Aris Mining (TSX:ARIS) Valuation Check After Strong 1 Year Shareholder Return

Aris Mining (TSX:ARIS) has drawn fresh attention after its shares closed at CA$22.67, with recent returns over the past month and past 3 months prompting investors to reassess the gold producer’s current valuation.

See our latest analysis for Aris Mining.

That move to CA$22.67 comes after a 15.90% 30 day share price return and a strong 50.63% 90 day share price return. The 1 year total shareholder return of over 3x reflects how much sentiment around Aris Mining has shifted over a longer horizon.

If Aris Mining’s run has caught your eye, it can be useful to compare it with other materials names and even broaden your search to fast growing stocks with high insider ownership for fresh ideas.

With Aris Mining showing strong recent returns, along with annual revenue of $770.175m and net income of $49.168m, the key question now is whether the current CA$22.67 share price offers a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 19.4% Undervalued

At CA$22.67, the most followed narrative sees Aris Mining’s fair value closer to CA$28.13, setting up a gap driven by long term growth assumptions.

The fair value estimate has risen slightly from approximately CA$26.59 to CA$28.13 per share, reflecting a modestly higher assessed intrinsic value for Aris Mining. The future P/E multiple has risen moderately from around 4.99x to 5.40x, signaling a somewhat higher valuation being applied to the company’s projected earnings.

Curious what kind of revenue climb, margin reset, and future earnings multiple are baked into that price range? The narrative describes an aggressive earnings path, rising profitability, and a lower future P/E than many peers. The full story connects those moving parts into one valuation number.

Result: Fair Value of CA$28.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story can change quickly if gold prices weaken, or if Colombia related regulatory or community issues disrupt the Segovia and Marmato expansion plans.

Find out about the key risks to this Aris Mining narrative.

Another View: Richer On Earnings Multiples

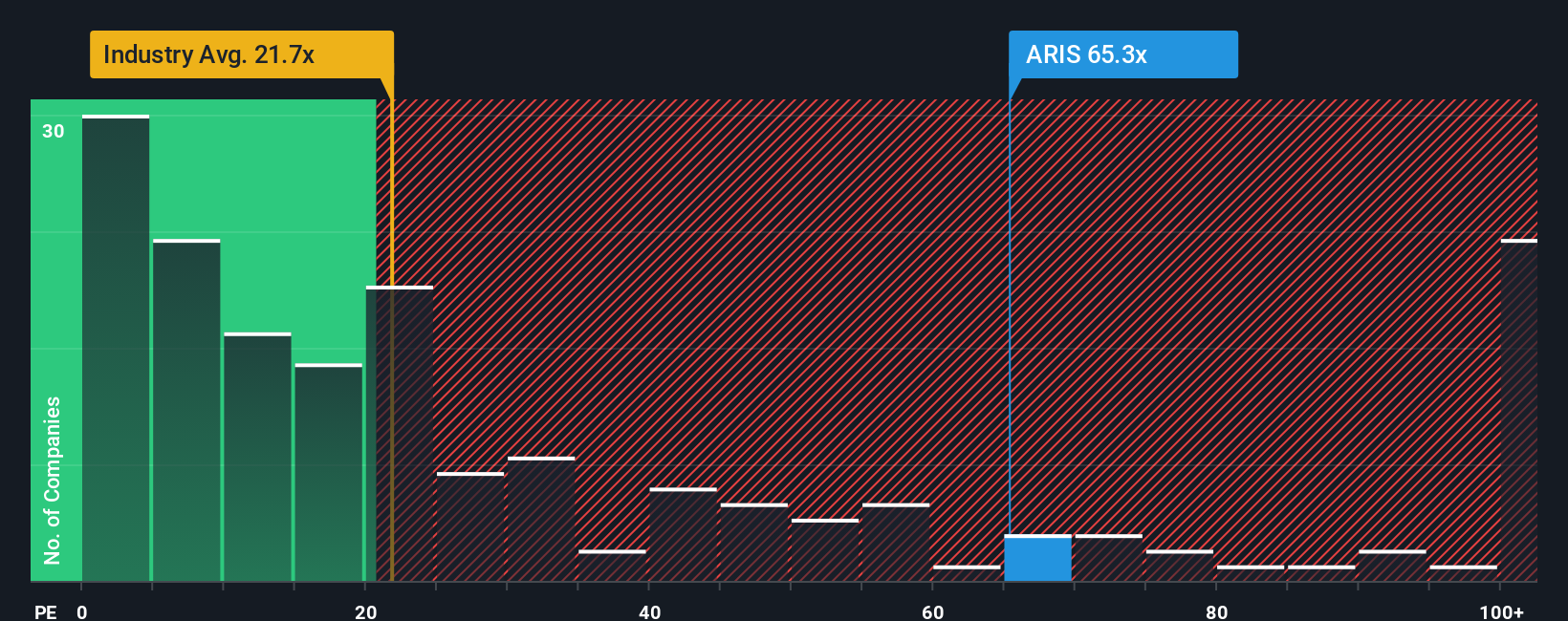

The earlier narrative leans on long term cash flow and growth assumptions to argue Aris Mining is undervalued at CA$22.67. If you look instead at the current P/E of 68.2x, the picture is very different, because that is higher than the Canadian Metals and Mining industry at 23.3x, the peer average at 7x, and even the fair ratio of 61.9x that the market could move toward over time.

Those gaps suggest less room for error and a higher valuation risk if earnings or sentiment slip. The question is whether you are comfortable paying a premium multiple for a company where a lot of future growth is already reflected in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aris Mining Narrative

If you see the numbers differently and want to stress test your own assumptions, you can build a custom view in just a few minutes by starting with Do it your way.

A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Aris Mining has sharpened your interest, do not stop here. Broaden your watchlist with focused stock ideas that match different goals and risk levels.

- Target potential value opportunities by scanning these 877 undervalued stocks based on cash flows, built around companies whose prices differ from their cash flow estimates.

- Spot growth stories at smaller price points by reviewing these 3556 penny stocks with strong financials that already have solid financial underpinnings.

- Position yourself in emerging themes with these 79 cryptocurrency and blockchain stocks, which are tied to digital assets and blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal