, with a market cap of ¥19.53 billion.

Operations: Tokyo Printing Ink Mfg. Co., Ltd.'s revenue is primarily derived from its Chemical Products Business at ¥23.49 billion, followed by the Ink Business at ¥17.81 billion, and the Processed Products Business at ¥7.53 billion, with additional income from Real Estate Leasing amounting to ¥90 million.

Dividend Yield: 3.1%

Tokyo Printing Ink Mfg. Co., Ltd. offers a stable dividend profile with consistent payments over the past decade, supported by a low payout ratio of 40.6%, ensuring dividends are well-covered by earnings and cash flows. Despite recent guidance projecting JPY 47.3 billion in net sales for fiscal year ending March 2026, the dividend yield of 3.11% remains below top-tier Japanese market payers, though its valuation suggests potential undervaluation at current trading levels.

- Navigate through the intricacies of Tokyo Printing Ink Mfg with our comprehensive dividend report here.

- Our valuation report here indicates Tokyo Printing Ink Mfg may be undervalued.

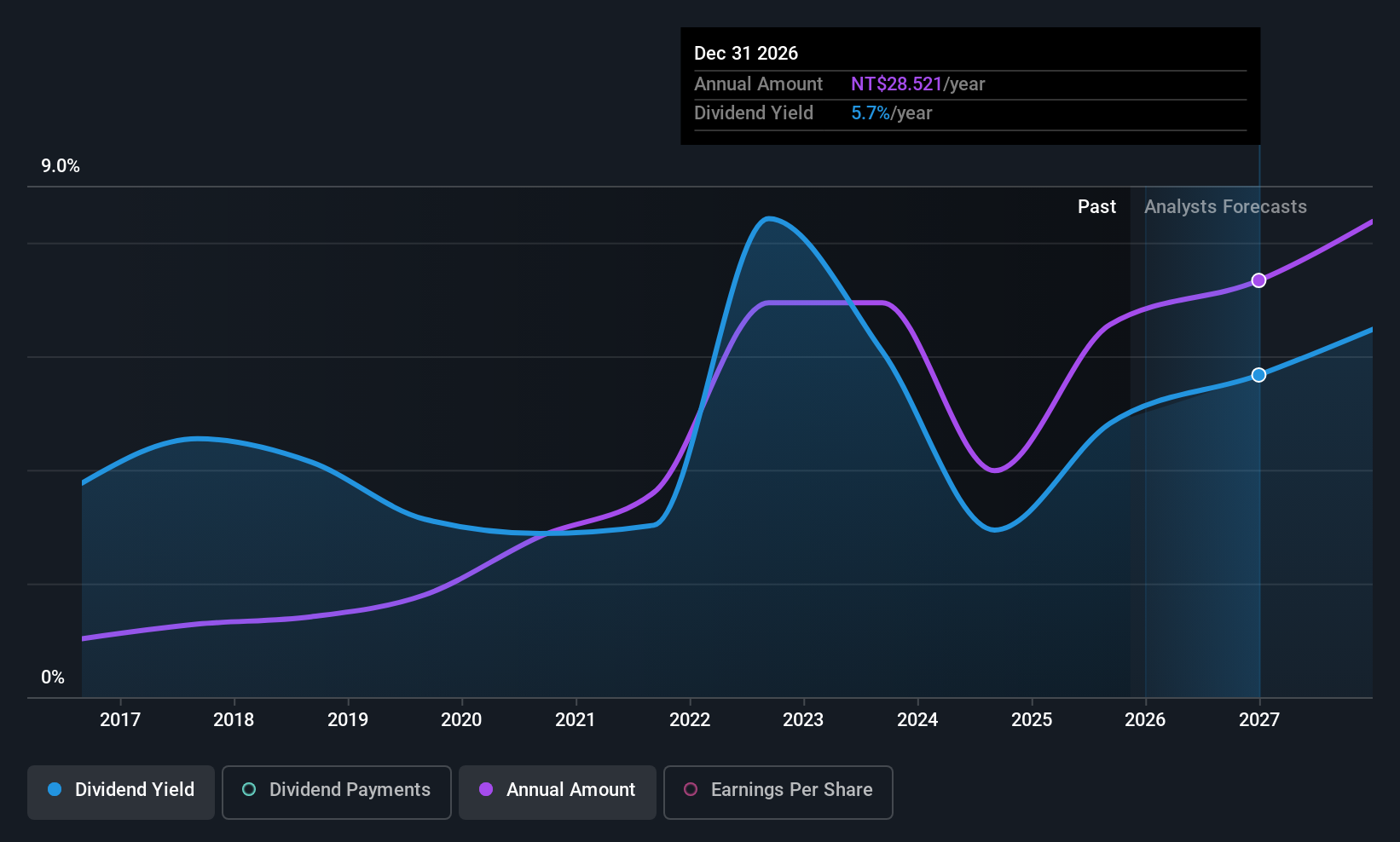

Realtek Semiconductor (TWSE:2379)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Realtek Semiconductor Corp., along with its subsidiaries, focuses on the research, development, production, and sale of integrated circuits and related application software across Taiwan, Asia, and globally; it has a market cap of NT$271.82 billion.

Operations: Realtek Semiconductor Corp.'s revenue primarily comes from its microcircuit and related application software segment, generating NT$122.77 billion.

Dividend Yield: 4.8%

Realtek Semiconductor's dividend profile is mixed, with a payout ratio of 84.4% indicating dividends are covered by earnings, though payments have been volatile over the past decade. The recent strategic alliance with AONDevices could enhance future revenue streams, potentially stabilizing dividends. Despite a lower yield compared to top Taiwanese payers, its valuation appears attractive with a P/E ratio of 17.5x below the market average, suggesting potential value for investors focusing on growth prospects alongside dividends.

- Click here to discover the nuances of Realtek Semiconductor with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Realtek Semiconductor's current price could be quite moderate.

Turning Ideas Into Actions

- Investigate our full lineup of 994 Top Asian Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal