Asian Market Value Stock Picks Featuring WuXi XDC Cayman And Two More

As the Asian markets navigate a complex landscape marked by mixed performances and cautious economic optimism, investors are increasingly on the lookout for opportunities in undervalued stocks. In this context, identifying stocks that offer strong fundamentals and potential for growth can be particularly rewarding, as exemplified by companies like WuXi XDC Cayman and others poised to capitalize on these conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WuXi XDC Cayman (SEHK:2268) | HK$68.50 | HK$135.26 | 49.4% |

| Visional (TSE:4194) | ¥10040.00 | ¥19790.82 | 49.3% |

| Suzhou Zelgen Biopharmaceuticals (SHSE:688266) | CN¥99.90 | CN¥199.49 | 49.9% |

| Sino Medical Sciences Technology (SHSE:688108) | CN¥21.89 | CN¥43.45 | 49.6% |

| PeptiDream (TSE:4587) | ¥1738.00 | ¥3437.58 | 49.4% |

| Kuraray (TSE:3405) | ¥1619.00 | ¥3157.04 | 48.7% |

| Fositek (TWSE:6805) | NT$1405.00 | NT$2741.10 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥797.00 | ¥1580.29 | 49.6% |

| ASE Technology Holding (TWSE:3711) | NT$275.00 | NT$540.37 | 49.1% |

| Andes Technology (TWSE:6533) | NT$247.00 | NT$481.04 | 48.7% |

Let's explore several standout options from the results in the screener.

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization across China, North America, Europe, and internationally with a market cap of HK$85.97 billion.

Operations: WuXi XDC Cayman Inc. generates revenue primarily from its Pharmaceuticals segment, which amounted to CN¥5.09 billion.

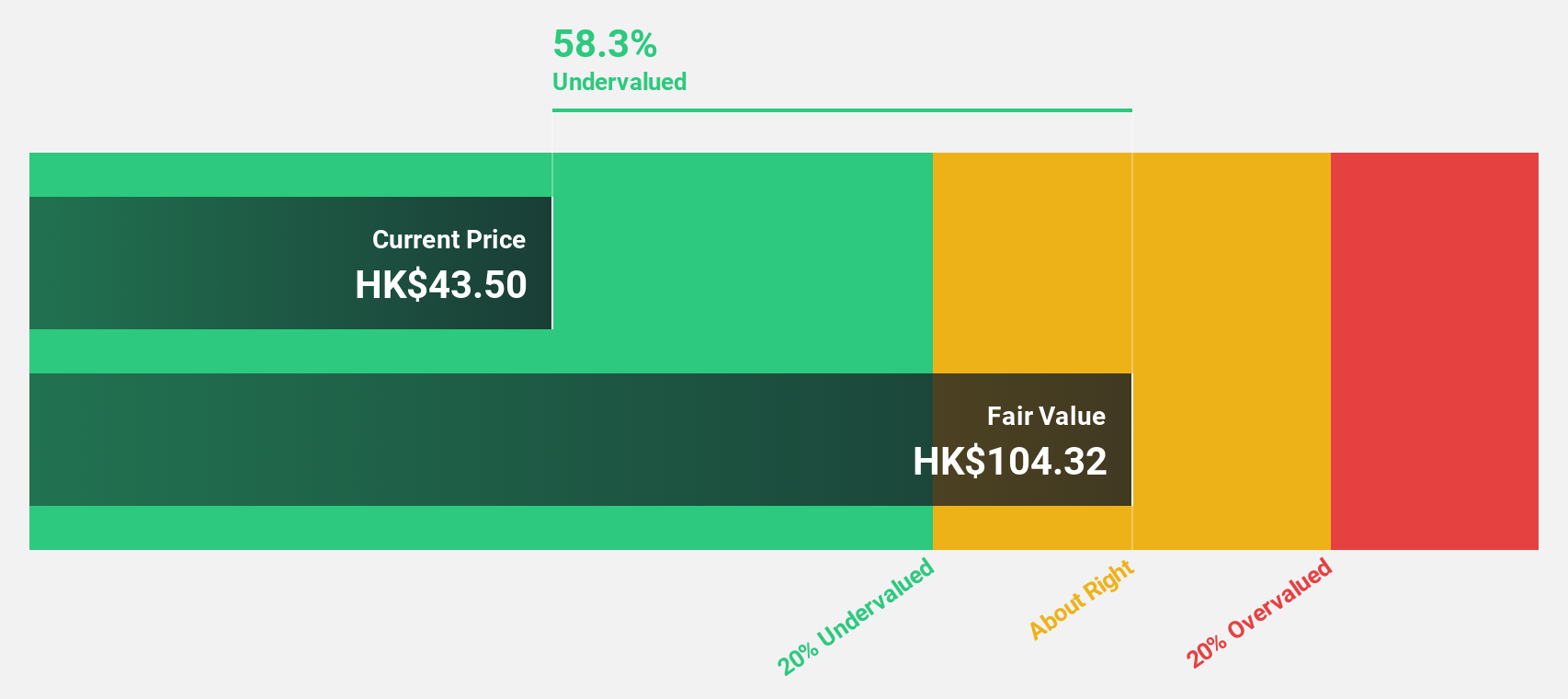

Estimated Discount To Fair Value: 49.4%

WuXi XDC Cayman is trading at HK$68.5, significantly below its estimated fair value of HK$135.26, indicating it may be undervalued based on cash flows. With earnings growth forecasted at 26.3% annually, outpacing the Hong Kong market's 12%, and revenue expected to grow by 25.6% per year, the company shows strong potential for investors seeking undervalued opportunities in Asia despite high non-cash earnings levels and a recent extraordinary shareholders meeting scheduled for December 2025.

- Our expertly prepared growth report on WuXi XDC Cayman implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in WuXi XDC Cayman's balance sheet health report.

InnoCare Pharma (SEHK:9969)

Overview: InnoCare Pharma Limited is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for cancer and autoimmune diseases in China, with a market cap of HK$25.52 billion.

Operations: InnoCare Pharma generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.43 billion.

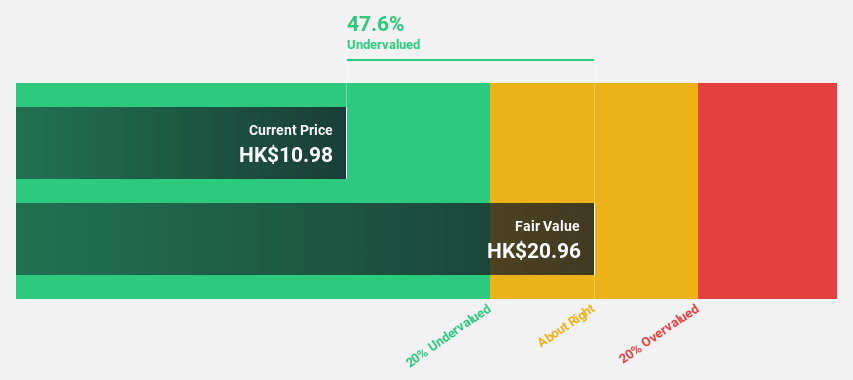

Estimated Discount To Fair Value: 42.5%

InnoCare Pharma is trading at HK$13.34, significantly below its estimated fair value of HK$23.2, highlighting its potential as an undervalued stock based on cash flows. Despite recent insider selling, the company is expected to become profitable in three years with annual profit growth above market averages. Recent product approvals and clinical trial advancements bolster its growth prospects, particularly in autoimmune and oncology sectors, positioning it well for future revenue expansion exceeding 20% annually.

- In light of our recent growth report, it seems possible that InnoCare Pharma's financial performance will exceed current levels.

- Dive into the specifics of InnoCare Pharma here with our thorough financial health report.

LianChuang Electronic TechnologyLtd (SZSE:002036)

Overview: LianChuang Electronic Technology Co., Ltd specializes in the research, development, production, and sale of optics and optoelectronics both in China and internationally, with a market cap of CN¥12.89 billion.

Operations: LianChuang Electronic Technology Co., Ltd derives its revenue from the research, development, production, and sale of optics and optoelectronics across domestic and international markets.

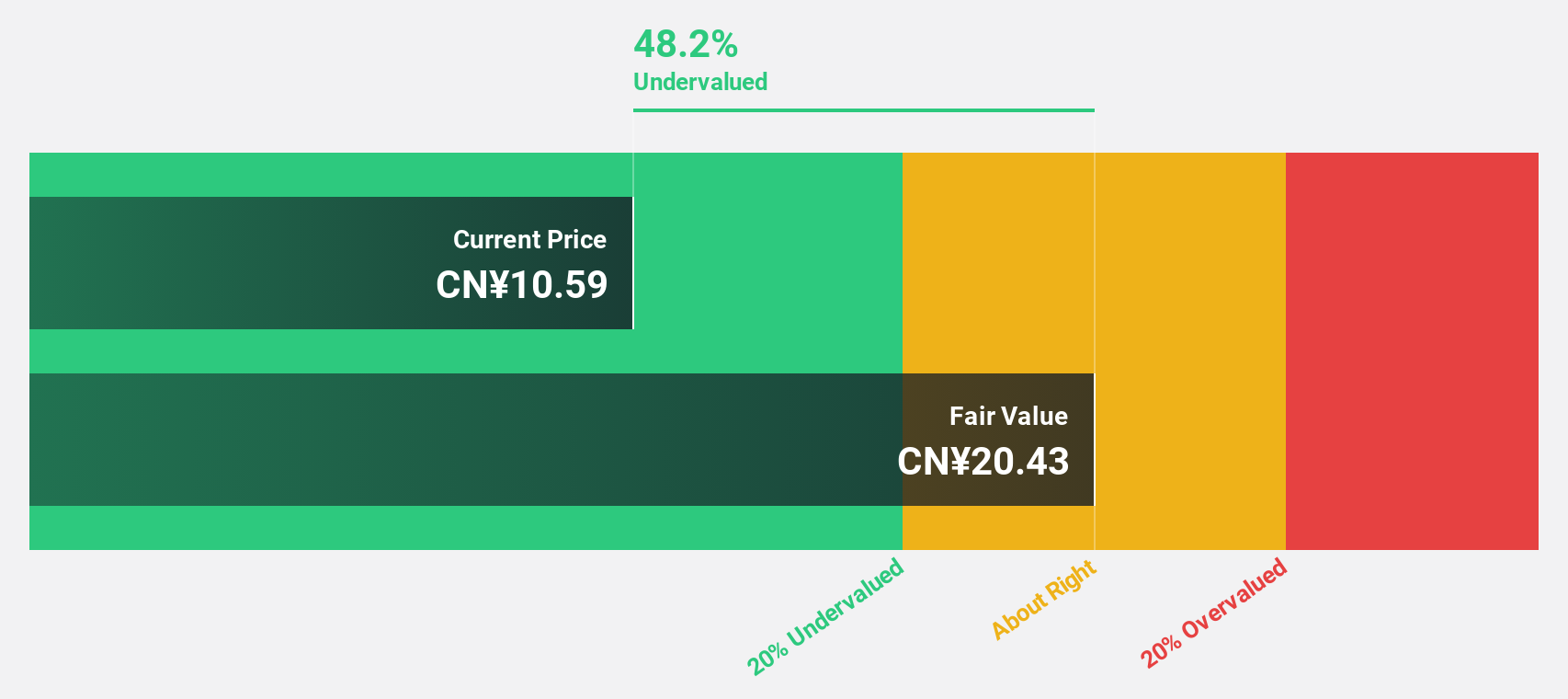

Estimated Discount To Fair Value: 42.9%

LianChuang Electronic Technology Ltd. is trading at CN¥12.36, well below its estimated fair value of CN¥21.63, marking it as undervalued based on cash flows. The company is expected to become profitable within three years, with profit growth surpassing market averages despite revenue growth projected at 15% annually, slower than the 20% benchmark. Recent transactions include a CN¥900 million stake acquisition and a private placement raising up to CN¥1.63 billion for strategic expansion.

- According our earnings growth report, there's an indication that LianChuang Electronic TechnologyLtd might be ready to expand.

- Take a closer look at LianChuang Electronic TechnologyLtd's balance sheet health here in our report.

Make It Happen

- Discover the full array of 261 Undervalued Asian Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal