A Look At Netcompany Group (CPSE:NETC) Valuation After Its DKK 500m Share Buyback Announcement

Buyback announcement and why it matters

Netcompany Group (CPSE:NETC) has launched a share buyback programme of up to DKK 500 million, targeting a maximum of 3,700,000 shares, to reshape its capital structure and cover share based incentives.

The programme, running no later than 30 January 2026 under EU Market Abuse Regulation, leaves Netcompany holding 1,735,556 treasury shares, equal to 3.7% of its share capital.

See our latest analysis for Netcompany Group.

Netcompany’s share price has been firming up, with a 30 day share price return of 5.76% and a 90 day share price return of 32.18%, while the 1 year total shareholder return sits at 8.0%. This suggests momentum has picked up recently after a weaker five year total shareholder return of 39.14%.

If this buyback has you thinking about where else capital is moving in tech, it could be a good moment to scan high growth tech and AI stocks for other ideas. You might spot companies with very different growth and risk profiles.

With the buyback in motion, Netcompany trading around DKK 367.20, and an internal estimate suggesting about a 17% discount, the real question is whether this represents a genuine value gap or whether the market already reflects future growth.

Most Popular Narrative: 0% Overvalued

Analysts see fair value for Netcompany Group close to the current DKK 367.20 share price, which puts extra weight on how their growth story plays out.

Long term investments and recent wins in AI driven platforms (such as EASLEY AI, Feniks AI, and PULSE) enable Netcompany to modernize legacy systems across both the public and private sectors, differentiating their offerings and positioning the company to win large, multi year contracts, improving both revenue growth and margin resilience.

Curious what kind of revenue path and margin reset would need to line up to support that fair value outcome? The narrative leans heavily on compounding earnings and a lower future P/E than today, all tied to multi year project visibility and tougher return hurdles. The full valuation story connects these pieces into one pricing case.

Result: Fair Value of DKK 365.29 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that ongoing margin pressure or slower than expected SDC integration could keep earnings and cash flow below the narrative’s fair value path.

Find out about the key risks to this Netcompany Group narrative.

Another View: Earnings Multiple Sends A Caution Flag

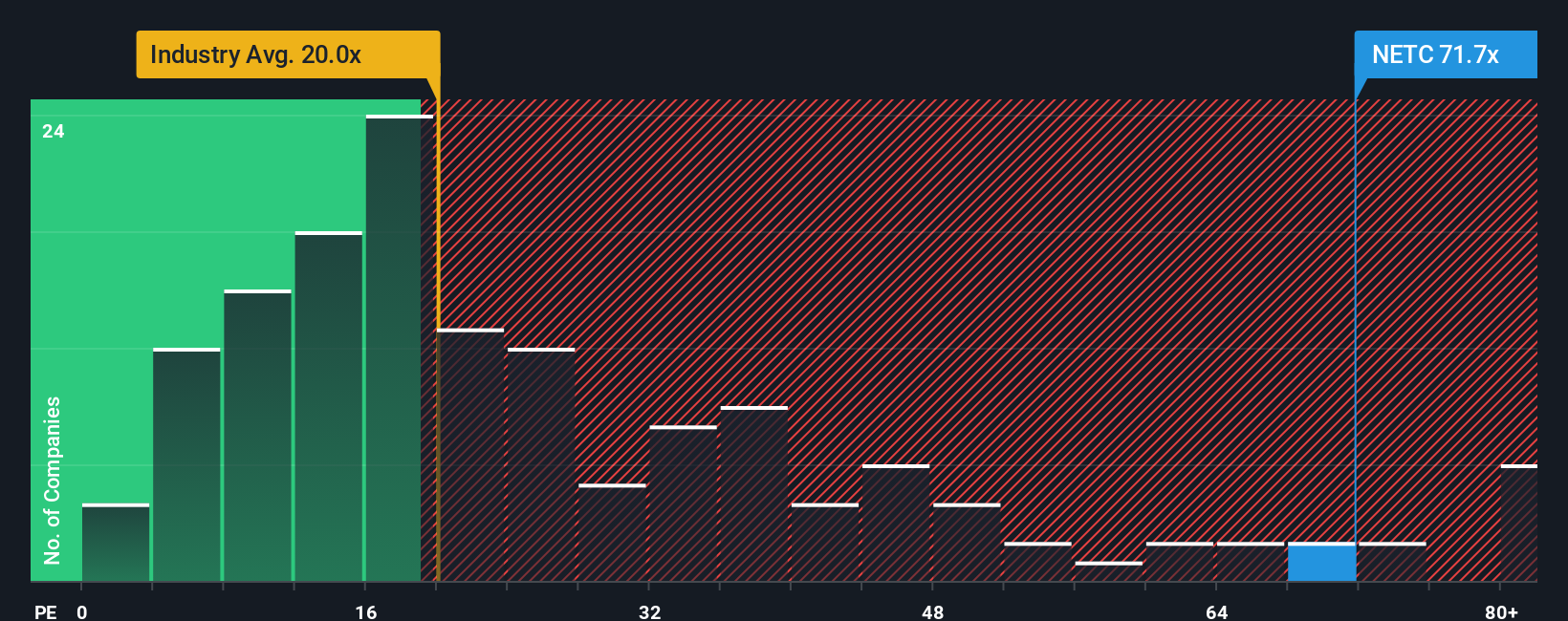

Our DCF work points to Netcompany trading about 17% below an estimate of fair value at DKK 443.31, which sounds supportive. However, the current 74x P/E is far above the European IT average of 19.2x, the peer average of 37.4x, and even the 58.1x fair ratio. This raises the question of whether that gap signals mispricing or simply reflects optimistic expectations already baked into the shares.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Netcompany Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Netcompany Group Narrative

If parts of this story do not quite fit your view, or you prefer to weigh the numbers yourself, you can sketch out your own thesis in just a few minutes and Do it your way.

A great starting point for your Netcompany Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to hunt for more ideas?

If this Netcompany story has sharpened your thinking, do not stop here. Widen your opportunity set and pressure test your next moves before the market does.

- Spot potential mispricings early by scanning these 877 undervalued stocks based on cash flows that may offer stronger cash flow support for their current prices.

- Target income focused opportunities by checking out these 11 dividend stocks with yields > 3% that might suit a yield leaning portfolio.

- Lean into thematic growth by reviewing these 79 cryptocurrency and blockchain stocks that are linked to blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal